World Gold Council: Even without a fiscal crisis, trillions of new U.S. debt will push up gold prices

2025-07-10 13:49:03

“With the passage of the ‘Big, American Act,’ the U.S. faces $3.4 trillion in additional debt over the next decade, as well as a $5 trillion increase in the debt ceiling, unless the Trump administration can deliver on its lofty growth forecasts,” they wrote on Tuesday (July 8) . “Add to that the political backdrop of the ‘American Party’ launched by Musk, and both fiscal and political risks are accumulating.”

Analysts said the uncertainties "have triggered a reallocation of global capital" as a weaker dollar pushed up gold prices and U.S. Treasury yields. "Bond market volatility is likely to persist as fiscal pressures increase, ultimately supporting demand for gold as a safe-haven asset," they wrote.

The WGC details the potential impact of this new fiscal landscape on the gold market.

“First there was ‘Liberation Day,’ when Trump’s initial tariff announcement sounded the alarm and triggered an unprecedented sell-off in Treasuries,” they noted. “Markets have barely recovered from that turmoil and are now pondering the potential impact of Trump’s ‘Big, Beautiful Act,’ which the nonpartisan Congressional Budget Office estimates would add $3.4 trillion to the nation’s $36.2 trillion debt.”

Investors are watching to see what impact the spending bill will have on asset allocation strategies, the analysts said. “With uncertainty omnipresent, gold is likely to continue to be an attractive safe haven for investors in a volatile world where fiscal concerns are increasing risk for investors,” they wrote.

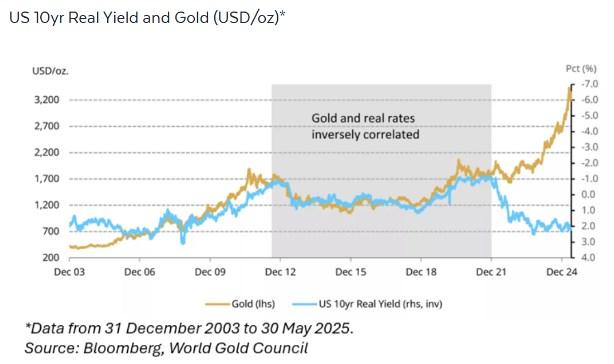

Rising interest rates are typically seen as a headwind for gold prices. “But since 2022, this inverse correlation has again been offset by other factors,” they noted. “As real interest rates have risen, now above 2%, gold prices have also generally risen, this time supported by buying by investors and central banks seeking to mitigate various risks.”

Figure 1: 10-year U.S. Treasury real yield (blue line) and gold price (yellow line) The shaded area indicates that the gold price and real interest rate are inversely correlated

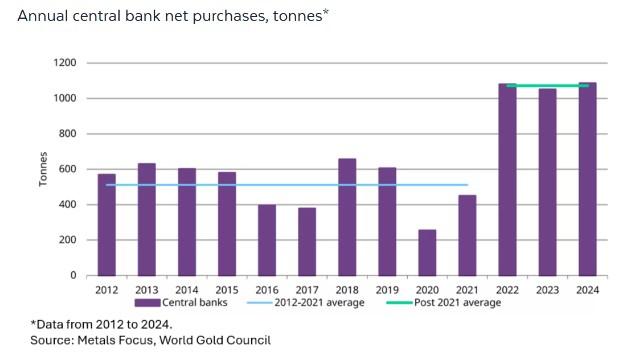

“Indeed, the central bank buying we have witnessed since 2022 and its acceleration has been an important factor in the strength of gold prices,” the analysts added. “The demand for gold reserves by emerging market central banks has grown for a variety of reasons, such as diversification, geopolitical risks, and gold’s performance in times of crisis.”

Figure 2: Central bank annual net purchases in tons (blue line: average level from 2012 to 2021; green line: average level after 2021)

“Recently, consumer confidence and corporate investment intentions have been affected by economic and trade policy uncertainties, which in turn has triggered a reallocation of global capital outflows from the United States, with global investors seeking other safe-haven assets besides U.S. Treasuries,” they said.

The result of the reallocation into safe-haven assets was "a weaker dollar, higher gold prices, and a widening of U.S. Treasury yields relative to other high-grade sovereign bonds, such as Germany," the WGC said.

The analysts added: “More broadly, we see fiscal concerns as one of the factors supporting the gold market. For example, the difference between Treasury yields and the fixed rate of interest rate swaps has been pushed higher – a possible sign of fiscal concerns. In other words, we are witnessing investors being unable or unwilling to absorb bonds issued or sold by other bondholders at going prices, thus putting upward pressure on bond yields and pushing up Treasury swap spreads.”

They said: "Our simplified analysis indicates that the difference between US Treasury and swap rates is statistically significant in explaining the movement of gold prices. We believe that this difference is at least partly related to US fiscal concerns. In fact, when fiscal concerns increase, which reflects concerns about the sustainability of US government debt or deficits, investors may seek the relative safety of gold, thereby pushing up gold prices."

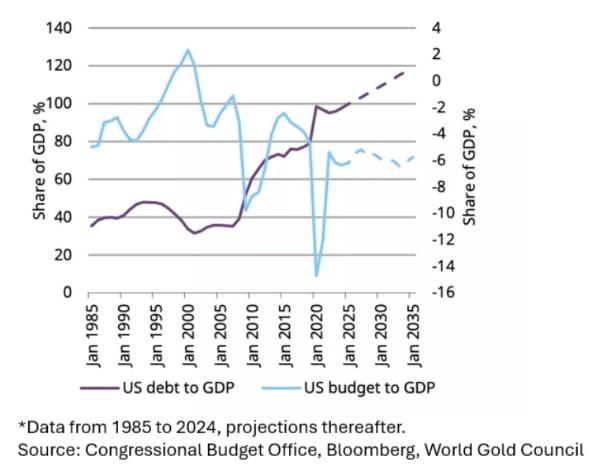

All of this puts the U.S. in a precarious fiscal position. The WGC noted: "The gold market is likely to continue to be supported by U.S. fiscal issues, as the bond market will remain sensitive to considerations of the sustainability of U.S. debt. In fact, the loose fiscal policy of the past 20 years and the changes in the demand structure have now put the United States in a precarious position, and the passage of the 'Big and American Act' is likely to exacerbate this situation."

Figure 3: Fiscal easing since 2001 (the purple line is the ratio of US debt to GDP, the blue line is the ratio of budget to GDP, and the dotted line is the CBO forecast)

Analysts point out that demand for U.S. Treasuries from the Federal Reserve and foreign governments, the least return-sensitive buyers, is declining. "By contrast, foreign private investors are now the largest unofficial holders of U.S. Treasuries. They are also likely to be the most price-sensitive group of investors, given their global reach and their tendency to compare U.S. Treasuries with government bonds in multiple jurisdictions."

The WGC stressed that they do not see a full-blown fiscal crisis in the United States as an imminent threat. They said: "Such a crisis would require a short-term trigger, such as a technical default caused by a miscalculation of the debt ceiling, which would exacerbate existing long-term destabilizing trends. Instead, a more likely outcome would be a series of rolling mini-crises as political goals conflict with bond market expectations. In fact, when it comes to fiscal sustainability, perceptions are as important as policies."

“If leaders give the impression that their commitment to long-term fiscal discipline is weakening or that they are determined to impose policies that will weaken the fiscal position, the bond market reaction is usually swift and severe,” the analysts warned. “But this is usually short-lived, as governments back off in the face of market pressure and central banks can step in to prevent yields from rising too quickly.”

As fiscal concerns continue to rise, they expect gold to continue to be well supported as an alternative safe-haven asset.

The WGC concluded: "The interest rate environment and geopolitical tensions have undoubtedly played an important role in driving gold prices higher, but they are not the only factors. Fiscal concerns also have an impact. Although there is a strong belief that the U.S. Treasury market will never lose its safe-haven status, a major crisis, while unlikely, is not impossible. The more likely outcome is a series of rolling mini-crises as highly indebted sovereigns such as the United States face market-imposed limits on fiscal generosity."

“This uncertainty and the resulting market volatility could provide additional support to the gold market.”

Spot gold daily chart source: Yihuitong

At 13:48 Beijing time on July 10, spot gold was quoted at $3323.24 per ounce

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.