Crude oil trading reminder: Global trade uncertainty puts pressure on oil prices, and the short-term range will remain volatile. Beware of another decline

2025-07-10 10:16:26

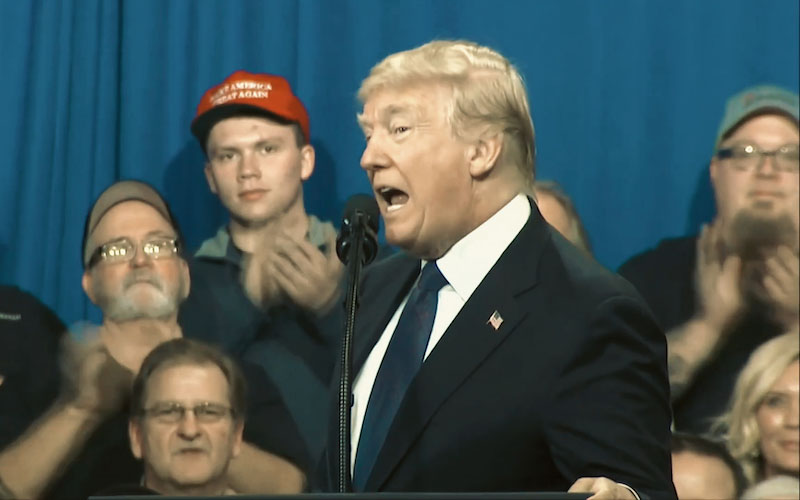

International oil prices continued to fall in early trading on Thursday, mainly because the new round of tariffs announced by US President Trump has caused the market to worry that the global economy may face a further slowdown. According to market data, Brent crude oil futures fell 0.31% to $69.97 per barrel, while US WTI crude oil fell 0.39% to $68.11 per barrel.

Tariffs spread to Latin American and Asian countries, and market expectations worsened

The Trump administration's latest trade moves are no longer limited to Asian countries. On Wednesday, Trump said he would impose 50% punitive tariffs on Brazilian exports due to a public dispute with Brazilian President Lula.

In addition, he also proposed to impose tariffs on copper, semiconductors and pharmaceutical products, and issued relevant notices to countries such as the Philippines and Iraq. These measures have caused the total number of tariff warnings issued this week to exceed more than a dozen, including major US suppliers such as South Korea and Japan.

According to market research, trade concerns are likely to significantly compress global demand growth for industrial and energy commodities in the second half of the year.

There are obvious differences within the Federal Reserve on interest rate cuts, and borrowing costs may continue to rise

The minutes of the Fed's meeting held on June 17-18 showed that only "a few officials" supported an early rate cut in July, a signal interpreted by the market as a cautious monetary policy. The increase in financing costs under a high interest rate environment will directly suppress corporate expansion intentions and further curb crude oil consumption.

An independent energy consultant said: "If the Fed does not turn to easing policy in the short term, the pressure on the demand side of crude oil will continue to exist."

Inventory data provides short-term support, but it is difficult to change the trend

Although oil prices are under overall pressure, inventory data released by the U.S. Energy Information Administration (EIA) showed that as of last week, U.S. gasoline and distillate inventories had fallen significantly, while gasoline consumption rose 6% month-on-month to 9.2 million barrels per day, indicating that the summer driving peak brought short-term positive factors.

In addition, global aviation demand has also become an important variable to boost market sentiment. JPMorgan Chase pointed out in a client report: "In the first eight days of July, the average number of daily flights worldwide reached 107,600, a record high, among which aviation activities in Asian countries recovered to the peak in nearly five months."

The bank also predicts that global daily crude oil demand will grow by 970,000 barrels this year, basically consistent with its forecast of 1 million barrels at the beginning of the year, indicating that although the consumption side is under pressure, it has not yet seen a cliff-like decline.

From the daily chart, after a brief rebound, the price of US WTI crude oil was blocked at the 70-dollar mark, and closed with a long upper shadow for three consecutive trading days, indicating significant pressure from above. The current price is running below the 20-day and 50-day moving averages, and the MACD indicator shows signs of a dead cross, and the kinetic energy column is gradually shortening, indicating that the bullish momentum is weakening.

A senior technical analyst pointed out: "If WTI cannot effectively break through the $70.50 resistance level, it may continue to fall to the $67.20 support area in the short term."

If the price falls below this support, the possibility of testing the previous low of $65.80 cannot be ruled out. Overall, under the background of macro-negative, the technical side does not support a sharp rebound in crude oil for the time being, and attention should be paid to the performance of key support levels.

Editor's opinion:

The current international crude oil market is in a sensitive period under the superposition of multiple variables of geopolitics and macroeconomic policies. Trump continues to pressure tariff policies, and the Federal Reserve has not yet reached a consensus on the interest rate outlook, making market expectations bearish.

However, the continued rise in US gasoline demand and global flight activity shows that there is still support on the actual consumption side. If trade concerns are not alleviated in the short term, oil prices may continue to be under pressure.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.