CBOT position alert! Net short positions of the three major grains soared simultaneously. Has the market already bet on the negative USDA report in advance?

2025-07-11 10:29:24

According to observations, the results estimated by overseas traders show:

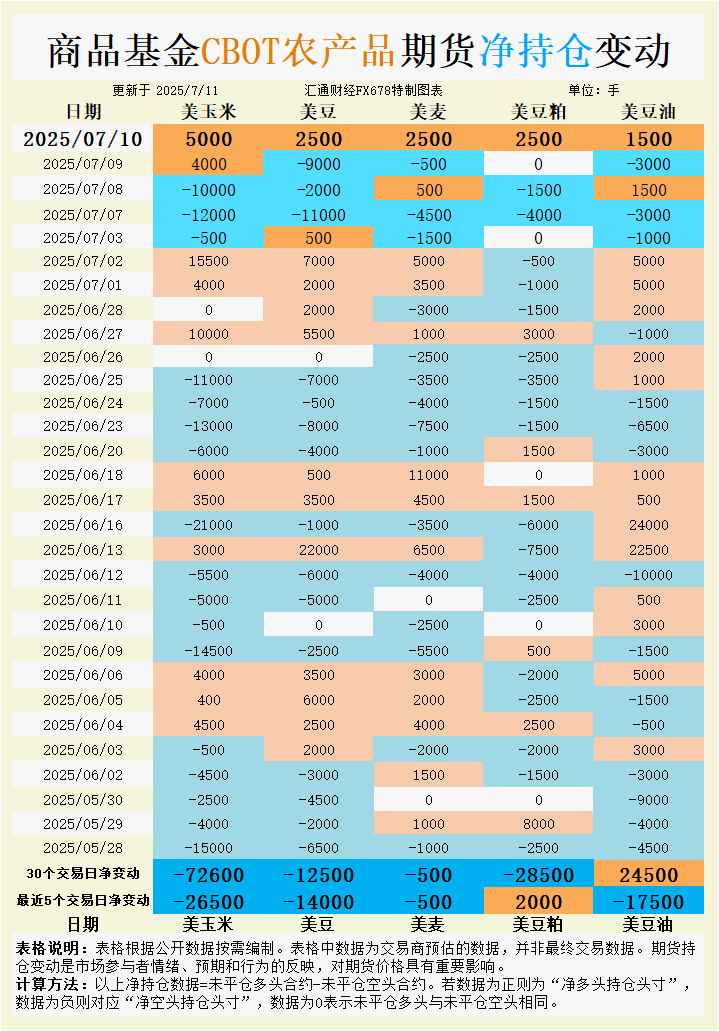

On July 10, 2025, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net short position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net short position; increase CBOT soybean oil speculative net short position.

In the past five trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net short position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net long position; increase CBOT soybean oil speculative net short position;

In the latest 30 trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net short position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net short position; increase CBOT soybean oil speculative net long position.

See the chart for specific change data.

Corn futures: Bearish sentiment dominates, ample supply puts pressure

Corn futures continued to be under pressure, with the most active December contract (CZ25) closing at $4.16-1/2 per bushel on July 10, up 1 cent, but down nearly 5% this week, the biggest weekly drop since late February. Commodity funds significantly increased their net shorts, increasing by 5,000 lots on July 10, 26,500 net shorts in the past five days, and 72,600 net shorts on the 30th, reflecting confidence in adequate supply in the United States. The National Weather Service's 6-10 day outlook shows that 100% of corn producing areas have below-normal precipitation and 35% have above-normal temperatures, supporting expectations for a bumper harvest. Internationally, Argentina's corn production in 2024/25 is expected to be 49 million tons, adding global supply pressure. Basis levels in the Midwest, such as Morris, Illinois (down 2 cents to +10 cents per bushel), remain stable to weak, indicating limited support in the spot market. The upcoming USDA report is expected to raise U.S. corn ending stocks, further weighing on market sentiment. Prices may recover in the short term due to technical buying, but the bearish positioning of funds and the supply outlook indicate that corn futures will continue to be weak.

Soybean futures: Short covering pushes prices higher, fundamentals limit gains

Soybean futures rebounded slightly, with the November contract (SX25) closing at $10.13-3/4/bushel on July 10, up 6-1/2 cents, driven by short covering ahead of the USDA report. Commodity funds turned net buyers, adding 2,500 lots on July 10, but net shorts increased by 14,000 lots in the past five days and 12,500 lots on the 30th. Strong U.S. export sales provided some support, but favorable weather in the Midwest (100% of soybean producing areas had below-normal precipitation) limited upside. Analysts expect the USDA to raise U.S. soybean ending stocks for 2024/25 and 2025/26, and Brazil's soybean production for 2024/25 is expected to be 169.5 million tons, slightly lower than 169.6 million tons last month. Midwestern basis levels, such as Decatur, Illinois (+25 cents/bushel), remained stable, reflecting cautious spot markets. Fund bearish positioning and expectations of ample supply suggest that soybean futures will find it difficult to sustain a sustained rise, and prices may fluctuate around current levels unless export demand is unexpectedly strong.

Soybean meal futures: Funds are long and push up prices, while export sales have mixed performance

Soybean meal futures rose, with the benchmark contract closing 0.8% higher on July 10, driven by commodity funds increasing their net long positions by 2,500 lots, reversing Wednesday's liquidation trend. In the past five days, funds have increased their net long positions by 2,000 lots, but on the 30th, they increased their net short positions by 28,500 lots, indicating mixed sentiment. The USDA report showed that as of the week of July 3, net sales of soybean meal in the United States in 2024/25 were 207,700 tons, down 32% from the previous week, but up 7% from the four-week average; sales in 2025/26 were 370,800 tons, down from 397,400 tons in the previous week. The Midwest basis level is stable, reflecting a balanced spot market. Fund buying is intertwined with expectations of strong production in the United States, and soybean meal prices have limited upside space and are expected to remain range-bound before USDA inventory updates. Changes in export demand or unexpected weather disturbances may trigger price fluctuations.

Soybean oil futures: Moderate gains, increased volatility in positions

Soybean oil futures edged higher, with the benchmark contract up 0.4% on July 10, tracking gains in the soybean and soybean meal markets. Funds turned net buyers of 1,500 lots, reversing a net sell of 3,000 lots on Wednesday, but net shorts increased by 17,500 lots in the past five days and net longs increased by 24,500 lots in the 30th day, indicating a swing in sentiment. USDA data showed that net sales of 2024/25 U.S. soybean oil were 4,000 tons in the week ended July 3, down 66% from the previous week and 20% below the four-week average, reflecting weak demand. Basis levels in the Midwest were stable, indicating limited spot market activity. Brazil's 2024/25 soybean harvest was completed with a production of 50.2 million tons, and ample global oil supplies limited price increases. Soybean oil futures may fluctuate in the short term due to fund positioning, but the bearish supply outlook suggests that prices are biased to the downside unless demand picks up significantly.

Wheat futures: Prices under pressure as supply concerns ease

Wheat futures retreated, with the most active contract (ZW1!) falling 0.1% to $5.54/bushel on July 10, after prices rose due to lower Russian exports. Funds increased their net shorts by 2,500 lots on July 10, with a net increase of 500 shorts in the past five days and 500 shorts on the 30th, reflecting cautious bearish sentiment. Russian wheat exports are expected to be 2-2.5 million tons in July, down from 3.67 million tons in the same period last year, but traders expect accelerated harvesting to ease supply tightness. Argentina's wheat planting is 91% complete, and recent rainfall has improved soil moisture, supporting global supplies. China's wheat production in 2025 will fall by 0.1%, which may reduce import demand. Basis levels have weakened slightly, such as the Chicago processor basis, which fell 3 cents to -10 cents/bushel. The USDA report may provide more guidance, but current fund positioning and improved global supply suggest that wheat futures will be under pressure unless geopolitical or weather risks intensify.

Future Trend Outlook

The CBOT grain futures market is expected to remain volatile, with bearish sentiment dominated by expectations of ample supplies in the United States and globally. Corn faces the greatest downward pressure, with aggressive fund shorting and favorable weather forecasts in the Midwest suggesting prices could test the $4.00/bushel level. Soybeans may receive short-term support from export sales and short covering, but ample supplies limit prices above $10.50/bushel. Soymeal and soybean oil futures are expected to follow the trend of soybeans, with export demand and fund positioning driving short-term volatility. Wheat futures may stabilize around $5.50/bushel, but improved global supplies may limit gains unless the risk of supply disruptions emerges. The upcoming USDA report is critical, and if ending stocks are raised as expected, it may reinforce the bearish trend.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.