Tariff reversal triggers copper price "roller coaster", but the long-term logic of the metal market remains strong

2025-08-05 20:02:06

Despite these negotiations, markets experienced a strange lull, allowing U.S. stocks to extend their gains. Both the S&P 500 and Nasdaq Composite hit record highs, buoyed by unexpectedly strong U.S. economic data. This strength delayed expectations of rate cuts, pushed up Treasury yields, and provided a small boost to the dollar after months of weakness.

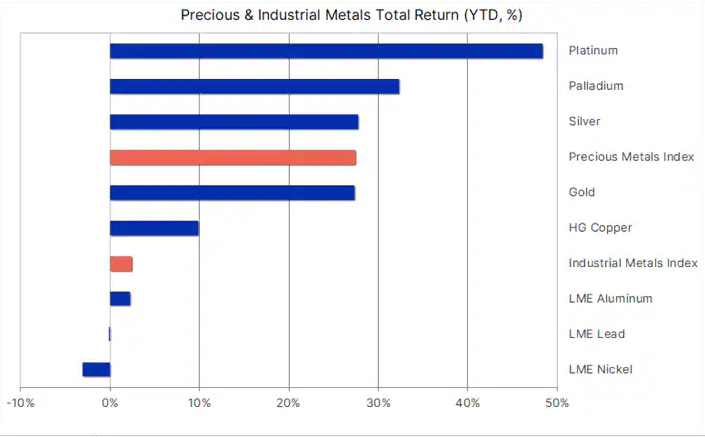

In July, precious metals consolidated after their gains in the first half of the year. Silver and platinum continued their upward trend, recovering some of their losses relative to gold. Gold has been trading in a narrow range since hitting an all-time high of $3,500 in April. Platinum's year-to-date gains reached as much as 61%, while silver is nearing $40—its highest level since 2011, though still below its all-time peak of $50.

Performance of major metals this year

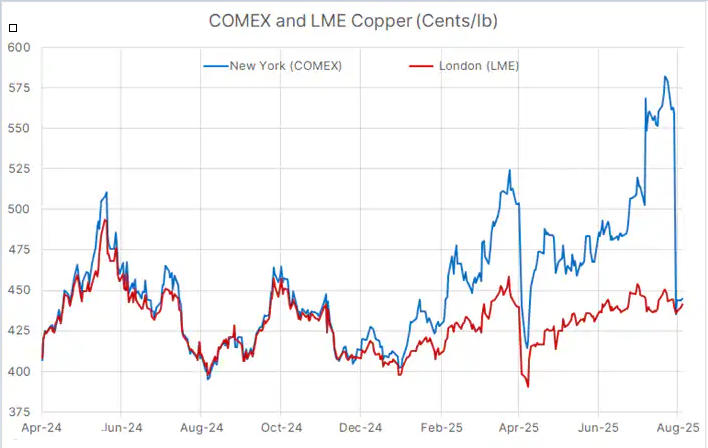

Also supporting silver and platinum earlier this month was a surge in high-grade copper prices in New York, which reached a record high of $5.8955 per pound on July 8. This followed President Trump's unexpected proposal to impose a 50% tariff on copper imports, double the market's expectations. The comments pushed New York copper prices to a record 34% premium over London Metal Exchange (LME) copper, triggering a rush to ship copper to the United States before the deadline.

(Full-year performance of major metals)

However, that deal unraveled last week when Trump abruptly reversed course, announcing that refined copper traded on futures exchanges would be exempt from tariffs until at least January 2027. Premiums in the New York market collapsed within minutes, leaving traders with losses and copper inventories in U.S. warehouses at their highest level in 21 years. With imports poised to dry up, U.S. copper prices are now likely to fall below the global benchmark to clear excess inventories.

The impact of tariffs on US and LME copper prices

The relative impact of tariffs on US copper prices and London Metal Exchange (LME) copper prices

While New York copper prices have dominated headlines, the London Metal Exchange (LME) price has remained relatively stable, fluctuating around $9,550 per ton ($4.33 per pound). The tariff reversal highlights copper's strategic role in the global energy and digital transformation. Demand for copper is expected to surge due to the electrification of transportation, industrial reshoring, and the rapid expansion of AI-driven data centers.

Meanwhile, copper supply remains constrained by underinvestment and recent disruptions, including a mining accident in Chile. Consequently, copper prices are likely to remain volatile, but overall biased to the upside, supported by short-term momentum and long-term structural factors. Copper is increasingly becoming a defining commodity in the energy and digital age.

Precious Metals: Focus Turns to Tariffs and Fed Policy

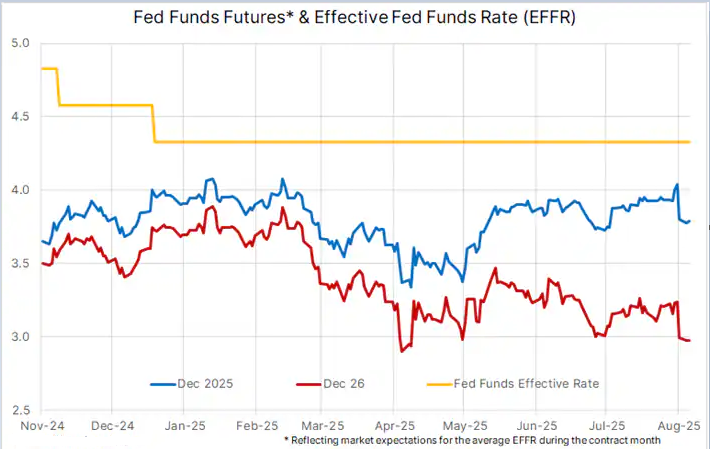

(Federal funds rate and projected changes in December 2025 and September 2026)

After an impressive first half of the year, investment metals entered a period of consolidation in July, with sharp fluctuations in copper prices triggering some market volatility. Gold's four-month sideways trend has given silver and platinum an opportunity to catch up. With gold and silver up nearly 27% year-to-date, and platinum up nearly 50%, investors naturally ask: Is the rally over?

Probably not. Recent weak US data has reopened the door for the Federal Reserve to cut interest rates. Last Friday's dismal jobs report (including significant downward revisions to prior months' figures) has left the market almost fully expecting a rate cut at the next Federal Open Market Committee (FOMC) meeting on September 17, with further cuts expected in 2026. By September of next year, the market is pricing in a 125 basis point drop in the Fed's effective interest rate.

The key drivers that have driven metals prices higher in recent years remain in place, and additional tailwinds may emerge in the second half of the year. Most notably, the aforementioned prospect of lower U.S. interest rates could reignite demand, particularly for metals-backed exchange-traded funds (ETFs), as this would reduce the opportunity cost of holding non-yielding assets like gold relative to short-term government bonds.

To understand the enduring appeal of gold (and, by extension, silver and platinum), it's important to recognize the unique characteristics of these metals. Unlike sovereign bonds or fiat currencies, precious metals are politically neutral. They are widely considered a store of value, unlinked to any particular nation's creditworthiness, which is why central banks are increasingly allocating gold as a core reserve asset.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.