USD/JPY analysis: Are tactical rebound signals emerging?

2025-07-18 19:16:52

Japan's policy uncertainty and US-Japan trade frictions will continue to put pressure on the yen, while the dollar is supported by economic data and Fed expectations, and its short-term strength may continue. According to Reuters, the dollar/yen was 148.81 on Friday, up nearly 1% for the week, outperforming the dollar against the euro, pound and Swiss franc. The election results may further push the dollar/yen up to the 150 mark.

Fundamental analysis

Domestically, election uncertainty weighed on the yen. The July 20 Japanese Senate election is a key factor affecting the yen's performance. Polls show that the ruling LDP-Komeito coalition is likely to lose its majority in the Senate (it needs to retain at least 50 seats to maintain a 125-seat majority). If the coalition loses, it will increase policy uncertainty, which could push up fiscal spending and tax cut expectations, leading to higher Japanese government bond yields and further pressure on the yen.

Derek Halpenny of MUFG pointed out that if the ruling coalition loses its majority, the yen may fall below the 150 mark, especially when liquidity is low on July 21, when Japan is on holiday, and price fluctuations may be amplified.

On the tariff front, the impasse in trade negotiations between Japan and the United States has exacerbated the yen's weakness. Sensitive issues such as automobile and agricultural tariffs have prevented the two sides from reaching an agreement. Although Japan was once considered a priority trading partner by the White House, slow progress may further weaken the yen's appeal, especially as global risk appetite fluctuates.

As for the U.S. dollar, the U.S. dollar rose against major currencies for the second consecutive week, with the U.S. dollar index at 98.487, up about 0.6% for the week. Strong U.S. economic data weakened market expectations for the Federal Reserve's recent rate cuts, supporting the dollar's strength. However, Trump's fiscal expansion policy (massive spending and tax cuts) and criticism of Federal Reserve Chairman Powell may bring uncertainty to the dollar's trend.

Upcoming data include U.S. housing starts for June (1.30 million units expected, 1.256 million units prior), building permits for June (1.39 million units expected, 1.394 million prior), and the preliminary University of Michigan Consumer Sentiment Index for July (61.5 units expected, 60.7 prior).

Technical Analysis

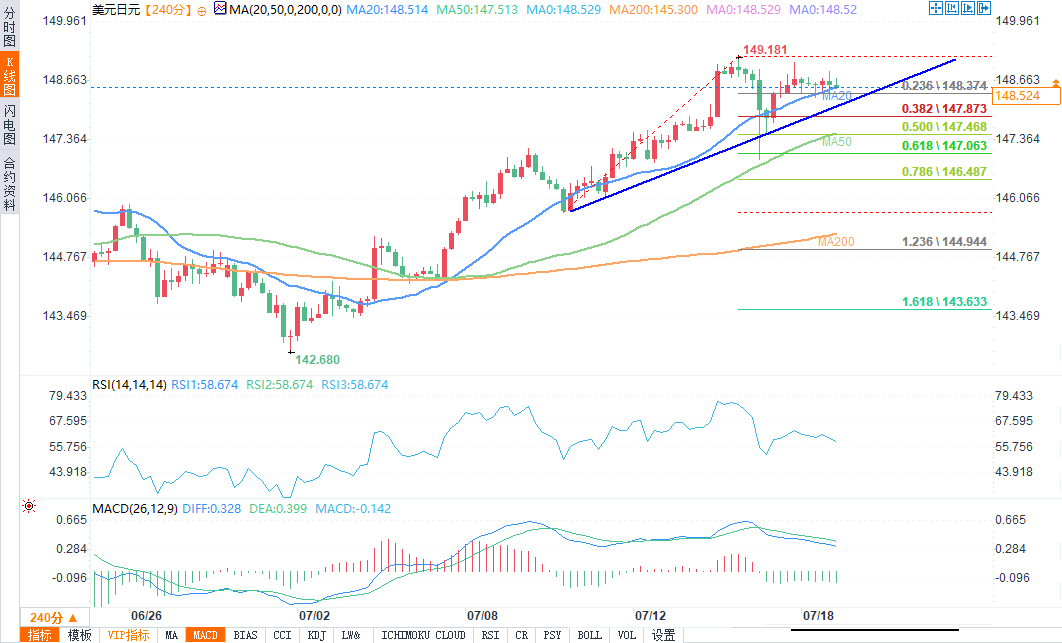

(Source of USD/JPY 4-hour chart: Yihuitong)

USD/JPY has recently stabilized above 146.50, breaking through the 147.50 and 148.00 resistance levels before entering an upward channel, but then formed a short-term high near 149.20 and entered a consolidation phase. From the 4-hour chart, the price is supported near 148.00, and a bullish trend connecting line at 148.00 further strengthens the support.

Technical indicators show that the bullish momentum on the daily chart remains, but the relative strength index (RSI) is close to the overbought area and shows signs of retreating, suggesting the risk of a short-term correction. On the upside, resistance is at 149.00 (trend line) and 149.20 (recent high). If the price breaks and closes above 149.20, it may trigger a new round of gains, with targets pointing to 150.00 or even 151.20 (200-day moving average coincides with the 50% Fibonacci retracement level). On the downside, 148.00 is the immediate support, and if it falls below it, it may test 147.45 (38.2% Fibonacci retracement level), and further downside may hit the key support area of 146.50.

Editorial Views

USD/JPY may maintain a volatile upward trend in the short term, with 148.00 as a key watershed. The bullish trend line and moving average support indicate that there is a tactical rebound opportunity, but we need to be wary of the volatility risk caused by the results of the Japanese Senate election. If it breaks through 149.20, the 150.00 mark will be the bullish target; if it falls below 147.45, it may trigger a technical correction.

At 19:14 Beijing time, USD/JPY was at 148.511/18, down 0.06%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.