Technical analysis: USD/JPY bulls regain control ahead of Fed minutes

2025-07-09 20:18:27

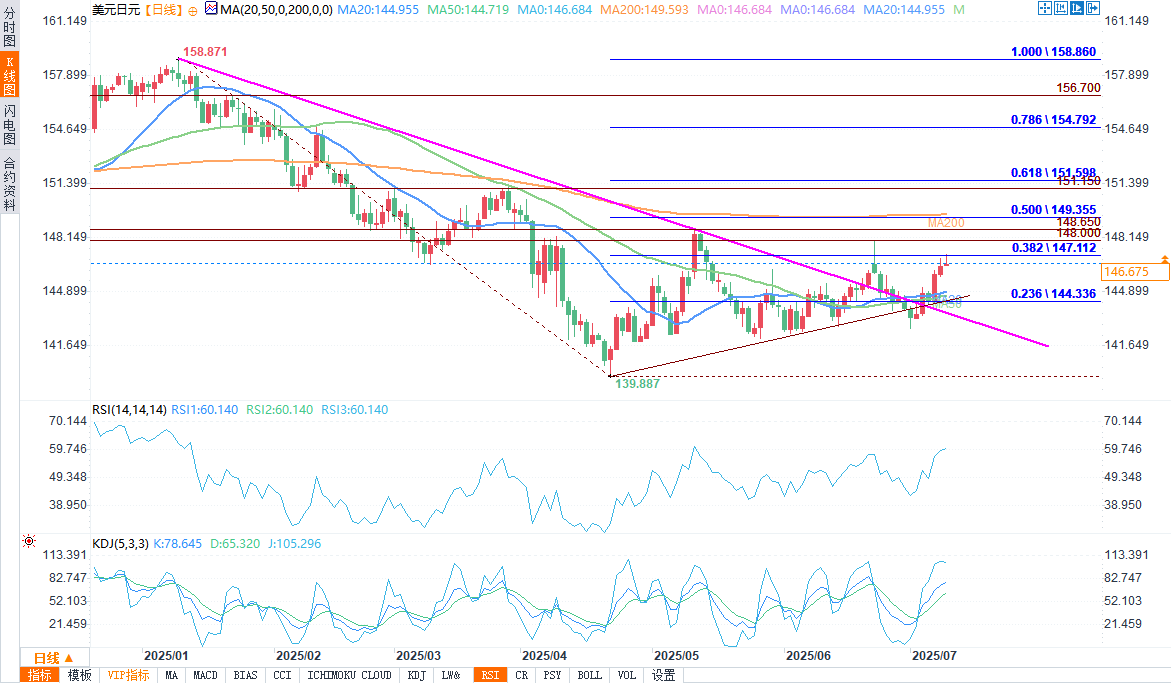

USD/JPY continued its bullish trend after rebounding from the 142.60 support level, decisively breaking through several key technical resistance levels, including the short-term simple moving averages (SMAs), the 23.6% Fibonacci retracement level of the 158.86–139.85 downtrend (144.35), and the long-term rising trend line.

The dollar was also supported by market expectations for today's Federal Reserve meeting minutes, which are expected to strike a cautious but potentially hawkish tone. Market participants will closely monitor the Fed's stance on the persistence of inflation and the expected timeline for rate cuts later in 2025.

(Source of USD/JPY daily chart: Yihuitong)

If the bullish momentum continues, the pair could target the next resistance zone of 148.00–148.65, followed by the key 149.40 level, which coincides with the 50.0% Fibonacci retracement level and the 200-day simple moving average. A sustained break above this area could turn the overall outlook strongly bullish.

On the contrary, in case of a correction, the pair could fall back to the short-term uptrend line and the support level of 144.35. A break below this level and further decline could lead to the 142.00–142.60 range, which could reignite the bearish pressure.

Overall, USD/JPY remains bullish in the short term, driven by improving momentum and favorable positioning ahead of the release of the Fed's meeting minutes.

At 20:11 Beijing time, USD/JPY was at 146.716/727, up 0.13%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.