Technical analysis: Gold bears attempt to attack and test the daily cloud again

2025-07-09 19:16:43

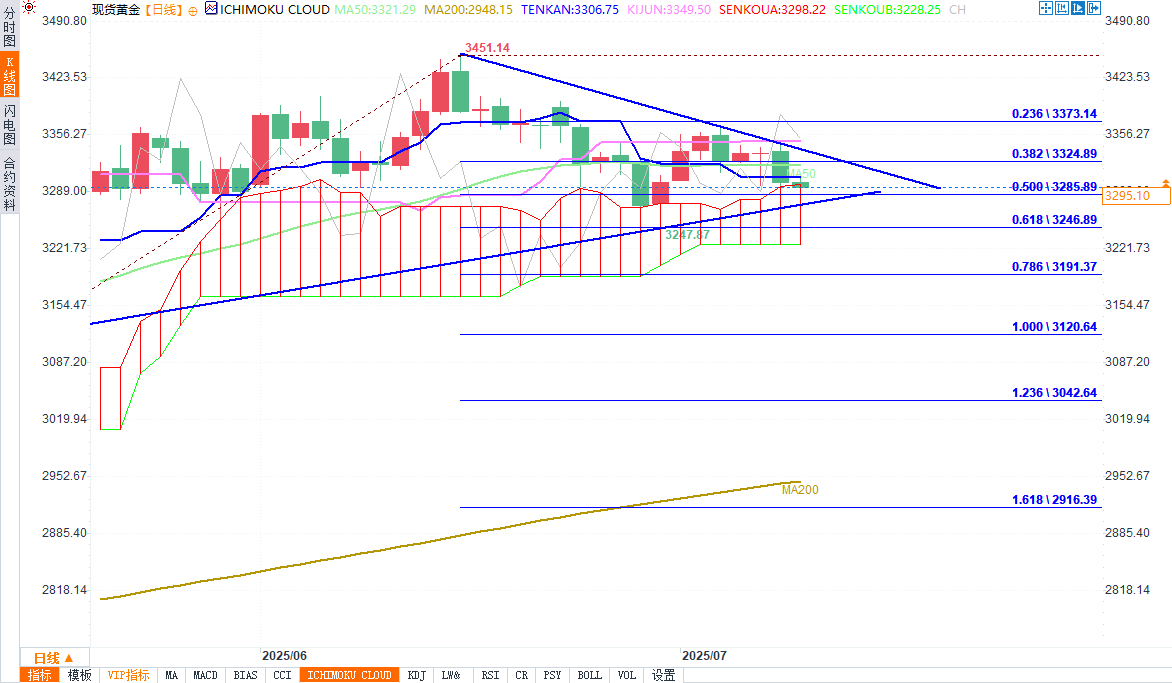

The daily cloud has blocked the bears’ attacks several times recently, and now the bears are trying again to break below the key support of $3,300 (this position has both psychological support and support from the top of the daily rising cloud) in an effort to maintain the downward breakout trend.

As of now, today’s gold price trend is still within the cloud. The bears broke below the 50% retracement level of the $3120-3452 range ($3286) during the intraday session and set their sights on the next important support level of $3277 (triangle support line).

Daily technical indicators are weak (conversion/base lines are in a bearish alignment, negative momentum is increasing), which supports further downside for gold prices. If the trendline support of $3277 is broken, gold prices may further test the key support of $3247 (June 30 higher low, also 61.8% Fibonacci retracement level) and $3228 (daily cloud bottom).

(Source of spot gold daily chart: Yihuitong)

On the contrary, if gold fails to close below the cloud again on the daily level, the short-term downside risk will be alleviated. However, it will take a recapture of the $3325-3336 range (the 38.2% Fibonacci retracement level that has been broken and the upper boundary of the triangle) to curb short-term bearish forces and shift the market focus to the upside.

The Federal Reserve's meeting minutes (to be released later today) will attract much attention as the market hopes to obtain more details on the Fed's short-term interest rate outlook.

Resistance levels: $3,300; $3,308; $3,325; $3,338

Support levels: $3,277; $3,247; $3,228; $3,205

At 19:09 Beijing time, spot gold was trading at $3,294.93 an ounce, down 0.20%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.