One chart: Baltic Dry Index posts first weekly gain in four weeks

2025-07-12 00:19:51

The Baltic Exchange's main sea freight index, which tracks freight rates for ships carrying dry bulk commodities, rose on Friday, with the index heading for its first weekly gain in four weeks, supported by strong rates for all vessel types.

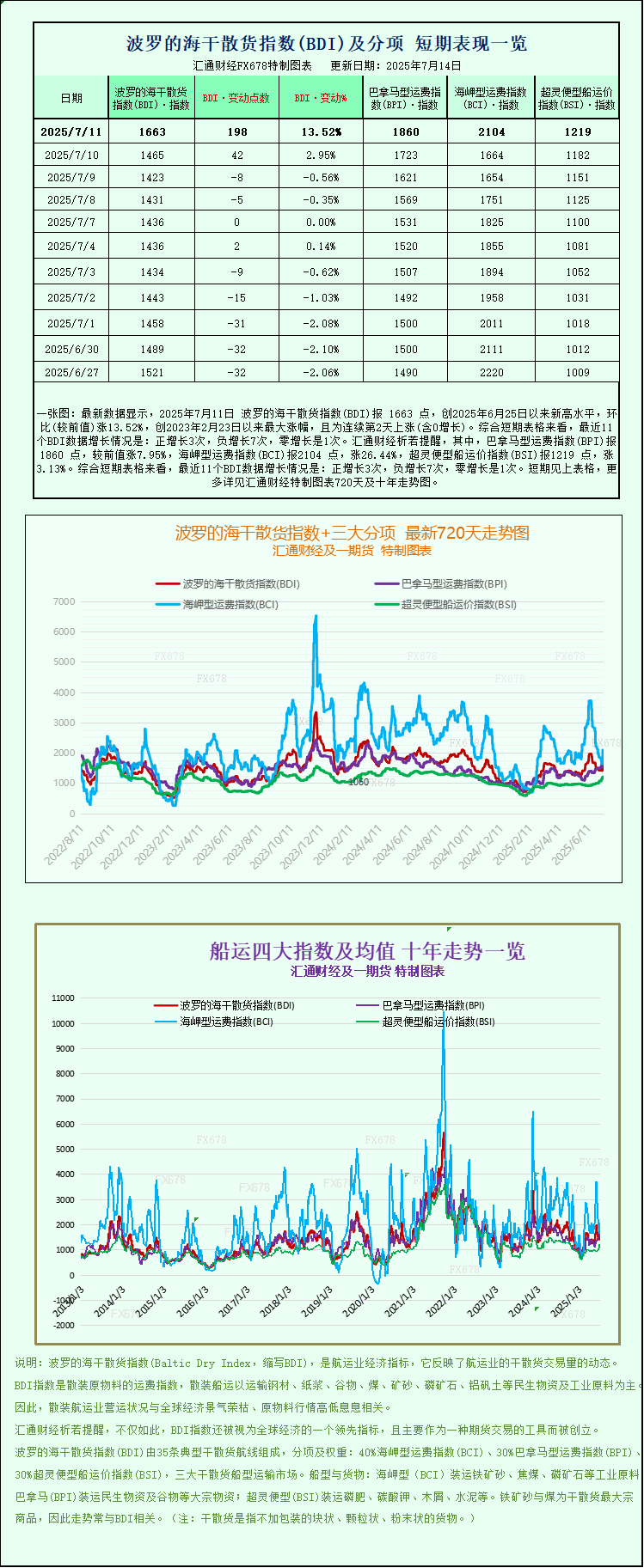

The main index tracking rates for Capesize, Panamax and Supramax vessels rose 198 points, or 13.5%, to 1,663, reaching its highest level since June 25. The contract gained 2% this week.

The Capesize index rose 440 points, or 26.4%, to 2,104. The contract posted its biggest one-day percentage gain since March 1, 2023. However, the index has fallen more than 10% this week.

Average daily earnings for capesize vessels, which typically carry 150,000 tonnes of cargo such as iron ore and coal, rose by $3,654 to $17,453.

Iron ore futures rose and were on track for a third weekly gain on renewed hopes that a crackdown on a price war in top consumer China will pave the way for a new round of reforms to curb steel overcapacity.

The panamax index rose 137 points, or 8%, to 1,860, its highest level since June 20 last year. The contract gained 13.4% this week.

Average daily earnings for Panamax vessels, which typically carry 60,000-70,000 tonnes of coal or grain, rose $1,236 to $16,743.

“The Panamax market gained notable upward momentum this week, driven primarily by strong growth in the Atlantic shipping basin,” shipbroker Fearnleys wrote in its weekly report on Wednesday.

“Strong performance in the Atlantic had a positive spillover effect, stimulating the previously quiet Indonesian market and supporting strong performance in the Pacific.”

Among smaller vessels, the supramax index rose 37 points, or 3.1%, to 1,219.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.