CBOT holdings: The last game before the Independence Day holiday! Funds suddenly reversed their operations: Why did they buy soybeans at the bottom while selling soybean oil?

2025-07-04 10:35:52

According to observations, the results estimated by overseas traders show:

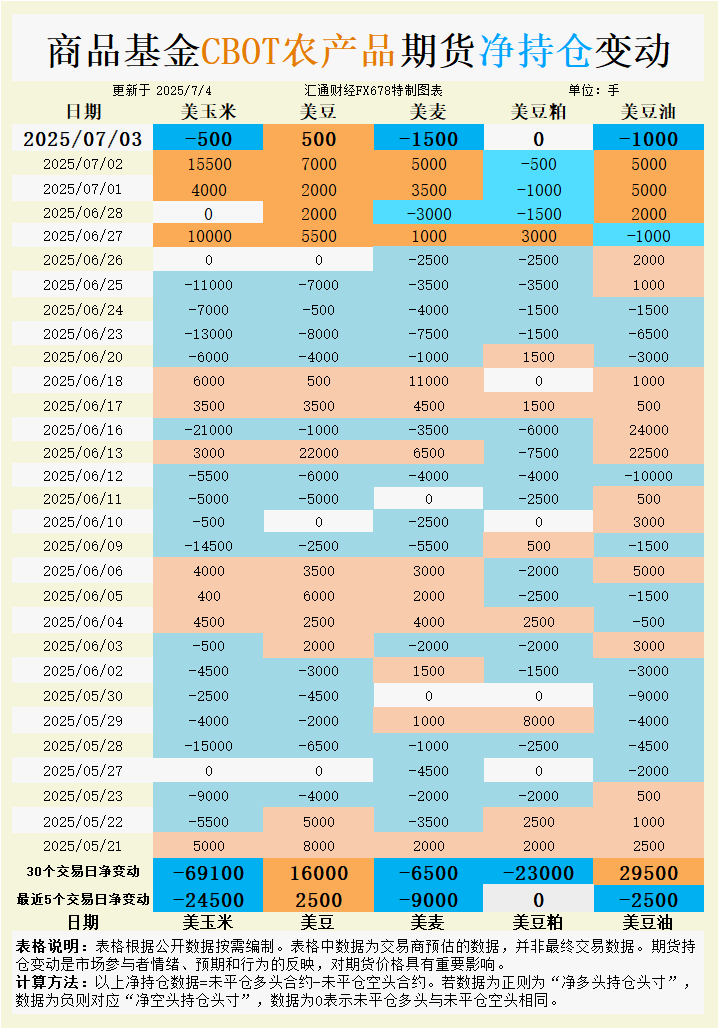

On July 3, 2025, commodity funds:

Increase CBOT corn speculative net long positions; increase CBOT soybean speculative net long positions; increase CBOT wheat speculative net long positions; increase CBOT soybean meal speculative net long positions; increase CBOT soybean oil speculative net long positions.

In the past five trading days, commodity funds:

Increased CBOT corn speculative net short; increased CBOT soybean speculative net long; increased CBOT wheat speculative net short; CBOT soybean meal open long and open short positions are equal; increased CBOT soybean oil speculative net short;

In the latest 30 trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net long position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net short position; increase CBOT soybean oil speculative net long position.

See the chart for specific change data.

Wheat: Global supply pressure and weather support coexist

CBOT wheat futures closed slightly fluctuating on the last trading day of the week, affected by the combined effects of ample global supply and domestic crop progress in the United States. The September hard red winter wheat contract (KWU25) closed up 6.25 cents/bushel at $5.36/bushel, but the overall market sentiment was cautious. Position data showed that commodity funds increased their speculative net long positions in wheat by 1,500 lots on July 3, but net short positions increased by 9,000 lots in the last five trading days, and net short positions accumulated by 6,500 lots in 30 trading days, indicating that the market's bearish expectations for wheat prices dominated. In terms of basis, the spot basis of hard red winter wheat in the plains of the United States has been stable and rising. For example, the basis in Wichita, Kansas, narrowed from -25 cents/bushel to -40 cents/bushel, reflecting stable domestic demand in the United States. However, the protein premium declined, with the premium of 12.6% protein wheat falling by 85 cents/bushel, indicating weak demand for high-quality wheat.

From a fundamental perspective, global wheat supply is sufficient, and crop yields in Europe and Russia and Ukraine are expected to be high, although extreme weather has brought some disturbances. Argentina's wheat planting progress for 2025/26 has reached 78.2%. Cold weather is conducive to crop growth, and production is expected to increase steadily. The US winter wheat crop is progressing smoothly, but global oversupply limits price upside. Market sentiment was briefly disturbed by tariff rhetoric, and investors are paying attention to future policy trends. In the short term, wheat futures may fluctuate in the range of US$5.00-5.50 per bushel, and attention should be paid to the harvest progress in US producing areas and international bidding dynamics.

Soybeans: Short-covering drives rebound, supply-demand balance limits gains

CBOT soybean futures rose slightly on Thursday, with the November contract closing up 0.1% and the weekly gain reaching 2.4%, reversing last week's 3.4% decline. Position data showed that commodity funds increased their net long soybean positions by 500 lots on July 3, and their net long positions increased by 2,500 lots in the last five trading days, with a cumulative net long position of 16,000 lots in 30 trading days, reflecting that the market's bullish sentiment on soybean prices has warmed up. In terms of basis, the domestic soybean basis in the United States remained stable, reflecting a mild recovery in export demand. The USDA report showed that as of the week of June 26, net sales of soybean exports in 2024/25 were 462,000 tons, up from 403,000 tons in the previous week. Private exporters reported sales of 226,000 tons of soybeans to unknown destinations, further boosting market confidence.

In terms of fundamentals, in the next 6-10 days, 61% of the main soybean producing states in the United States will have higher temperatures than normal, and 89% of the areas will have more precipitation, which is conducive to the growth of crops before flowering and pod formation. The USDA drought report shows that as of July 1, only 8% of soybean planting areas were affected by drought, a decrease of 4 percentage points from the previous week, indicating that domestic supply pressure in the United States has eased. However, Brazil's soybean harvest expectations and Argentina's production of 50.3 million tons (an increase of 100,000 tons from last year) have suppressed global supply. Market concerns about tariff rhetoric have eased, but we still need to be vigilant about policy uncertainties. Soybean futures are expected to consolidate in the range of US$10.50-11.00 per bushel in the short term, with attention paid to the export rhythm of South America and US crop rating data.

Soybean oil: Fund selling puts pressure on oil, export demand provides support

CBOT soybean oil futures fell 0.7% on Thursday, with the December contract trading in the range of 54.45-55.19 cents per bushel, still up 3.9% on the week. Position data showed that commodity funds sold 1,000 lots of soybean oil on July 3, and the net short position increased by 2,500 lots in the last five trading days, but the net long position accumulated to 29,500 lots in 30 trading days, indicating that short-term bearish sentiment coexists with long-term bullish expectations. Trading volume fell from 59,019 lots on Wednesday to 49,818 lots, and the short position increased to 264,200 lots, reflecting a slight decline in market activity. In terms of basis, the domestic soybean oil basis in the United States remained strong, and export market demand provided some support for prices. The USDA report showed that as of the week of June 26, net sales of soybean oil exports in 2024/25 were 12,000 tons, higher than 4,000 tons in the previous week, indicating that demand has picked up.

In terms of fundamentals, the global vegetable oil supply is abundant, and the expected bumper soybean harvest in South America and high palm oil stocks in Malaysia have suppressed soybean oil prices. The optimistic expectations of the US biofuel policy provide some support to the market, but weak global demand and increased supply in South America limit the upside. In the short term, soybean oil futures may fluctuate in the range of 54.00-56.00 cents/bushel, and attention should be paid to US crushing data and the dynamics of the international oil and fat market.

Soybean meal: Improved export sales boost prices, but supply pressure remains

CBOT soybean meal futures rose 0.5% on Thursday, with the December contract up 1.3% on a weekly basis, ending four weeks of losses. Position data showed that commodity funds were basically flat in the soybean meal market on July 3, with long and short positions balanced in the last five trading days, and a net short position accumulated of 23,000 lots in 30 trading days, reflecting the market's lack of confidence in price increases. The USDA report showed that as of the week of June 26, net sales of soybean meal exports in 2024/25 were 306,200 tons, significantly higher than 94,000 tons in the previous week, and net sales in 2025/26 were 397,400 tons, higher than 166,100 tons in the previous week. Private exporters reported sales of 195,000 tons of soybean meal to unknown destinations, boosting market sentiment. In terms of basis, the domestic soybean meal basis in the United States fell slightly, reflecting an imbalance between supply and demand.

From a fundamental perspective, the high domestic crushing volume in the United States, the abundant supply of soybeans in South America, and the stable but weak growth in global animal feed demand have limited the upward space of soybean meal prices. The bumper soybean harvest in Argentina has further exacerbated supply pressure. It is expected that soybean meal futures will fluctuate in the range of US$290-310 per short ton in the short term, and attention should be paid to US export shipment data and the rhythm of the new season soybeans in South America.

Corn: Favorable weather and global supply pressure game

CBOT corn futures fluctuated limitedly on Thursday, with prices affected by favorable weather in the United States and global supply pressures. Position data showed that commodity funds increased their net long corn positions by 500 lots on July 3, but net short positions increased by 24,500 lots in the last five trading days, and net short positions accumulated by 69,100 lots in 30 trading days, indicating a strong bearish sentiment in the market. In terms of basis, domestic corn basis in the United States remained stable, reflecting weak export demand. The USDA report showed that as of the week of June 26, net corn export sales in 2024/25 were expected to be between 400,000 and 1 million tons, and private exporters reported sales of 150,000 tons of corn to unknown destinations, indicating a slight recovery in demand.

In terms of fundamentals, in the next 6-10 days, 61.11% of the main corn-producing states in the United States will have higher temperatures than normal, and 78% of the areas will have more precipitation, which is conducive to crop growth. The USDA drought report shows that as of July 1, only 12% of corn-growing areas were affected by drought, a decrease of 4 percentage points from the previous week. Brazil's corn production forecast for 2024/25 has been raised, and Argentina's corn harvest progress has reached 61.7%, with an estimated output of 49 million tons. Ample global supply suppresses prices. Corn futures are expected to fluctuate in the range of US$4.50-4.80 per bushel in the short term, and attention should be paid to the weather in the US producing areas and the export dynamics of South America.

Future Trend Outlook

The CBOT grain futures market will maintain a volatile pattern in the short term. Wheat futures are suppressed by ample global supply and may fluctuate in the range of $5.00-5.50/bushel. Soybean futures are expected to consolidate in the range of $10.50-11.00/bushel, supported by short covering and export demand. Soybean oil futures are affected by fund selling and global supply pressure and may run in the range of 54.00-56.00 cents/bushel. Soybean meal futures are slightly supported by improved export sales, but the supply and demand balance limits the increase and is expected to fluctuate in the range of $290-310/short ton. Corn futures may consolidate in the range of $4.50-4.80/bushel under favorable weather and global supply pressure. Investors need to pay close attention to the weather in the US producing areas, the export rhythm of South America and the progress of tariff rhetoric to grasp the market direction.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.