CBOT Grains: Funds’ holdings shifted! Soybean oil net shorts were suddenly squeezed out, and wheat became a “meat grinder” at $5.3

2025-07-18 10:47:56

This article analyzes the sentiment and trends of the CBOT grain futures market based on the latest position changes, basis dynamics and international trading conditions, and looks at future directions.

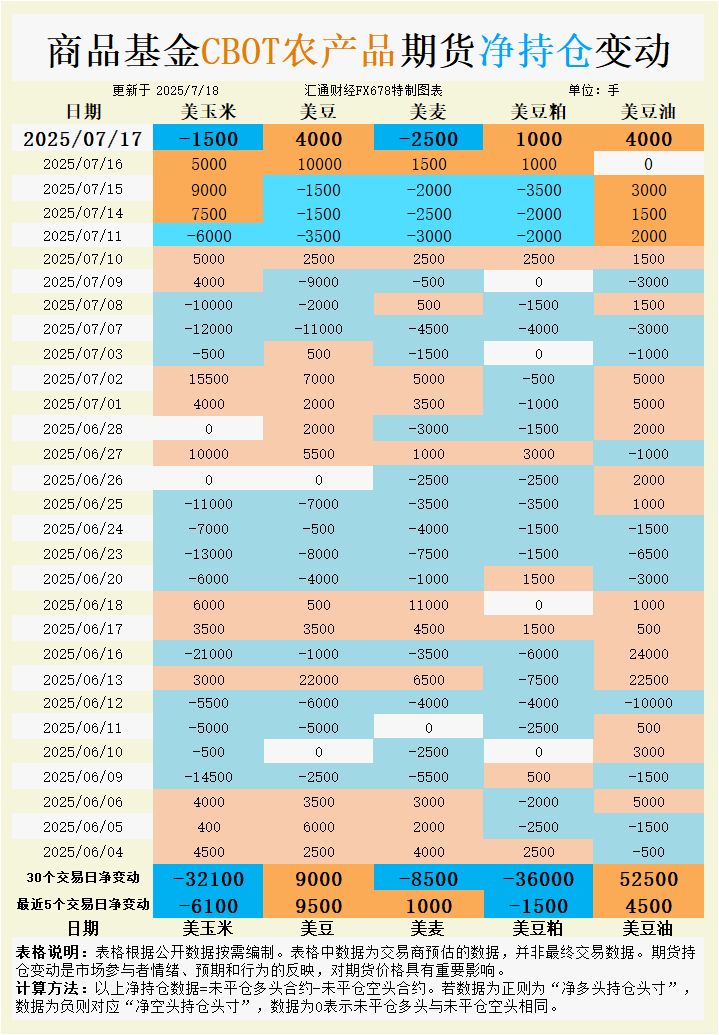

According to observations, the results estimated by overseas traders show:

On July 17, 2025, commodity funds:

Increase CBOT corn speculative net long position; increase CBOT soybean speculative net long position; increase CBOT wheat speculative net long position; increase CBOT soybean meal speculative net long position; increase CBOT soybean oil speculative net short position.

In the past five trading days, commodity funds:

Increase CBOT corn speculative net short; increase CBOT soybean speculative net long; increase CBOT wheat speculative net long; increase CBOT soybean meal speculative net short; increase CBOT soybean oil speculative net long;

In the latest 30 trading days, commodity funds:

Increase CBOT corn speculative net short position; increase CBOT soybean speculative net long position; increase CBOT wheat speculative net short position; increase CBOT soybean meal speculative net short position; increase CBOT soybean oil speculative net long position.

See the chart for specific change data.

Wheat: Supply pressure dominates, short-term fluctuations are weak

CBOT wheat futures rose slightly on Thursday, with the main contract closing at $5.35-3/4 per bushel, up 0.4%, but the weekly line is expected to fall by about 2%, reflecting the supply pressure brought by the harvest season in the northern hemisphere. Position data showed that commodity funds sold a net of 2,500 wheat futures contracts on July 17, indicating that short-term bearish sentiment has intensified. However, the fund has turned to a net purchase of 1,000 lots in the last five trading days, indicating that the market has increased interest in short-covering at low wheat prices. In the past 30 trading days, the fund has sold a total of 8,500 lots, reflecting the dominance of medium- and long-term bearish sentiment. From a fundamental perspective, the weather conditions in the Midwest of the United States are good, with temperatures above normal and precipitation close to normal in the next 6-10 days, which is conducive to the growth of wheat crops, but global supply is abundant, especially the optimistic production expectations in South America, which limits the room for price rebound. In terms of basis, the basis of US hard red winter wheat remains stable, but farmers are on the sidelines due to low prices, and market trading activity is limited. Looking ahead, wheat futures may fluctuate in the range of $5.30-5.60 per bushel, and attention should be paid to the potential impact of U.S. export sales data and the situation in Russia and Ukraine on market sentiment.

Soybean: Export and policy support, short-term strong fluctuations

CBOT soybean futures rose modestly on Thursday, with the main contract closing at $10.26-3/4 per bushel, unchanged, and expected to rise by about 2% on a weekly basis. Position data showed that commodity funds bought a net of 4,000 soybean futures contracts on July 17, a cumulative net purchase of 9,500 contracts in the last five trading days, and a cumulative net purchase of 9,000 contracts in the past 30 trading days, reflecting the market's bullish sentiment on soybean prices. Fundamental support comes from improved US export sales. The US Department of Agriculture report showed that as of the week of July 10, net sales of soybeans in 2025/26 reached 529,600 tons, exceeding market expectations, and sales of 120,000 tons to "unknown destinations" triggered speculation about Chinese purchases. In addition, biofuel policy expectations boosted soybean oil demand, indirectly supporting soybean prices. However, supply pressure in South America cannot be ignored. Brazil's soybean export forecast for 2024/25 was raised to 109 million tons, and Argentina's production was expected to increase to 49.5 million tons. Combined with the expectation of a bumper harvest in the United States, the upward space for prices is limited. In terms of basis, the soybean basis in the Midwest of the United States has rebounded slightly, but is weak overall, reflecting the pressure of export competition. In the future, soybean prices may fluctuate strongly in the range of US$10.20-10.60 per bushel, and attention should be paid to the USDA crop report and South American weather dynamics.

Soybean oil: Driven by crude oil and exports, short-term bullish momentum is strong

CBOT soybean oil futures performed strongly, with the benchmark closing up about 2.7% on Thursday and expected to rise about 3.5% on a weekly basis, hitting the highest level in nearly two years. Position data showed that commodity funds bought a net of 4,000 soybean oil futures contracts on July 17, a cumulative net purchase of 4,500 contracts in the last five trading days, and a cumulative net purchase of 52,500 contracts in the past 30 trading days, indicating a strong bullish sentiment in the market. From a fundamental perspective, the strengthening of international crude oil prices and expectations for biofuel demand are the main driving forces. The U.S. Department of Agriculture report showed that as of the week of July 10, net sales of soybean oil in the 2024/25 fiscal year were 7,900 tons, a year-on-year increase of 97%, reflecting strong export demand. In addition, the increase in Malaysia's palm oil export tariffs and Indonesia's edible oil export restrictions have pushed up global vegetable oil prices, which is good for the soybean oil market. However, the news that PepsiCo has reduced its use of soybean oil may pose potential pressure on food processing demand. In terms of basis, the export basis of U.S. soybean oil remained strong, reflecting the resilience of market demand. In the future, soybean oil prices may run strong in the range of 46-48 cents per pound, and we need to pay attention to the dynamics of the global energy market and the USDA supply and demand report.

Soybean meal: Ample supply and weak demand, low-level fluctuations continue

CBOT soybean meal futures closed flat on Thursday, with the main contract price fluctuating at a low level, and market sentiment was cautious. Position data showed that commodity funds bought a net of 1,000 soybean meal futures contracts on July 17, but harmoniously sold a net of 1,500 contracts in the last five trading days, and sold a net of 36,000 contracts in the past 30 trading days, reflecting the market's cautious attitude towards the outlook for soybean meal. From a fundamental perspective, the expectation of a bumper harvest in the United States and high crushing volume have led to sufficient soybean meal supply, suppressing the upward space for prices. Although global demand for animal feed has grown steadily, expectations of a bumper harvest in South America and increased domestic inventories in the United States (stocks reached 390,000 tons at the end of April) have put pressure on the market. In terms of basis, the soybean meal basis in the Midwest of the United States is weak, and the railroad and truck market quotations are flat, reflecting sluggish demand. In the future, soybean meal prices may continue to fluctuate at a low level in the range of US$290-300/short ton, and attention should be paid to the impact of US export sales and South American supply dynamics on the market.

Corn: Technical buying boosted briefly, but overall pressure

CBOT corn futures rose slightly by 0.2% on Thursday, with the main contract closing at $4.22 per bushel, and the weekly line is expected to rise by about 2%. Position data showed that commodity funds sold a net of 1,500 corn futures contracts on July 17, with a cumulative net sale of 6,100 contracts in the last five trading days and a cumulative net sale of 32,100 contracts in the past 30 trading days, indicating that bearish sentiment dominated the market. From a fundamental perspective, the weather outlook for the main corn-producing states in the United States in the next 6-10 days shows high temperatures and normal precipitation, which are conducive to crop growth, and the expectation of a bumper harvest suppresses prices. In terms of basis, the US Gulf Coast corn basis has strengthened due to rising freight costs, but slow sales by farmers have limited trading activity. Increased supply in South America and weak US export sales (only 777,000 tons last week, lower than expected) have further exacerbated market pressure. In the future, corn prices may fluctuate at a low level in the range of $4.20-4.50 per bushel, and attention should be paid to the USDA crop report and changes in international demand.

Future Trend Outlook

The CBOT grain futures market is expected to continue its divergent trend in the short term. Affected by supply pressure, the wheat market may fluctuate in the range of $5.30-5.60 per bushel, and attention should be paid to export data and the situation in Russia and Ukraine. Supported by export and biofuel policies, soybean futures may run strong at $10.20-10.60 per bushel in the short term, but the bumper harvest in South America limits the increase. Driven by crude oil prices and export demand, the soybean oil market may fluctuate strongly in the range of 46-48 cents per pound. Due to abundant supply and weak demand, soybean meal is expected to consolidate at a low of $290-300 per short ton. The corn market is suppressed by the expectation of a bumper harvest and weak exports, and the price may run at a low of $4.20-4.50 per bushel. Traders need to pay close attention to the USDA supply and demand report, South American production dynamics and international market changes to grasp the market direction. [](https://cn.investing.com/commodities/us-soybeans)[](https://finance.sina.com.cn/money/future/fmnews/2025-06-07/doc-inezfuic6314988.shtml)[](https://cn.investing.com/commodities/us-soybean-meal)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.