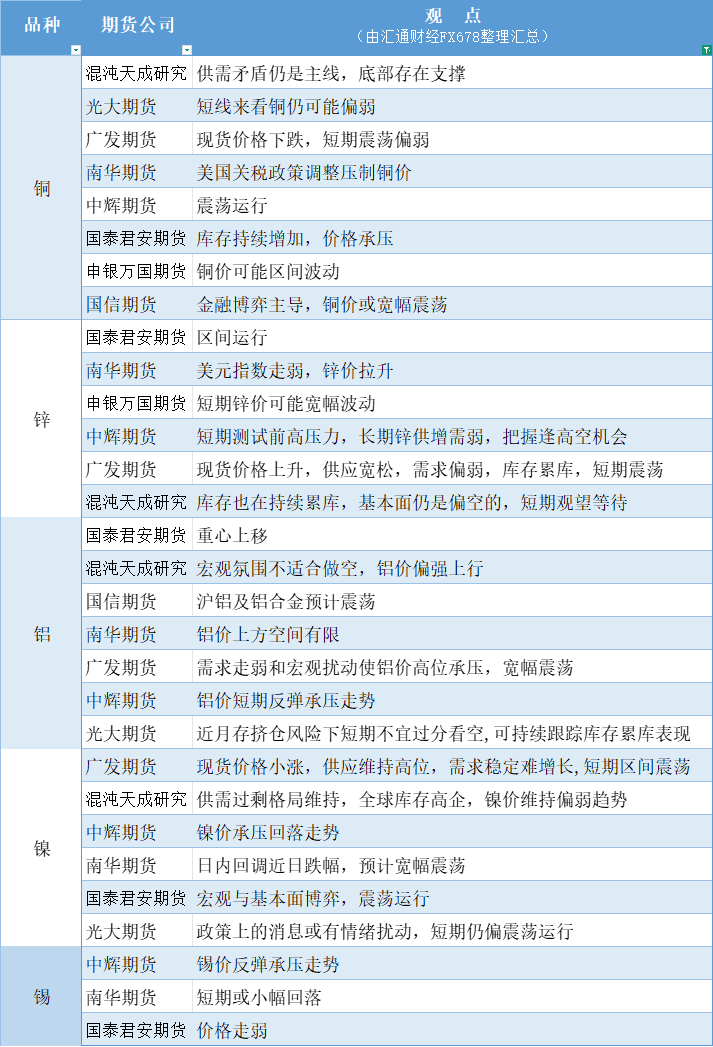

Futures companies' views summarized in one chart: July 11 nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2025-07-11 13:33:48

Copper: The contradiction between supply and demand is still the main line, there is support at the bottom, the spot price has fallen, and the short-term volatility is weak; Zinc: Short-term test of previous high pressure, long-term zinc supply increases and weak demand, seize the opportunity to go high, the spot price rises, the supply is loose, the demand is weak, the inventory is accumulated, and the short-term volatility; Aluminum: Under the risk of recent inventory squeeze, it is not appropriate to be overly bearish in the short term, and the performance of inventory accumulation can be continuously tracked; Nickel: Spot prices rose slightly, supply remained high, demand was stable and difficult to grow, and short-term range volatility; Tin: Tin prices rebounded under pressure.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.