Powell's conflict with Trump is set to escalate, and the Fed will wait and see before cutting interest rates by 50 basis points by the end of the year

2025-07-10 23:45:16

Since the start of the year, the consensus GDP growth forecast for 2025 and 2026 has fallen from 2.2% to 1.5%, and at the heart of the problem lies the consumer. Consumer confidence has been dampened, causing consumer spending - once the engine of economic growth after the pandemic - to stagnate over the past six months.

There are three reasons for this. First, households are quickly realizing that they are actually paying for most of the tariff costs, despite President Trump’s claims that they will be borne by foreigners. With the United States re-imposing tariffs on many of its major trading partners in recent days, consumers will be haunted by the idea that tariff-induced price increases will squeeze their purchasing power.

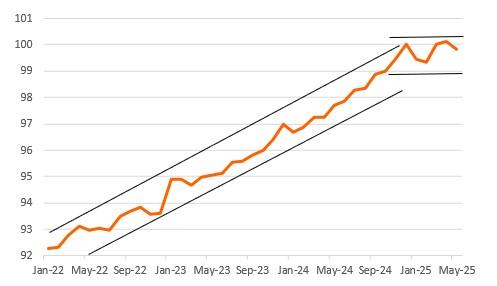

(U.S. consumer spending levels highlight weak growth since December last year (December 2024 = 100)

Trade uncertainty hurts business sector

At the same time, the perception is that the job market is weaker than official data suggest. With the exception of private education and health services, government, and the leisure and hospitality sectors, job creation has all but stagnated, and has actually fallen in nine of the past 30 months. In addition, the rise in the number of Worker Adjustment and Retraining Notifications (the 60-day notice most large companies must give of impending mass layoffs) suggests the market needs to brace for more layoffs in the second half of the year and the threat of another rise in unemployment.

Third, the volatility of household wealth is troubling. The stock market fell 20% earlier this year but has since recovered, and now the largest store of wealth for most Americans, home prices, is becoming a problem. Today, housing affordability issues are emerging as for-sale inventory increases, and home prices have fallen for two consecutive months.

Fourth, this has left the corporate sector in an uncertain position, with tariffs and trade issues further clouding the outlook. This has led to even weaker investment spending, with residential investment particularly vulnerable given the trajectory of house prices. GDP growth in the second quarter will be boosted by a sharp pullback in imports that surged in the first quarter as companies circumvented tariffs, but that boost is likely to reverse again in the third quarter given President Trump’s renewed push for higher tariffs on major trading partners starting August 1.

Tariff-induced inflation will set off a bitter clash between Trump and the Fed

Inflation has been steady in recent months, with monthly increases of 0.1% and 0.2%, but ING analysts have been assuming that the impact of tariffs will only be felt three months after April and May. This means that we could see monthly increases of 0.4% or even 0.5% in the July, August and September Consumer Price Index (CPI) reports. President Trump has been pushing the Fed to immediately cut interest rates by 200-300 basis points, and two of the Federal Open Market Committee (FOMC) members he appointed during his first term have indicated that they may vote for a rate cut at the July FOMC meeting. However, the rest of the committee believes they have time to wait, especially given the recent better-than-expected June jobs report.

The Fed has been criticized for calling price increases caused by the post-pandemic supply shock "transitory," only to see inflation soar to 9% in 2022. ING analysts speculate that most FOMC members will want to confirm that tariffs are just a one-off price change rather than a more permanent factor in inflation. ING analysts believe that by the time of the September FOMC meeting, they may not have enough evidence to confirm this, so only clear weakness in employment data is likely to trigger a rate cut at that time. This means that the president's dissatisfaction with Jerome Powell will intensify, and he may seek a replacement who is more inclined to loose policy when Powell's term as Fed chairman ends early next year. Talk of dismissal may also escalate.

Fed to wait and see, but cut rates by 50 basis points in December

Nevertheless, rate cuts will come eventually. Slower economic growth, a weaker job market, and muted wage pressures will help ensure that inflation is indeed temporary. Moreover, shifts in housing market dynamics mean that housing costs, which have been the main driver of inflation in recent years, will increasingly act as a dampener. Given that unemployment may indeed start to rise, ING analysts believe the Fed will be more willing to start cutting rates at the December FOMC meeting, with an initial cut of 50 basis points.

In addition, analysts believe that the Big Beautiful Act will add a lot of debt, mainly because it will make the 2017 Tax Cuts and Jobs Act permanent, but it will do nothing to promote economic growth. This is because most of the bill simply extends the tax cuts that were due to expire at the end of this year. In addition, the newly announced additional tax cuts (including tax cuts on tips and overtime pay) are more than offset by net spending cuts - these spending cuts mainly fall on low-income families through Medicare and food programs, while also reducing tax benefits for environmental, social and governance (ESG)-related projects. Therefore, economic growth in 2026 will face a net headwind compared with 2025, which means that the risk may be tilted towards the Federal Reserve having to do more easing in 2026 than currently forecast, rather than less.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.