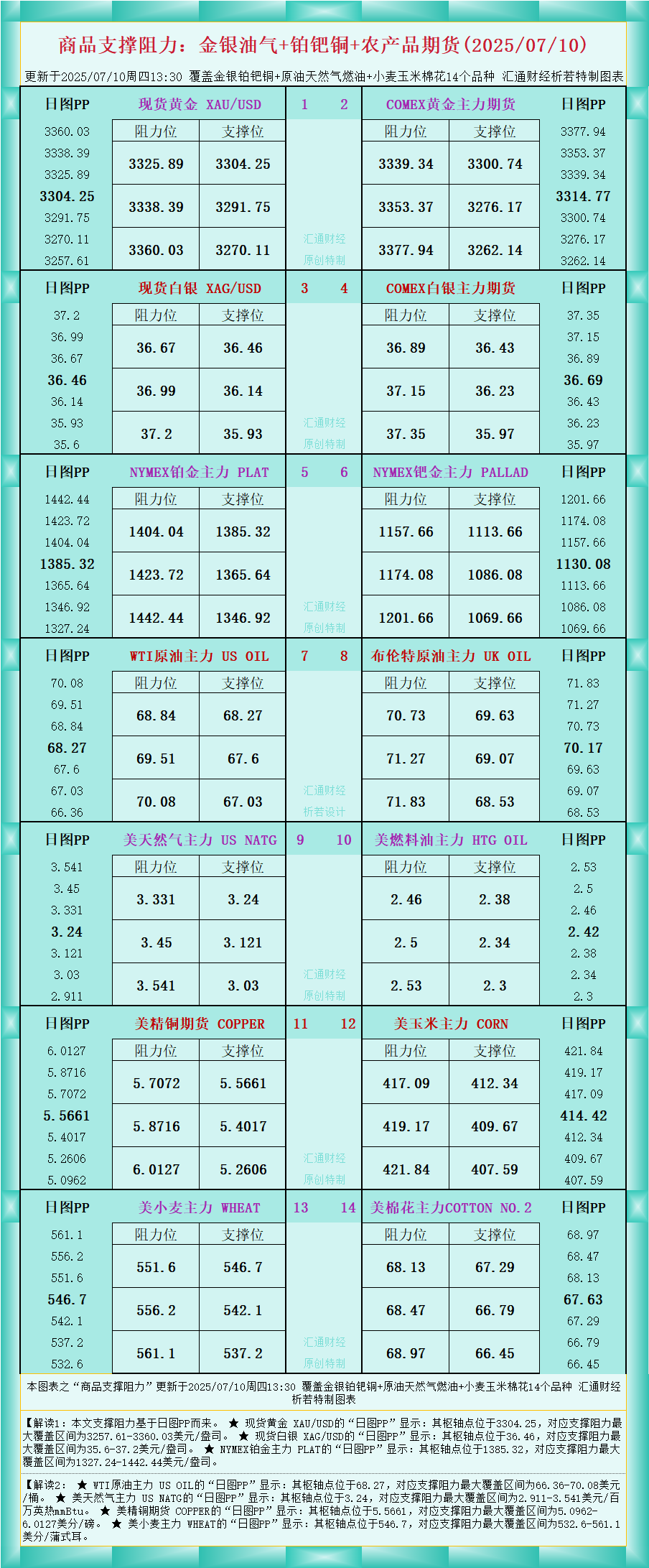

Commodity support and resistance in one chart: gold, silver, oil and gas + platinum, palladium, copper and agricultural product futures (July 10, 2025)

2025-07-10 13:34:47

As shown in the data, Interpretation 1: The support and resistance in this article are based on the daily chart PP.

★ The "Daily PP" of spot gold XAU/USD shows that its pivot point is at 3304.25, and the corresponding maximum support and resistance range is 3257.61-3360.03 US dollars per ounce.

★ The "Daily PP" of spot silver XAG/USD shows that its pivot point is at 36.46, and the corresponding maximum support and resistance range is 35.6-37.2 US dollars per ounce.

★ The "Daily PP" of NYMEX platinum main force PLAT shows that its pivot point is at 1385.32, and the corresponding maximum support and resistance range is 1327.24-1442.44 US dollars per ounce.

Interpretation 2:

★ The "Daily PP" of the main WTI crude oil US OIL shows that its pivot point is at 68.27, and the corresponding maximum support and resistance range is 66.36-70.08 US dollars per barrel.

★ The "Daily PP" of US NATG, the main natural gas commodity in the United States, shows that its pivot point is at 3.24, and the corresponding maximum support and resistance range is US$2.911-3.541 per million British thermal units (mmBtu).

★ The "Daily PP" of COPPER, a US copper futures contract, shows that its pivot point is at 5.5661, and the corresponding maximum support and resistance range is 5.0962-6.0127 cents/pound.

★ The "Daily PP" of the main U.S. wheat commodity WHEAT shows that its pivot point is at 546.7, and the corresponding maximum support and resistance range is 532.6-561.1 cents/bushel.

For more information on varieties, please refer to the chart. Original and copyrighted by Huitong Finance, for reference only.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.