Some U.S. banks say Trump bill could boost U.S. economy

2025-07-02 10:47:55

The bill was passed by Senate Republicans on Tuesday with the narrowest of margins and is now awaiting final approval in the House of Representatives, but a minority of Republicans in the House have already expressed opposition to some of the Senate's provisions. Trump hopes to sign the bill before the July 4 Independence Day holiday, and House Speaker Johnson hopes to complete the signing on that date.

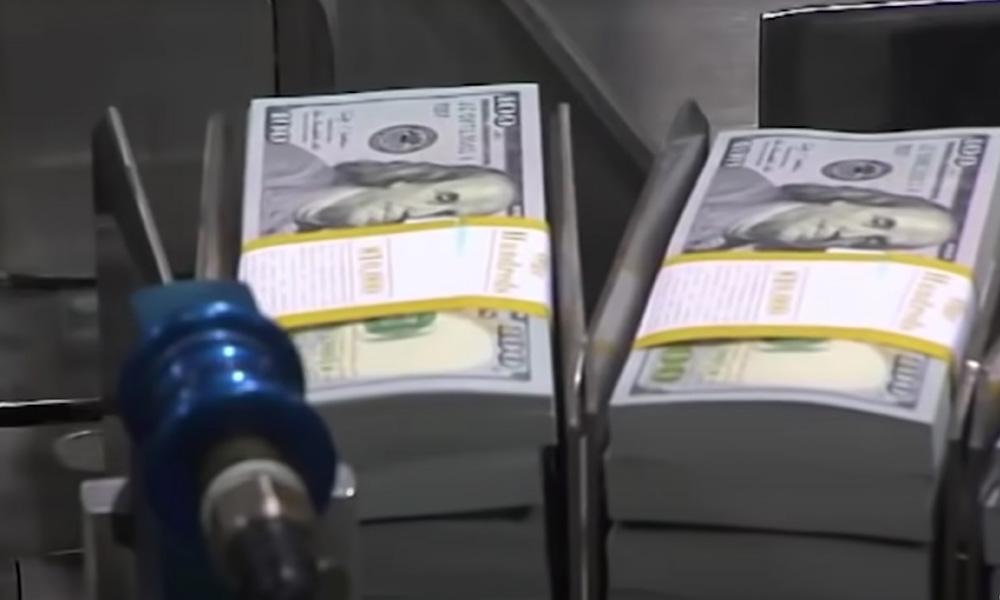

The bill, which features sweeping tax reforms and targeted incentives that are expected to increase the federal deficit, has prompted warnings from credit agencies and drawn criticism, but some banks said they believe the bill could boost the U.S. economy.

OBBB "is undoubtedly beneficial"

The American Bankers Association said in a letter published Sunday that it "strongly supports" many of the provisions in the bill because they provide "much-needed tax relief."

“I think OBBB is almost certainly going to be good for the U.S. economy over the next few years compared to if nothing was passed,” said David Seif, chief economist for developed markets at Nomura Securities, given that taxes are set to rise sharply next year after many provisions of Trump’s 2017 tax bill expire.

The 2017 Tax Cuts and Jobs Act included lower income tax rates, larger child tax credits and generous relief for businesses. Without congressional action, many of the bill's provisions will expire by the end of 2025, a change that analysts say could shrink household consumption and business investment. They say OBBB's short-term appeal is its ability to avoid a sharp fiscal contraction in 2026.

“The most important thing for OBBB to do in the next few years is to renew most of the expiring tax provisions and prevent a major sudden fiscal contraction,” Seif said. “OBBB provisions that allow for faster expensing of corporate capital investments could increase investment in the next few years, though probably at the expense of investment in later years,” he added.

Citigroup strategists also said in a note published last Wednesday that passage of the bill would be good for the economy. “In the short term, trade deals with other countries and the (net stimulative) OBBB passed in July should improve growth sentiment,” they wrote.

Citi also expects the Federal Reserve to ease its monetary policy, boosting growth sentiment, and said: "We do not see a bond alert moment in 2025/2026 as it is mainly funded by tariff revenues."

Disadvantages of OBBB

However, some have pointed out serious flaws.

The debt burden is a central concern for many critics. The nonpartisan Congressional Budget Office (CBO) projects that OBBB will add at least $3 trillion to the federal deficit over the next decade.

While Morgan Stanley noted in early June that the bill’s pro-growth tax provisions could benefit businesses and individuals, as well as key stock sectors such as communications services, industrials and energy, it said it could raise concerns about fiscal sustainability.

Likewise, Erica York, vice president of federal tax policy at the Tax Foundation’s Federal Tax Policy Center, said: “This would be fiscally irresponsible and would substantially increase the budget deficit and debt, even accounting for economic growth.”

She said many of the tax cuts were complicated, poorly designed and gave relief to certain types of workers while excluding others.

Beyond that, she said, because the bill includes many tailored tax rules, the Internal Revenue Service will need to spend more time and resources updating forms, guidance and enforcement tools, adding an administrative burden to an already stretched agency.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.