Nonfarm forecast: June report expected to show weak U.S. job growth

2025-07-02 14:35:05

“We are seeing a slowdown in the economy, but we are not at alarm levels yet,” said David Rogal, managing director of global fixed income at BlackRock, which manages funds including the $18.7 billion BlackRock Total Return Fund (MAHQX). “We expect a modest slowdown in the labor market, with gains remaining in the low 100,000 range.”

An early indicator of job market weakness in June was a rise in continuing unemployment claims, a weekly data release. UBS economists noted that "high-frequency indicators point to continued labor market weakness over the past 6-8 weeks," and forecast just 100,000 new jobs in June.

June employment report forecast highlights

Release time: Thursday, July 3, 20:30 Beijing time

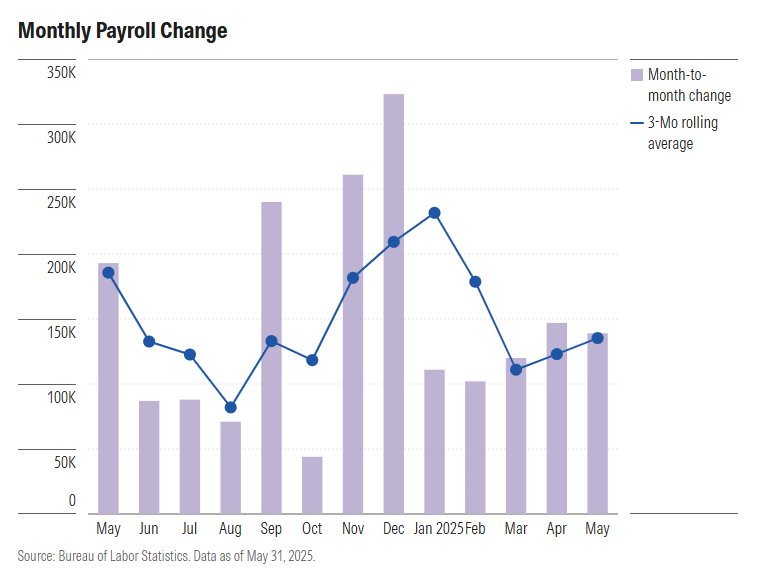

Nonfarm payrolls are expected to fall to 115K (from 139K in May)

The unemployment rate is expected to rise from 4.2% to 4.3%.

Hourly wage growth is expected to slow to 0.3% from 0.4%

(Table of historical changes in non-agricultural employment)

Policy uncertainty looms over job market

Although the labor market slowdown has been relatively mild this year, economists are closely watching policy factors that could disrupt the market.

First, President Trump's executive order revoked the "temporary protected status" (TPS) of hundreds of thousands of people. UBS data shows that 380,000 people have had their status revoked so far, and 558,000 more will expire in the coming months. "TPS-related layoffs are expected to drag on employment, but there is still great uncertainty about the specific extent of the impact and whether it will be reflected in the survey," said UBS economists, who estimated that the policy has led to a reduction of about 5,000 jobs in June.

Goldman Sachs economists predict that non-farm payrolls will only increase by 85,000 in June (lower than market consensus), of which 25,000 will be reduced due to this policy.

Another uncertainty is that the 90-day tariff suspension imposed by the Trump administration this year will expire on July 9. "Although the next two weeks will usher in important nodes for economic policy, the relevant information remains unclear," the UBS report said. Even if the worst-case scenario of tariffs returning to pre-suspension levels does not occur, the uncertainty in this major economic field has already caused damage. The Kansas City Fed's June manufacturing survey showed that about 25% of the companies surveyed reduced their recruitment positions and 21% had laid off employees.

Fed expected to keep interest rates unchanged

Futures markets are pricing in a nearly 80 percent chance that the Fed will keep interest rates unchanged in July, according to the CME FedWatch tool.

"The main argument against a rate cut is rising inflation expectations and (the Fed's) concerns about the inflationary impact of tariffs," Rogal said. "The transmission of tariffs to consumers is not yet clear. How big this transmission effect is is the key factor that constrains the Fed's decision-making."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.