Gold Price Forecast: Gold prices expected to breakout in July

2025-07-03 18:08:23

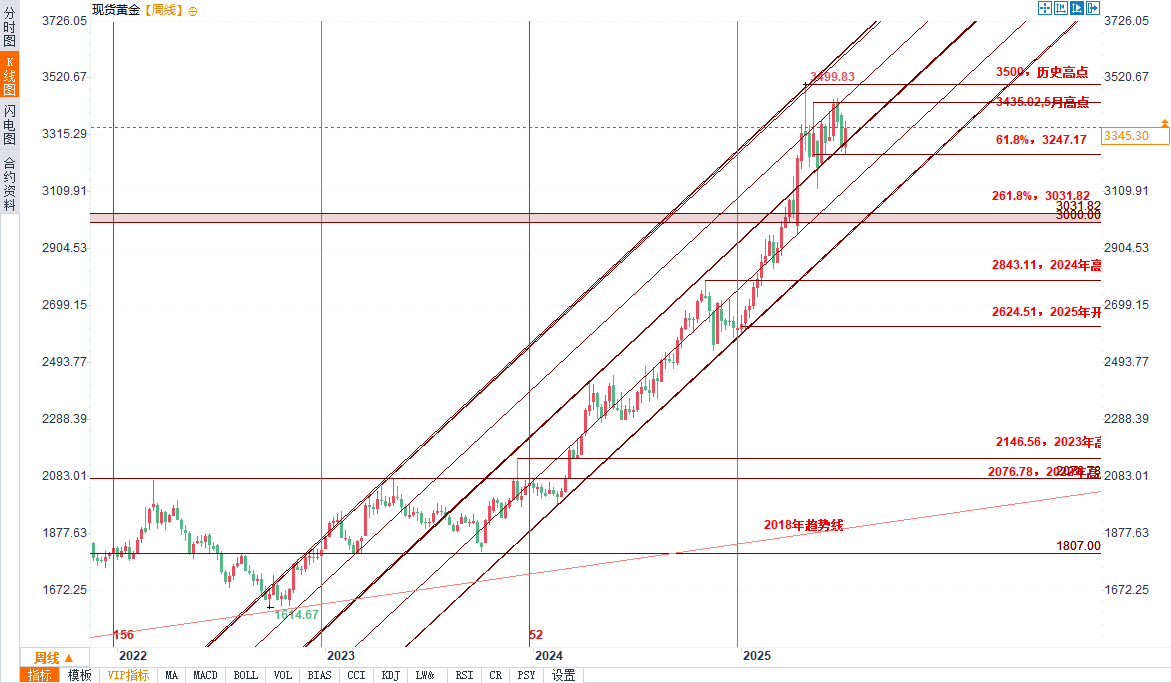

Technical Outlook: In our previous gold technical forecast, we noted that gold prices were "consolidating above the midline of a multi-year uptrend. From a trading perspective, the near-term focus is on a breakout of the 3229-3419 range for guidance, while bulls remain weak below the 75% parallel." Gold attempted a breakout the following week, with prices reaching a high of 3432 before retreating. The subsequent decline extended nearly 5.9% from the high, rebounding this week after finding support at the 61.8% Fibonacci retracement level of the May rally at 3247. Now that July has arrived, the stage has been set, and the near-term market focus will be squarely on whether prices can break out of this six-week range.

Resistance is seen at the record closing high/May high of 3432-35, and a breakout/weekly close above 3500 is needed to signal the resumption of the broader uptrend. Subsequent resistance is focused on the upper parallel line, currently near 3630.

A breakout/close below 3247 would threaten a larger correction in the multi-year uptrend. Subsequent support is located near the May low at 3121, with broader bullish invalidation holding at 3000/31, and downside exhaustion/price inflection points could occur if these areas are touched.

Summary: Gold is trading in a clear range, just below the uptrend resistance, and a breakout is expected in the coming weeks. From a trading perspective, the near-term focus is on a breakout of the 3247-3435 range for guidance. For the uptrend to remain viable in 2024, declines should be limited to 3000, while a close above 3500 is still needed to initiate the next major uptrend.

Keep in mind that we are in the early stages of the July opening range, ahead of an extended holiday weekend with US non-farm payrolls due. Until this range is breached, stay flexible and watch the weekly close for guidance.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.