Global trade uncertainty has driven up risk aversion, and gold prices have rebounded slightly, but are still in a range of fluctuations in the short term.

2025-07-10 13:35:02

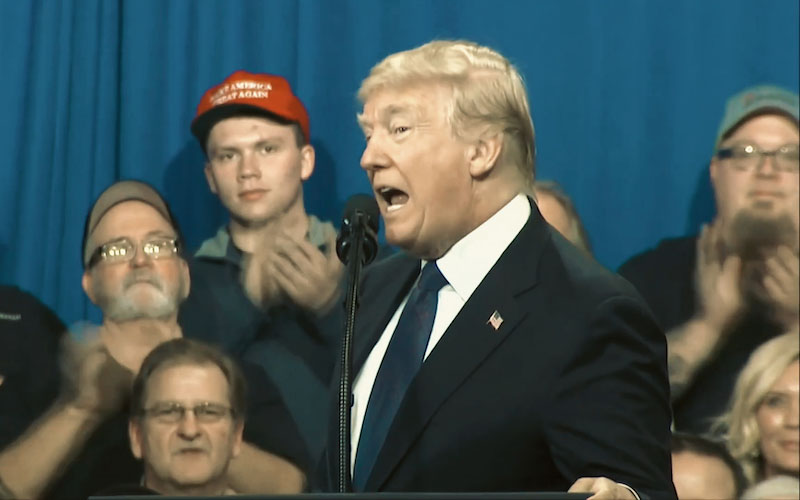

After the Trump administration issued a series of tariff notices against many countries around the world, the market's risk aversion sentiment has intensified. The US President announced on Wednesday that a new 50% tariff on copper imports will be imposed from August 1, and reiterated that "the deadline will not be extended for countries that have received the notice, and any retaliatory measures will be responded to with additional tariffs."

The move sparked market concerns about slowing global economic growth, and traditional safe-haven assets such as gold were sought after. The current gold price has rebounded significantly from the one-and-a-half-week low hit the previous day.

According to market research, safe-haven funds are being reconfigured, especially against the backdrop of uncertainty over the Fed's policy and the direction of the U.S. dollar, making gold a non-yielding asset of short-term preference.

The Fed's attitude remains cautious and there is uncertainty about the interest rate path

The minutes of the Fed's June meeting showed that although most officials believed that there was no need to cut interest rates immediately, it was generally expected that if inflation rose due to tariffs, interest rates would be lowered within the year. In addition, the Fed also said that the price shock from trade policy might be "mild and temporary", which also prompted the 10-year Treasury yield to continue to decline.

A monetary policy researcher said: "The market is no longer firmly betting on a rate cut in July, but the possibility of easing within the year remains."

At the same time, strong U.S. employment data for June released last week led some investors to reassess the need for interest rate cuts, which provided short-term support for the dollar.

Gold prices boosted by dollar pullback, bond demand

The US dollar index (DXY) has continued to fall from a two-week high and is currently fluctuating around 97.40. At the same time, the strong demand for the US 10-year Treasury auction on Wednesday and the sharp decline in yields have exacerbated market anxiety about economic uncertainty.

The combination of these two factors has pushed gold prices to continue to rise, and short-term bulls are trying to break through key technical levels upward.

From the 4-hour chart, the gold price has approached the 100-period simple moving average (SMA), which is currently located at 3,335, forming an initial resistance. If the price effectively breaks through this area, the next resistance level will be in the 3,358-3,360 range. Once it breaks through, it may trigger a short-covering market, pushing the gold price back to the 3,400 integer mark.

If gold breaks above 3,360, it will confirm the short-term bottom and open the door to re-challenging the year's high. On the contrary, if the price of gold falls back below 3,300 again, it may retest the 3,282 support, and further downside will extend to the July low of 3,247.

Editor's opinion:

Gold is strong in the short term amid rising trade concerns, falling U.S. bond yields and a pullback in the U.S. dollar. However, the Fed's ambiguous attitude, strong employment data and technical suppression still limit gains.

In the short term, if the gold price cannot break through the 3,360 area, it may continue to show a range consolidation pattern. We need to pay close attention to the speeches of Fed officials and the subsequent economic data releases to confirm whether gold has the momentum for further breakthroughs.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.