Weak labor data adds to downward pressure on AUD

2025-07-17 22:11:49

Australia's unemployment rate unexpectedly rose in June, hitting a three-and-a-half-year high, while the number of employed people increased only slightly, and the overall employment picture was negative.

The weak labor data boosted market expectations for more rate cuts, but policymakers are likely to be more cautious and prefer to wait for more evidence on inflation (the third-quarter inflation report will be released in late July) before taking action.

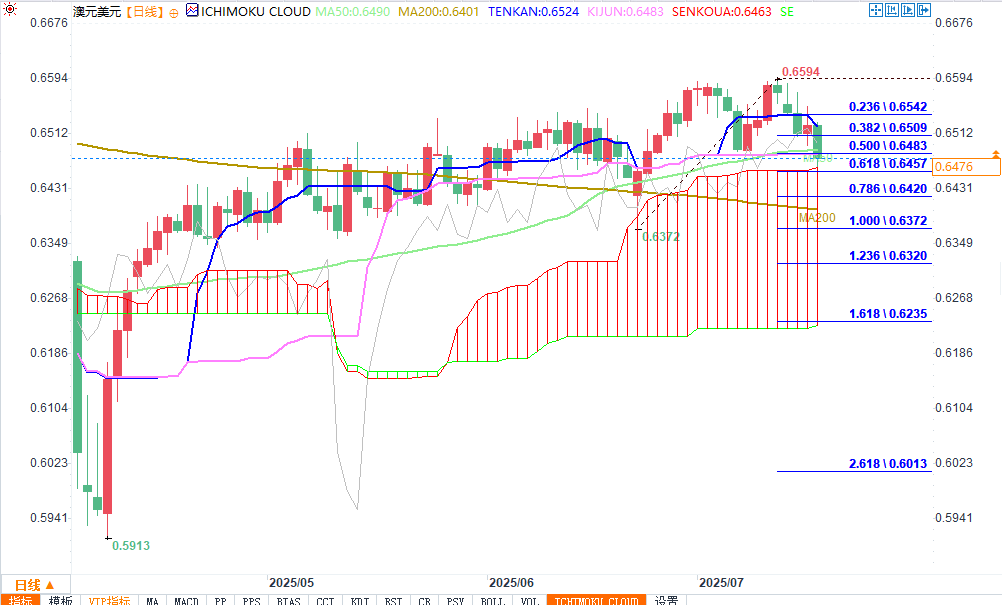

The Australian dollar has fallen significantly today (the pair is on track for one of its biggest one-day declines since the April 4 crash), breaking below the bottom of its recent range (0.6483, which is also the 50% retracement of the 0.6372-0.6594 surge), but has found support at the top of the daily Ichimoku cloud (0.6463).

The large daily range (between 0.6463 and 0.6230) provides extremely solid support and a strong resistance to new bears, which may limit the current downside momentum.

In this scenario, short-term downside risks will be reduced and the exchange rate may remain in the established range for a long time.

On the contrary, if the exchange rate breaks through the cloud chart and closes within the cloud chart range, the short-term structure will weaken and may trigger a deeper correction.

(AUD/USD daily chart source: EasyFX)

Daily technical indicators show differentiation: the cloud chart continues to provide support, but the momentum indicator turns negative, the moving average (MA) is arranged in a chaotic manner, and there is currently a lack of clear directional signals.

Resistance levels: 0.6483; 0.6530; 0.6575; 0.6592

Support levels: 0.6463; 0.6434; 0.6407; 0.6372

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.