ATFX Forex Market Preview: Super Central Bank Week: Fed and Canada expected to cut interest rates, while ECB/JCB likely to remain on hold

2025-10-28 09:24:15

This Thursday at 2:00 PM, the Federal Reserve will announce its October interest rate decision, followed by a monetary policy press conference at 2:30 PM by Fed Chairman Powell. This week's meeting marks the seventh and penultimate Fed meeting of the year. The outcome will profoundly impact the performance of gold, silver, the US dollar, and other currencies. The mainstream consensus is that the Fed will announce a 25 basis point rate cut. According to CME data, the probability of a Fed rate cut has reached over 99%, making it a near certainty. However, it's important to note that the more consistent market expectations are, the more likely the market will fluctuate in the opposite direction. A 25 basis point rate cut by the Fed would formally signify the Fed's entry into a rate-cutting cycle, weakening the US dollar's interest rate advantage. Logically, the US dollar index would experience a sharp decline following the announcement. However, given the "buy expectations, sell facts" mentality, the US dollar index is highly likely to experience an unusual rebound in the short term. Fed Chairman Powell's press conference is also a key focus for the market. If Powell expresses overly pessimistic views on the US job market or dwells excessively on the impact of tariffs on inflation, the US dollar index could suffer a secondary blow.

This Thursday, the European Central Bank (ECB) will announce its October interest rate decision at 9:15 PM, and ECB President Christine Lagarde will hold a monetary policy press conference at 9:45 PM. Market expectations are that the ECB will hold its rate decision steady, as it has kept its three key interest rates unchanged for two consecutive times since its last rate cut in June. ECB President Lagarde stated this month, "In terms of where we are, we are in a good position to weather future shocks well." This statement suggests that the ECB has no intention of adjusting its current key interest rates. A decision without an interest rate adjustment does not necessarily mean the outcome will not impact the euro. Lagarde's remarks at the press conference could directly impact market confidence in the euro. Over the past six months, the US dollar index has continued to decline due to Trump's aggressive policies, giving the euro a boost in appreciation. If Eurozone macroeconomic developments fail to keep pace with the euro's appreciation, the EUR/USD could reverse course. The Eurozone currently faces challenges such as high public debt, the Ukraine crisis, and high US tariffs. If Lagarde touches on these sensitive topics at the press conference, the EUR/USD could experience significant volatility, prompting caution.

The Bank of Japan will announce its October interest rate decision during the Asian session on Thursday. Bank of Japan Governor Kazuo Ueda will hold a press conference at 2:30 PM. While the mainstream consensus is for the Bank of Japan to maintain its benchmark rate at 0.5%, market participants are calling for another rate hike. According to a Reuters poll of economists, 14% believe the Bank of Japan will raise rates in October, while 31% believe the December rate hike will occur. Bank of Japan board member Naoki Tamura stated this month that given the risk of rising prices, the Bank of Japan should push interest rates closer to neutral to avoid being forced to raise them significantly in the future. Therefore, while the probability of a 25 basis point rate hike is low, the risk is significant. Japan's core CPI for September was 2.9% year-on-year, up from 2.7% the previous month and in line with expectations. The 2.9% inflation rate is significantly above the central bank's 2% target. If the Bank of Japan does not raise interest rates soon, there is a risk of runaway inflation.

The Bank of Canada will announce its October interest rate decision at 9:45 PM this Wednesday, with the mainstream expectation being a 25 basis point rate cut. Canada's economic development is heavily dependent on the United States. Since the beginning of this year, US President Trump has continuously raised tariffs on Canadian imports. Coupled with signs of a recession in the US economy, Canada's economic growth outlook is extremely pessimistic. Last Saturday, Trump announced on social media that he would impose an additional 10% tariff on Canada in retaliation for publishing an advertisement criticizing US tariff policies. This will severely undermine market confidence in holding the Canadian dollar.

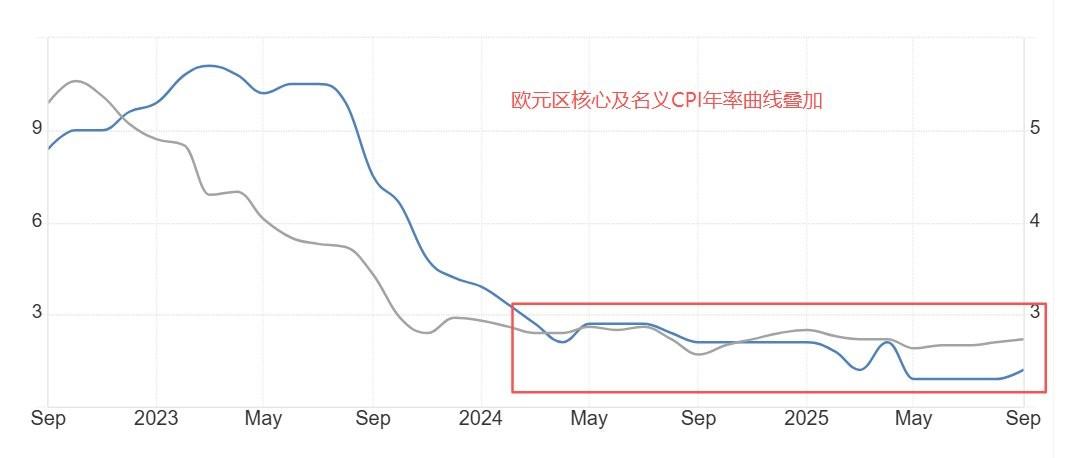

This Friday at 6:00 PM, Eurostat will release the preliminary annualized core CPI for the eurozone for October. Market expectations are for a reading of 2.3%, down from the previous reading of 2.4%. The preliminary annualized CPI for the eurozone for October, also released simultaneously, is expected to be 2.1%, down from the previous reading of 2.2%. In absolute terms, an inflation rate above 2% is consistent with the ECB's target of moderate inflation. Historical data shows that both the core and nominal CPI annualized rates in the eurozone have stabilized, avoiding extreme fluctuations. This stability in inflation is a key factor in the ECB's decision to pause interest rate cuts.

ATFX Risk Warning, Disclaimer, and Special Notice: Markets are risky, so invest with caution. The above content represents the analyst's personal opinions and does not constitute any operational advice. Please do not rely on this report as the sole basis for reference. Analyst opinions may change over time and will be updated without prior notice.

- Risk Warning and Disclaimer

- The market involves risks, and investment requires caution. The content provided here is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.