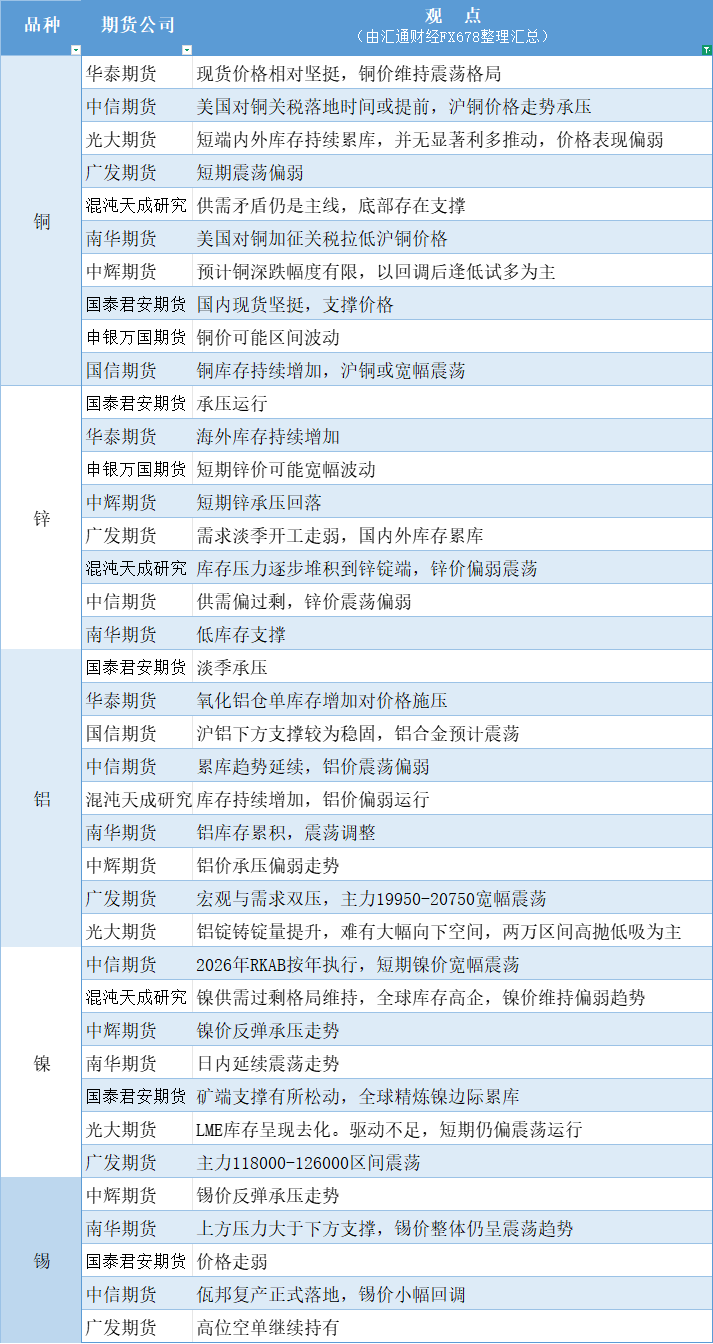

Futures companies' views summarized in one chart: July 17 nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2025-07-17 12:35:50

Copper: Short-term domestic and foreign inventories continue to accumulate, and there is no significant positive driving force. Price performance is weak, spot prices are relatively strong, and copper prices maintain a volatile pattern; Zinc: Demand starts weak in the off-season, domestic and foreign inventories accumulate, and inventory pressure gradually accumulates to the zinc ingot end, and zinc prices fluctuate weakly; Aluminum: The casting volume of aluminum ingots has increased, and it is difficult to have a large downward space. The main market is high selling and low buying in the 20,000 range; Nickel: The nickel supply and demand surplus pattern is maintained, global inventories are high, and nickel prices maintain a weak trend; Tin: The upper pressure is greater than the lower support, and the overall tin price is still volatile.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.