CBOT positions: The short-order storm escalates! Is there an escape route from the double blow of weather and tariffs?

2025-07-10 10:27:38

Market sentiment is generally bearish, and speculative funds have continued to increase their net short positions in corn, soybeans, wheat and soybean meal in the past 30 trading days, reflecting concerns about excess supply and demand. However, the soybean oil market has shown some resilience due to palm oil price fluctuations and speculative funds' net long positions. This article analyzes the trend and future direction of the CBOT grain market based on the latest position data, basis changes and fundamental information.

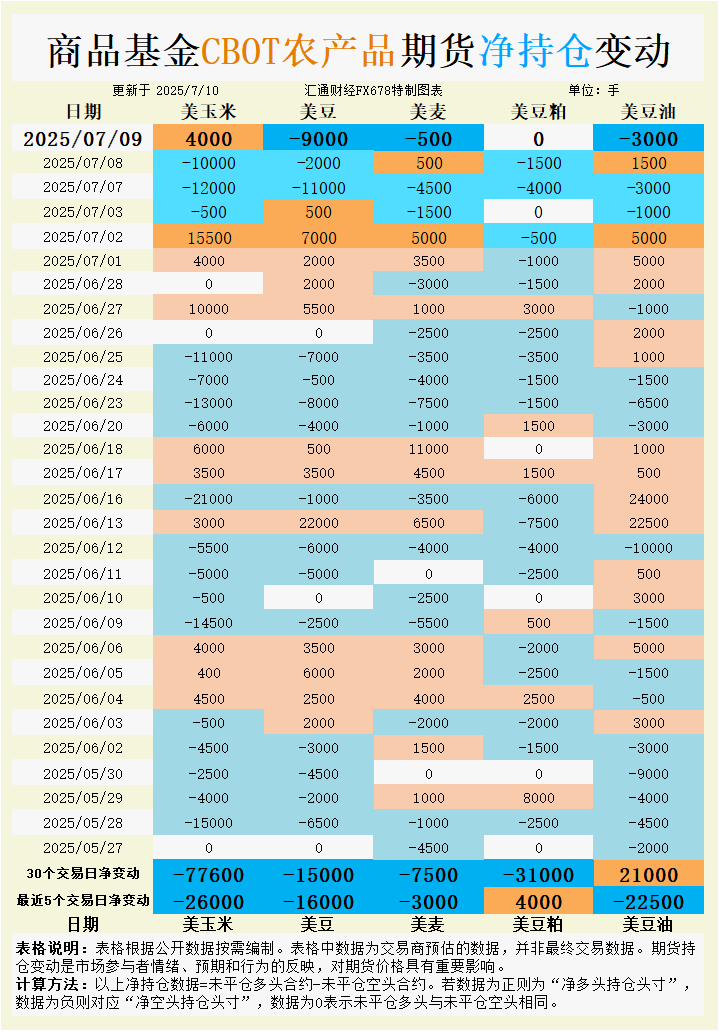

According to observations, the results estimated by overseas traders show:

On July 9, 2025, commodity funds:

CBOT corn open long interest is equal to open short interest; CBOT soybean open long interest is equal to open short interest; CBOT wheat speculative net short position increased; CBOT soybean meal open long interest is equal to open short interest; CBOT soybean oil speculative net short position increased.

In the past five trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net short position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net long position; increase CBOT soybean oil speculative net short position;

In the latest 30 trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net short position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net short position; increase CBOT soybean oil speculative net long position.

See the chart for specific change data.

Corn: Speculative shorts dominate, basis area differentiation

According to the latest data, as of July 9, the speculative net short position of CBOT corn futures increased by 77,600 lots in the past 30 trading days, and 26,000 net shorts were added in the last five trading days, indicating that funds continue to be bearish on the outlook for corn prices. The balance of open long and short positions on July 9 indicates that market participants lack a clear direction in the short term. However, the net short positions on July 8 and July 7 increased by 10,000 lots and 12,000 lots respectively, reflecting the funds' growing concerns about oversupply.

The precipitation in the main corn-producing areas of the Midwest of the United States is expected to be higher than the historical median in the next 6-10 days, and the temperature is slightly higher than normal, which is conducive to corn growth. The U.S. Department of Agriculture report shows that the quality rate of corn crops remains stable, and the V8-V10 growth stage is progressing smoothly, indicating a good harvest prospect. In terms of basis, the spot market in the Midwest of the United States has diverged: the basis of the Decatur processing plant in Illinois rose by 3 cents to +18 cents/bushel, and the basis of the Columbus railway terminal in Ohio rose by 3 cents to +48 cents/bushel, but the basis of Council Bluffs in Iowa fell by 2 cents to +13 cents/bushel, indicating regional supply and demand differences. Demand concerns caused by tariff remarks further pressured market sentiment, and traders were worried about the decline in the competitiveness of U.S. corn exports.

In the short term, corn futures may fluctuate in the range of $4.10-4.20/bushel, suppressed by the expectation of a good harvest and export uncertainty. If the weather continues to be favorable, the price may further test the psychological barrier of $4.00/bushel.

Soybeans: Supply pressure and export concerns coexist

CBOT soybean futures net short positions increased by 15,000 lots in the past 30 trading days, and 16,000 lots of net short positions were added in the last 5 trading days. On July 9, the fund sold a net of 9,000 lots, indicating that speculative sentiment continued to be pessimistic. On July 9, the balance of open long and short positions indicated that the market entered a wait-and-see state. Previously, on July 7, the net short position increased by 11,000 lots, reflecting the fund's cautious attitude towards the supply and demand pattern.

Weather conditions in the main soybean producing areas in the Midwest of the United States are good. Precipitation in the next 6-10 days is expected to be higher than the historical median, and the temperature is moderate, which is conducive to the resumption of soybean growth. South American crop experts maintain their forecast for US soybean yields in 2025 at 51.5 bushels per acre. If the weather continues to be favorable in August, the yield may be raised. In terms of basis, the basis at the Lafayette processing plant in Indiana rose by 5 cents to +20 cents per bushel, and the basis at Morris River Port in Illinois rose by 1 cent to +1 cent per bushel, indicating local demand support in the spot market. Argentina's corn planting boom in September may squeeze soybean planting area and boost South American soybean price expectations, but the potential impact of tariff remarks on US soybean exports has put pressure on the market.

Soybean futures may fluctuate in the range of $10.00-10.20/bushel in the short term, and the expectation of a good harvest and export uncertainty will continue to dominate the price trend. If the USDA supply and demand report on Friday shows weak export data, the price may further drop to $9.80/bushel.

Wheat: Harvest pressure and technical weakness

CBOT wheat futures net short positions increased by 7,500 lots in the past 30 trading days, and 3,000 lots of net short positions were added in the last five trading days. Speculative net short positions continued to increase on July 9. Fund selling sentiment was driven by the pressure of a bumper harvest in the northern hemisphere, and the market's expectations of oversupply of wheat increased.

Rainfall in Manitoba, Canada, was insufficient to alleviate the drought, and the quality rate of spring wheat remained as high as 90%, but the uneven growth stage of crops in some areas increased market uncertainty. The U.S. wheat market was affected by global harvest pressure, and the basis remained stable. The basis of Chicago and Toledo ports remained at -10 cents/bushel and -29 cents/bushel, respectively. Supply concerns caused by the situation in Russia and Ukraine have eased, and high global wheat stocks have further pressured prices. From a technical perspective, wheat futures fell below the 20-day and 50-day moving averages, indicating a weak pattern.

Wheat futures may continue to be pressured in the $5.40-5.60/bushel range. If the USDA report confirms loose global supplies, prices may fall to $5.30/bushel.

Soybean meal: Net long positions increased, supported by demand expectations

CBOT soybean meal futures showed differentiation, with net short positions increasing by 31,000 lots in the past 30 trading days, but turning into net long positions increasing by 4,000 lots in the last five trading days, with open long and short positions balanced on July 9. Fund operations in the soybean meal market reflect cautious optimism about demand recovery, which may be an expected response to reduced supply from South America.

The soybean crushing profit for August-September shipments is -40 to 10 yuan/ton, indicating weak demand, but the slowdown in September shipment purchases may push up the forward basis. The USDA export sales report expects net soybean meal export sales of 75,000 to 400,000 tons in 2024/25, indicating stable demand. The basis data has not changed significantly, but the soybean meal spot market is dragged down by soybean prices, and short-term demand expectations are limited.

Soybean meal futures may stabilize around current price levels, with an eye on USDA report on export data updates. If expectations of tighter supply in South America increase, prices may test higher resistance levels.

Soybean oil: Net long turns to net short, dragged down by palm oil

CBOT soybean oil futures net long position increased by 21,000 lots in the past 30 trading days, but turned to net short position increased by 22,500 lots in the last 5 trading days, and continued to increase speculative net short position on July 9. The rapid shift of funds to short position reflects concerns about the weakness of the external market.

Malaysian palm oil futures fell due to good weather in the Midwest of the United States and trade policy concerns. Inventories are expected to be 1.99 million tons at the end of June, down slightly from the previous month. Soybean oil futures were dragged down by palm oil prices, and basis data has not been updated yet, but spot market sentiment is weak. USDA expects net soybean oil export sales to be 0-22,000 tons in 2024/25, and demand is expected to be sluggish.

Soybean oil futures may continue to follow the fluctuations of palm oil prices and consolidate around the current level in the short term. If the Malaysian palm oil supply and demand report shows a further decline in inventories, soybean oil prices may receive some support.

Future Trend Outlook

The CBOT grain futures market will continue to be under the dual pressure of favorable weather in the Midwest and tariff rhetoric in the short term. Corn and soybean futures may fluctuate at low levels, testing the support levels of $4.00/bushel and $9.80/bushel respectively. Wheat futures may continue to fall to $5.30/bushel due to global harvest pressure. The soybean meal market may stabilize due to improved demand expectations, while the trend of soybean oil futures will be highly dependent on the results of the Malaysian palm oil supply and demand report. The USDA supply and demand report on Friday will be key, and traders need to pay close attention to export data and global inventory updates to determine whether new drivers will emerge in the market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.