Tariffs cause biggest slowdown in U.S. online shopping in more than a decade: Survey

2025-07-02 13:03:21

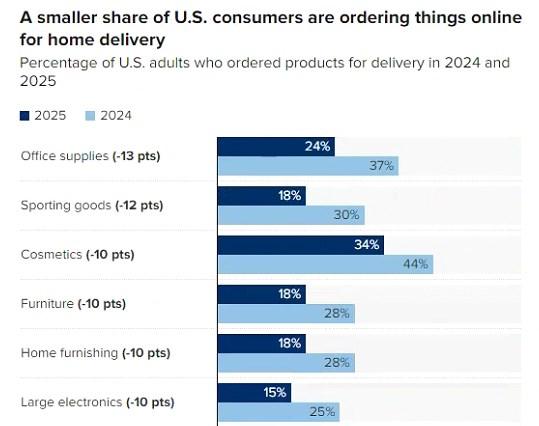

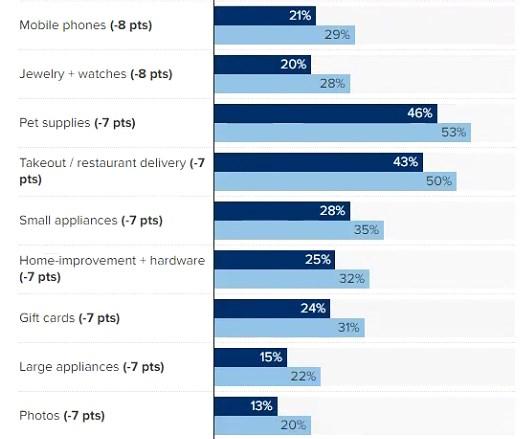

Data from AlixPartners shows that major categories of home delivery online shopping experienced double-digit percentage year-on-year declines, including office supplies, which fell 13 percentage points; sporting goods, which fell 12 percentage points; and cosmetics, furniture, home furnishings and large electronics, which each fell 10 percentage points.

“This marks the first broad-based decline in online category growth in more than a decade,” said Chris Considine, partner in the consultancy’s retail practice.

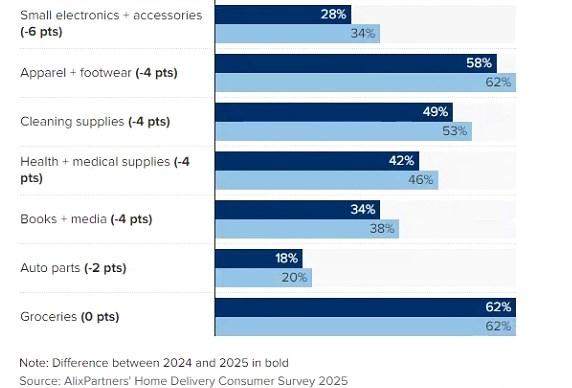

Groceries are a notable exception to this negative trend.

According to AlixPartners, tariffs have been a catalyst for consumers to change their purchasing behavior. The data found that 34% of consumers said they postponed purchases due to price uncertainty, 66% said they would seek domestic options if overseas prices increased by 10%, and 28% of consumer respondents said they bought early to avoid additional import costs.

The survey shows that a considerable number of people (20%) want to "buy American products."

Figure: The proportion of adults in the United States who make home-delivery online purchases has declined (comparison of various product categories in 2024 and 2025)

“Tariffs are having a significant impact on consumer behavior, leading to changes in timing and potential reshoring of demand,” Considine said. “Retailers may need to reassess sourcing and pricing strategies to remain competitive.”

The online home delivery survey was conducted by AlixPartners between May 31 and June 3 among consumers, retail and transportation companies.

In addition to tariffs affecting purchases, retailers are struggling with challenges around returns and delivery costs. The survey showed an increase in return rates, while nearly three-quarters of executives said the cost of delivering each package has risen.

The survey shows that delivery and return policies are tightening across the e-commerce industry, with a greater emphasis on in-store pickup and returns. Consumer behavior is still heavily influenced by free shipping and next-day delivery, but nearly half of the retailers surveyed have increased the minimum order requirements for free shipping or now require a membership.

Most e-commerce executives surveyed by AlixPartners said cutting last-mile delivery costs takes precedence over improving service.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.