CITIC Construction Investment Futures: Overseas economy is resilient, copper prices stabilize and fluctuate

2025-07-18 10:49:22

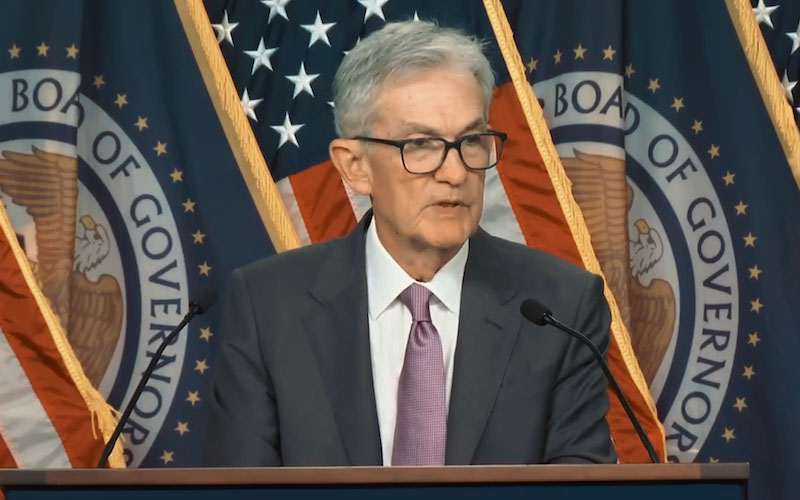

Stock index futures: In the previous trading day, the Shanghai Composite Index rose by 0.37%, the Shenzhen Component Index rose by 1.43%, the ChiNext Index rose by 1.75%, the Science and Technology Innovation 50 rose by 0.80%, the CSI 300 rose by 0.68%, the Shanghai 50 rose by 0.12%, the CSI 500 rose by 1.08%, and the CSI 1000 rose by 1.14%. The turnover of the two markets was 1,539.369 billion yuan, an increase of about 97.331 billion yuan from the previous trading day. ? Among the Shenwan first-level industries, the best performing industries were: defense and military industry (2.74%), communications (2.41%), and electronics (2.18%). The worst performing industries were: banking (-0.42%), transportation (-0.39%), and environmental protection (-0.26%). ? In terms of basis, the basis of the four major futures indexes strengthened significantly. The annualized basis rates of IH and IF quarterly contracts are -0.60% and -3.00% respectively, and the annualized basis rates of IC and IM quarterly contracts are -9.10% and -11.80% respectively. For hedging, short hedging may consider quarterly and monthly contracts. ? On the last trading day, the Shanghai Stock Exchange fluctuated upward, closing up 0.37%, and the turnover of the two markets increased. Yesterday, the Shanghai and Shenzhen stock markets fluctuated in a narrow range in the morning, and accelerated upward after the opening of the afternoon. The turnover of the two markets rebounded. The basis of the four major index futures all strengthened significantly, which may indicate that the short-term market structural adjustment has been completed, and the stock index is likely to rise again. Recently, the US government has continued to put pressure on Federal Reserve Chairman Powell, and the possibility of a reduction in the US benchmark interest rate in the near future has increased again. If the Federal Reserve cuts interest rates, the interest rate gap between China and the United States is expected to narrow further, thereby prompting the appreciation of the RMB against the US dollar. The appreciation trend of the RMB may further attract foreign capital inflows. Overall, economic data is stable and rising, and my country's economy is expected to continue to expand steadily. Short-term adjustments are unlikely to affect the medium- and long-term upward trend of the index. IC and IM may perform better than IF and IH due to short-term sentiment and expected improvement. It is recommended to hold long positions.

Stock index options: In the last trading day, the Shanghai Composite Index rose by 0.37%, the Shenzhen Component Index rose by 1.43%, the ChiNext Index rose by 1.75%, the Science and Technology Innovation 50 rose by 0.8%, the CSI 300 rose by 0.68%, the Shanghai 50 rose by 0.12%, the CSI 500 rose by 1.08%, the CSI 1000 rose by 1.14%, and the Shenzhen 100ETF rose by 1.42%. The turnover of the two markets was 1,539.369 billion yuan, an increase of about 97.3 billion yuan from the previous trading day. Among the Shenwan first-level industries, the best performing industries are: defense and military industry (2.74%), communications (2.41%), and electronics (2.18%). The worst performing industries are: environmental protection (-0.26%), transportation (-0.39%), and banking (-0.42%). After three consecutive weeks of upward movement, the stock index may have a short-term consolidation demand. In the medium term, with the active efforts of domestic policies and the support of loose liquidity, the market risk appetite has been significantly restored, and the stock index may be dominated by strong fluctuations. In terms of strategy, the medium-term option covered call portfolio can continue to be held; in terms of volatility, as the market returns to the volatile range, the volatility seller strategy can be appropriately deployed.

Treasury bond futures: On Thursday, long-term Treasury bond futures adjusted slightly. On the one hand, based on the closing price, the main contract of 30-year period fell by 0.02%, the main contract of 10-year period rose by 0.02%, the main contract of 5-year period rose by 0.02%, and the main contract of 2-year period rose by 0.01%. The yield of active 30-year Treasury bonds rose by 0.1bp to 1.868%, the yield of active 10-year bonds rose by 0.3bp to 1.662%, and the yield of active 2-year bonds fell by 0.25bp to 1.3825%. In terms of inter-product spreads of futures, 4TS-T, 2TF-T and 3T-TL changed by 0.015 yuan, 0.025 yuan and 0.095 yuan respectively. Unilateral strategy: There is a certain differentiation in futures bonds, and short bonds are more resilient. In recent days, the bond market has fully demonstrated that the negatives have been exhausted, and the futures bonds have stopped falling when the economic data is better than expected. Although the latest economic inflation data exceeded expectations, it is still low. The funding environment remains loose, and the fundamentals are generally friendly to the bond market. The logic of long-term bond bull market has not changed. It is recommended to buy TL and hold. Cross-product strategy: Policy disturbances will not change the preference of funds for long-term bonds, and the expectation of reserve requirement ratio and interest rate cuts may cool down in the short term, which is not conducive to short-term bonds. Continue to hold short-term and long-term arbitrage combinations. Hedging strategy: The basis has returned to a high level recently. It is recommended to participate in the strategy of long futures bonds instead of current bonds.

Shanghai Lead: Shanghai Lead fluctuated overnight. From a fundamental perspective, on the primary side, there is no change in the recent start-up, and it is expected that there will be a reduction in production in August. On the regeneration side, the cost is high, and the current market lacks continuous support from positive news. The profit recovery of the regeneration lead refinery is not obvious, and the production enthusiasm of the refinery is difficult to increase. Most of the production is maintained on orders. On the demand side, consumption is lower than expected, and the seasonal peak season may need to wait. Downstream battery factories are not willing to pay high lead prices. Overall, the bottom support is strong, and consumption is still waiting for feedback, and low-level fluctuations are the main trend.

Shanghai zinc: Shanghai zinc fluctuated strongly overnight. On the macro side, US retail sales in June increased by 0.6% month-on-month, exceeding expectations, and market sentiment continued to recover. From a fundamental perspective, in terms of raw materials, zinc concentrate supply continued to increase, the overall supply of imported ore was loose, and the daily TC remained flat; on the supply side, according to Baichuan Yingfu statistics, new large factories continued to produce goods within the month, and the production capacity after inspection and restoration was also restored normally, and the supply still increased month-on-month. On the demand side, the off-season characteristics are obvious. When the futures market rises, the premiums of various markets accelerate the decline, and the inquiry and trading atmosphere are both deserted. Overall, the macro sentiment has been repaired, and the fundamentals suppress the upward range.

Rubber: On Thursday, domestic full latex was 14,650 yuan/ton, up 200 yuan/ton from the previous day; Thailand No. 20 mixed rubber was 14,420 yuan/ton, up 120 yuan/ton from the previous day. Raw material side: Yesterday, Thai glue closed at 54.3 baht/kg, up 0.2 baht/kg from the previous day; Thai cup rubber closed at 48.55 baht/kg, up 0.2 baht/kg from the previous day; Yunnan glue closed at 13.6 yuan/kg, up 0.1 from the previous day; Hainan glue closed at 13.0 yuan/kg, up 0.1 yuan/kg from the previous day. As of July 13, 2025, China's social inventory of natural rubber was 1.295 million tons, up 1,800 tons from the previous day, an increase of 0.14%. China's total social inventory of dark rubber was 797,000 tons, up 0.8% from the previous month. Among them, Qingdao spot inventory increased by 0.6%; Yunnan decreased by 1%; Vietnam 10# decreased by 13%; NR inventory subtotal increased by 12.9%. China's total social inventory of light-colored rubber was 498,000 tons, down 0.9% month-on-month. Among them, old full latex decreased by 2% month-on-month, 3L decreased by 0.7% month-on-month, and RU inventory subtotal increased by 0.4%. Viewpoint: The rain in the northern region of Southeast Asia (northeastern Thailand, Vietnam, etc.) has weakened, and rubber tapping activities may be carried out in an orderly manner. Overall, it is in line with seasonality. Under relatively normal weather conditions this year, the unexpected impact on the supply side (global production) is still limited. On the demand side, the production activities of domestic downstream industries have not changed much, mainly selling inventory, and the demand side is still stable and "weak". The strong drive of the balance sheet is lacking, and market expectations continue to drive the rebound. Since it is difficult to say the end of this round of policy expectations, RU&NR will still run strong in the short term.

Rebar: Steel profits have improved, daily average molten iron output has remained strong, blast furnace operating rates remain high, raw material demand is strong, and cost support is still there. In the short-term market sentiment recovery, steel mills are mainly active in shipping, but terminal consumption is not satisfactory. Among the five major steel varieties, the reduction in rebar production is prominent, inventory has accumulated 28,900 tons month-on-month, and apparent demand has decreased by 153,300 tons. The contradiction between supply and demand in the short term is not significant, and macroeconomic policies have triggered positive feedback repairs in the industry, and steel prices continue to run strong.

Hot-rolled coil: On the industrial side, data from the Steel Union showed that this week's hot-rolled coil production decreased by 20,000 tons, inventory slightly decreased by 26,500 tons, and the surface demand slightly rebounded by 12,800 tons. Steel mills reduced supply, and the contradictions on the finished product side have not yet fully emerged. Macroeconomic policies have triggered positive feedback repairs in the industry, and the overall sentiment is strong. In the short term, hot-rolled coils will continue to run strong. In terms of strategy, wait-and-see is the main approach in the short term.

CITIC Construction Investment Futures Co., Ltd. authorized by "a professional market analysis information website focusing on domestic futures derivatives trading": [ http:// ] forwarding

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.