Powell just said "wait and see", ADP threw a "bomb"! The dollar fell and gold rose. What is the market afraid of tonight?

2025-07-02 20:42:45

At the same time, the Challenger corporate layoff report showed that the number of layoffs in June was 48,000, a monthly decrease of 48.84% and a slight annual decrease of 1.6%, which was a significant decline from the previous value of 93,800, indicating that the pressure of layoffs has eased. After the release of ADP data, the US dollar index fell sharply in the short term, and gold rose rapidly as a safe-haven asset.

Market focus quickly shifted to Thursday's non-farm payrolls report (released early on Thursday due to the Independence Day holiday), with investors' expectations further divided on the resilience of the labor market and the Federal Reserve's policy path.

Market background and real-time quotes

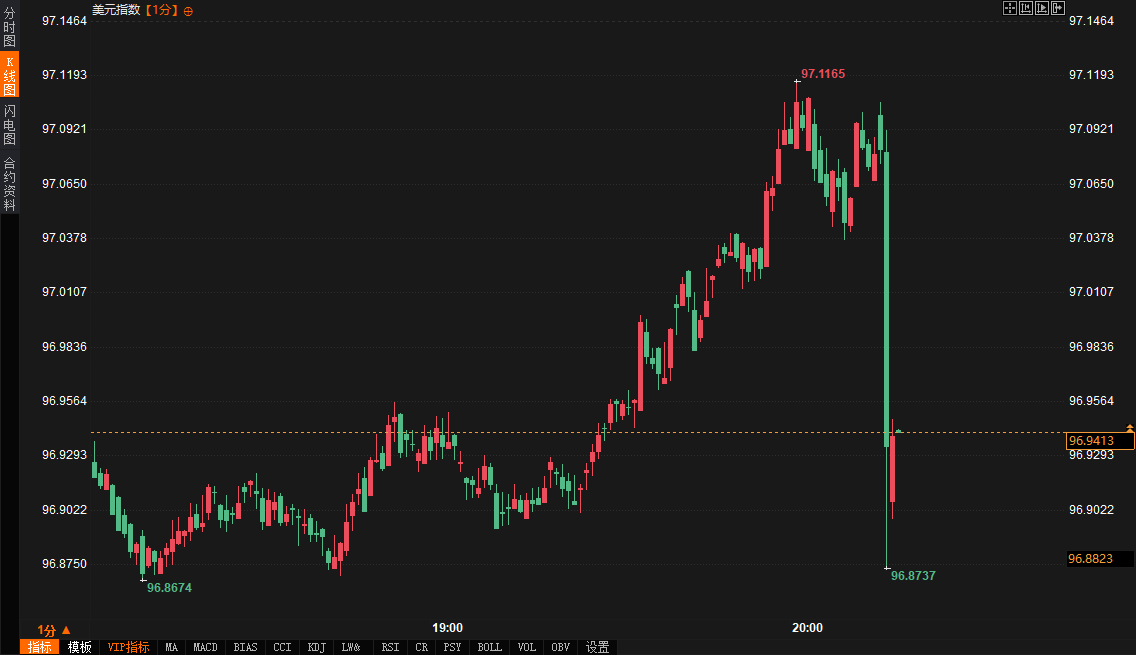

Before the release of the ADP data, the market's expectations for the US labor market were slightly optimistic due to the JOLTS job openings data on Tuesday exceeding expectations (5.503 million, down 112,000 from April). Some institutions and retail investors have cautious expectations for the ADP data, saying that if the ADP data exceeds expectations, it may push up US Treasury yields and the US dollar/yen; while the market expects ADP to add 95,000 jobs in June, up from the previous value of 37,000, but still lower than 183,000 in January this year. The market reaction will depend on the degree of deviation of the data from expectations. However, the unexpected cold snap of the ADP data completely broke this expectation. The US dollar index plunged about 22 points in the short term, hitting a low of 96.8737 and now reported 96.9437; spot gold rose about $11 in the short term, reaching a high of $3,348.93 per ounce.

Nela Richardson, chief economist of ADP, pointed out in the report that although layoffs are still not common, the hesitation of enterprises to recruit and their unwillingness to fill the vacancies of departing employees have directly led to a reduction in jobs, but wage growth has not been significantly affected. This structural differentiation echoes the "high at the beginning and stable at the end" layoff trend reported by the Challenger: 48,000 layoffs in June, a sharp drop from May, and 247,000 cumulative layoffs in the second quarter, a year-on-year surge of 39%, the highest in the same period since 2020, but a slight year-on-year decrease of 2% in a single month, indicating that the labor market still has a certain resilience under the pressure of corporate restructuring and industry adjustment.

Market reaction and sentiment changes

The ADP data was a surprise, which directly triggered a sell-off of the US dollar. The US dollar index fell to 96.8737 in the short term, a recent low, reflecting the market's growing concerns about the momentum of the US economy. Pay attention to the unexpected decline in the ADP data and its potential guidance for Thursday's non-farm report. Retail investors ADP employment fell to 10,000-33,000, the largest drop since March 2023, but the number of layoffs by challenger companies decreased from the previous month, showing that the labor market is both resilient and weak, and market sentiment is therefore in a "confused" state. It triggered a decline in gold prices and a rise in risk aversion in the market.

The US dollar index was supported near 96.80, and there was no sign of further decline in the short term, indicating that the market's expectation of the Fed's "wait-and-see" stance limited the selling momentum. Fed Chairman Powell reiterated at the Portugal meeting on July 2 that as long as the economy remains sound, the Fed will maintain a wait-and-see attitude and assess the impact of tariff remarks on prices and growth. This statement contrasts with the market panic caused by the ADP data, and investors began to reassess the timing of the Fed's interest rate cut. Well-known institutions pointed out that if the non-agricultural data on Thursday is also a surprise, the US dollar may fall further.

The relative stabilization of the Challenger layoff data provides some comfort to the market. The number of layoffs in June was 48,000, a significant decrease from the previous value of 93,800, indicating that the pace of corporate layoffs has slowed down. Challenger Gray said that the layoffs in June were mainly driven by economic conditions, but there was no large-scale layoff wave. Technology, finance and manufacturing are still the hardest hit areas for layoffs. Although the total number of layoffs in the second quarter hit a four-year high, the slight month-on-month decline released a short-term stabilization signal.

Some institutions pointed out that the downward trend of ADP data and layoff data need to be analyzed together, pointing out that "hiring↓laying↓" may reflect that companies are still gritting their teeth and persisting. Although concerns about short-term economic slowdown are increasing, they are not on the verge of collapse. This view is highly consistent with the current data background, and investor sentiment is therefore swinging between risk aversion and wait-and-see.

The impact of the Fed’s rate cut expectations and market trends

The unexpected decline in ADP data directly impacted the market's expectations for the Fed's rate cuts. Previously, the market generally expected the Fed to resume rate cuts in the second half of 2025, but the unexpected drop in ADP data and the weakening of JOLTS job openings data led some investors to bet that the rate cuts might be brought forward to the middle of the year.

Well-known institutions analyzed that if Thursday's non-farm data confirms further weakness in the job market, the US dollar index may fall below the 96 mark, and assets such as gold and the euro will be further boosted. However, Powell's "wait-and-see" statement and the stabilization of the Challenger layoff data have limited the market's aggressive expectations for rate cuts.

Judging from the market trends, the selling of the US dollar and the rise in gold reflect the short-term dominance of risk aversion. The Challenger Report pointed out that the proportion of layoffs in the technology and financial industries is still high, reflecting that the pressure for industry adjustment has not been eliminated, and consumption and capital expenditure expectations may be further under pressure.

Future Trend Outlook

Looking ahead, the market focus will undoubtedly be on Thursday's non-farm payrolls report. Well-known institutions predict that non-farm payrolls will increase by 110,000 in June, lower than 139,000 in May, and the unemployment rate may rise from 4.2% to 4.3%. If the non-farm data continues the weak trend of ADP, the US dollar index may further drop to 94.62, and safe-haven assets such as gold and the euro will be supported; but if the non-farm data is unexpectedly strong, the US dollar may rebound quickly and the market's risk aversion will quickly subside. The stabilization signal of the Challenger layoffs data provides some support for the labor market, but the pressure of layoffs in the technology and financial industries remains, and attention should be paid to the transmission effect of the industry recovery progress on consumption and investment.

In the short term, the uncertainty of the US dollar trend will continue, and investors need to be wary of the risk of false breakthroughs caused by data fluctuations. On the X platform, both retail investors and institutions believe that the ADP data's surprise has cast a shadow on the non-farm report, but the resilience of the labor market and the Fed's wait-and-see stance may limit the unilateral trend of the market. In the long run, geopolitical risks such as tariff rhetoric and the situation between Russia and Ukraine will continue to inject uncertainty into the market. Safe-haven assets such as gold may remain volatile at high levels, while the trend direction of the US dollar and US stocks needs to wait for clearer guidance from non-farm data and the Fed's July meeting. Investors should pay close attention to Thursday's non-farm data and the distribution of industry layoffs, and comprehensively judge the policy and market path based on inflation and consumption data.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.