CBOT grains approaching critical levels: dramatic changes in positions release long and short signals. How will the trends of corn, soybeans, wheat, soybean oil and soybean meal break the deadlock?

2025-07-03 09:11:53

Market sentiment is driven by fundamental news, position changes and international trading dynamics. Ideal crop growing weather in the Midwest of the United States continues to provide the market with sufficient supply expectations, but weak export demand and competitive pressure from South America limit the upward space of prices. Based on the latest data, this article will analyze the position changes, market sentiment, basis dynamics and international trading trends of CBOT corn, soybeans, wheat, soybean meal and soybean oil, explore their impact on futures prices, and look forward to future trends.

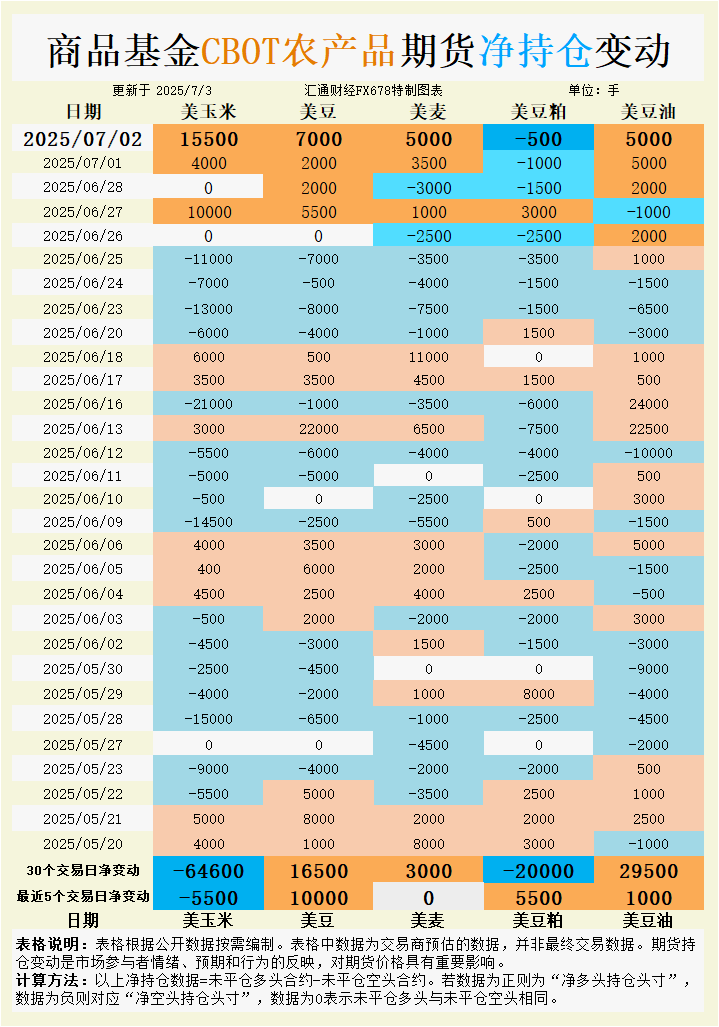

According to observations, the results estimated by overseas traders show:

On July 2, 2025, commodity funds:

Increase CBOT corn speculative net long position; increase CBOT soybean speculative net long position; increase CBOT wheat speculative net long position; increase CBOT soybean meal speculative net long position; increase CBOT soybean oil speculative net short position.

In the past five trading days, commodity funds:

Increase CBOT corn speculative net short; increase CBOT soybean speculative net long; CBOT wheat open long and open short are equal; increase CBOT soybean meal speculative net long; increase CBOT soybean oil speculative net long;

In the latest 30 trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net long position; increase CBOT wheat speculative net long position; increase CBOT soybean meal speculative net short position; increase CBOT soybean oil speculative net long position.

See the chart for specific change data.

Corn: Speculative long positions increase, short-term rebound momentum is limited

Corn futures rebounded on Wednesday, with the CBOT September corn contract (CU25) closing up 12 cents at $4.18 per bushel, and the December new crop contract (CZ25) rising 11.5 cents to $4.33 per bushel. The market rebound was mainly due to technical buying and pre-holiday position adjustments. Traders pointed out that the recent price hit the contract low and attracted bargain hunting funds to enter the market. However, the continued ideal weather in the Midwest of the United States provides good conditions for crop growth, coupled with Brazil's record second-quarter corn harvest expectations, the pressure of easing supply is still significant. In terms of basis, the CIF corn barge quotation for July shipment is stable at 71 cents above the July futures (CN25), and the August shipment quotation is 82 cents above the September futures (CU25), indicating that the spot market trading activity is limited and farmers are reluctant to sell due to low prices. The FOB export premium rose slightly, to 79 cents for July shipments and to 89 cents for August shipments, reflecting some support for export demand, but overall demand was weak.

Position changes show that commodity funds net bought 15,500 corn futures contracts on July 2, reflecting an increase in short-term speculative net longs and a cautiously optimistic market sentiment. However, in the last five trading days, funds have turned to net short positions, with a cumulative net short position of 64,600 contracts in 30 trading days, indicating that medium- and long-term bearish sentiment still dominates. This is consistent with the data from the U.S. Department of Agriculture (USDA). Last week, corn export sales were only 445,000 tons, far below market expectations (700,000-1.4 million tons). Low-priced corn in South America and Eastern Europe poses a challenge to the competitiveness of U.S. exports. In terms of international transactions, Tunisia is seeking 250,000 tons of feed corn, indicating that global demand exists, but the U.S. market share is limited.

Trend forecast: In the short term, corn futures may fluctuate at a low level due to technical buying and pre-holiday position adjustments, but the supply and demand fundamentals are bearish, coupled with export competition pressure, the upward space for prices is limited. Pay attention to the impact of the USDA's subsequent supply and demand report and South American production data on the market.

Soybeans: Market sentiment improves, export expectations boost prices

Soybean futures rose significantly on Wednesday, with the CBOT August soybean contract (SQ25) closing up 23.75 cents at $10.53/bushel and the November new crop contract (SX25) up 20.75 cents at $10.48/bushel. The price rebound was driven by multiple factors: technical buying, stronger soybean oil prices and the market's optimistic interpretation of Trump's tariff remarks. Traders pointed out that Trump's planned visit to Iowa on Thursday, where he may announce progress in trade negotiations with the United States, boosted market expectations for US soybean exports. In terms of basis, CIF soybean barge quotes for July shipment were stable at 76-77 cents above July futures (SN25), and August shipment quotes were 82 cents above August futures (SQ25). FOB export premiums rose slightly, with July and August shipments quoted at 83 cents and 85 cents respectively, indicating that the spot market is stable and firm. However, USDA data showed that soybean export sales last week were only 484,700 tons, lower than expectations (500,000-1.2 million tons), reflecting that export demand has not yet fully recovered.

In terms of position data, commodity funds net bought 7,000 soybean futures contracts on July 2, with a cumulative net long increase of 10,000 lots in the last five trading days and a net long increase of 16,500 lots in 30 trading days, indicating that speculators have increased confidence in the future of soybeans. This is consistent with market expectations for growth in soybean oil demand and potential export recovery. Well-known institutional analysts said that rising soybean oil prices and favorable biofuel policies provide indirect support for soybeans, but expectations of bumper harvests in South America (Brazil's soybean production in 2024/25 is expected to reach 171.5 million tons) may limit price upside.

Trend forecast: Soybean futures may continue to rebound in the short term, driven by technical support and improved export expectations, but supply pressure in South America and a stronger dollar may limit gains. Pay attention to news after Trump's visit to Iowa and USDA export data.

Wheat: Short-covering supports rebound, supply and demand pressures remain

Wheat futures recorded gains on Wednesday, with the CBOT September wheat contract (WU25) closing up 15 cents at $5.64/bushel, and the Kansas City September hard red winter wheat contract (KWU25) rising 9.75 cents to $5.40/bushel. The price rebound was mainly driven by short covering and pre-holiday position adjustments, and the market attracted bargain-hunting buying after hitting the May low. In terms of fundamentals, the U.S. Department of Agriculture reported that as of June 30, the winter wheat harvest progress reached 37%, significantly faster than the previous week, but the quality rates of winter wheat and spring wheat fell to 49% and 53%, respectively, slightly lower than market expectations. In terms of basis, the spot price of hard red winter wheat in the U.S. Plains region was stable, reflecting a relative balance of supply and demand, but farmers were reluctant to sell due to low prices, limiting the activity of spot trading. In the international market, Jordan did not purchase 1.2 million tons of feed barley in the tender on Wednesday, Tunisia sought 250,000 tons of feed corn, and Bangladesh planned to purchase 50,000 tons of milling wheat, showing that global demand exists but competition is fierce.

In terms of position data, commodity funds net bought 5,000 wheat futures contracts on July 2. In the last five trading days, long and short positions were balanced, and net long positions increased by 3,000 lots in 30 trading days, indicating that speculators are cautiously bullish on the future of wheat. Market participants pointed out that the situation between Russia and Ukraine and the high temperature in Europe may provide some support for wheat prices, but the ample global supply (especially in Europe and the Black Sea region) limits the room for growth.

Trend forecast: Wheat futures may rebound from a low level in the short term due to short covering, but ample global supply and weak export demand will limit the upward space of prices. Pay attention to the weather in the Black Sea region and the USDA supply and demand report.

Soybean meal: Cautious positions, prices under pressure

Soybean meal futures performed steadily, with the CBOT August soybean meal contract (SMQ25) closing up $1.8 at $275.60/short ton. Market transactions were light, and some processing plants entered a planned shutdown due to the long holiday, limiting the activity of the spot market. In terms of basis, soybean meal basis quotations at railway and truck terminals in the Midwest of the United States were stable, and CIF and FOB quotations were slightly differentiated. The USDA report showed that the US soybean crushing volume in May was 203.7 million bushels, lower than the market expectation of 204.7 million bushels, reflecting slightly weak crushing demand. South Korea's NOFI sought to purchase 60,000 tons of soybean meal, indicating that global feed demand is stable, but expectations of bumper harvests in South America have suppressed soybean meal prices.

In terms of position data, commodity funds sold a net of 500 soybean meal futures contracts on July 2, and the net long position increased by 5,500 lots in the last five trading days, but the net short position increased by 20,000 lots in 30 trading days, indicating that the medium- and long-term bearish sentiment is dominant. Market participants pointed out that the steady growth of global animal feed demand provides some support for soybean meal, but the abundant supply in South America and weak export demand limit the room for price rebound.

Trend forecast: Soybean meal futures may remain volatile in the short term due to technical buying and pre-holiday adjustments, but the expectation of bumper harvests in South America and weak crushing demand may continue to put pressure on prices. Pay attention to South American production data and changes in global feed demand.

Soybean oil: Biofuel policy is favorable, speculative sentiment is divided

Soybean oil futures continued to be strong, supported by favorable biofuel policies and the rise in the global vegetable oil market. In terms of basis, soybean oil spot market quotations were stable and demand was relatively stable. Traders pointed out that the biofuel policy in the latest US budget provided support for soybean oil prices. Coupled with the continuous rise in Malaysian palm oil prices, the demand for soybean oil as an alternative oil increased. In terms of international transactions, corn and soybean meal tenders in South Korea and Algeria showed that global feed and oil demand was stable, but the competitiveness of US exports still needs to be observed.

In terms of position data, commodity funds net bought 5,000 soybean oil futures contracts on July 2, and the net long position increased by 1,000 lots in the last five trading days. The net long position increased by 29,500 lots in 30 trading days, reflecting speculators' strong confidence in the future of soybean oil. However, the increase in net short positions on July 2 showed that short-term market sentiment was somewhat divided. Well-known institutional analysts believe that global population growth and long-term growth in biofuel demand will provide support for soybean oil prices, but short-term fluctuations in palm oil prices may bring uncertainty.

Trend forecast: Soybean oil futures may continue to rise in the short term, supported by biofuel policies and alternative demand, but we need to be wary of the risk of a correction caused by palm oil price fluctuations and divergent speculative sentiment. Pay attention to the global oil market dynamics and USDA export data.

Future Trend Outlook

The rebound in the CBOT grain futures market on Wednesday reflects the short-term momentum of technical buying and pre-holiday position adjustments, but the fundamental pressure is still significant. Corn and soybeans are suppressed by ideal weather in the Midwest of the United States and expectations of bumper harvests in South America, and the upward space of prices is limited. They may remain low and volatile in the short term. Wheat is supported by short-covering, but ample global supply and export competition limit the rebound. The soybean meal market is under pressure due to weak crushing demand and supply pressure in South America, and the short-term trend is cautious. Soybean oil benefits from biofuel policies and global oil demand growth, and still has the potential to rise in the short term. Future market trends will depend on the USDA supply and demand report, South American production data and global demand dynamics. Traders need to pay close attention to the further impact of Trump's tariff remarks and international bidding results on export expectations.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.