Next week's outlook: Trump and Powell's dispute, ECB decision and big company earnings

2025-07-18 23:22:48

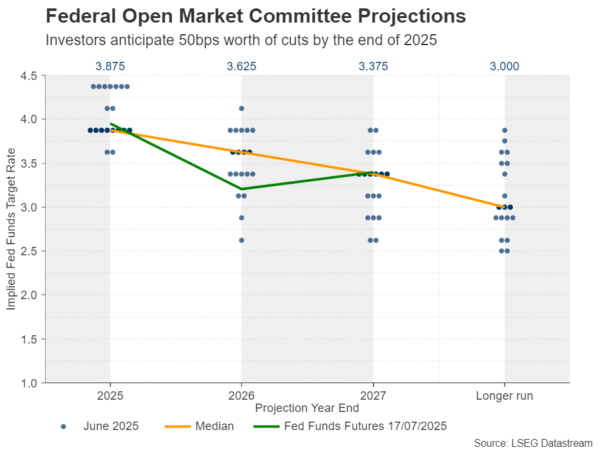

Consumer price index data on Tuesday showed inflation accelerated in June, with core inflation driven mainly by strong growth in core goods. This was seen as evidence that tariffs were causing inflation and prompted investors to scale back their bets on rate cuts, all but eliminating the possibility of a July rate cut.

Even a September rate cut is not a done deal, with the probability of a 25 basis point cut at that meeting falling to 60%. Investors have not resumed betting on a rate cut despite Wednesday’s producer price index data showing a slowdown in producer price growth last month.

(Federal Open Market Committee rate forecasts)

Will Powell compromise under Trump's pressure?

Next week's agenda includes the release of preliminary S&P Global Purchasing Managers' Index data for July on Thursday, while earlier on Tuesday, Federal Reserve Chairman Jerome Powell will speak at a conference hosted by the Federal Reserve. With President Trump recently stepping up his attacks on him, it will be interesting to see whether this pressure affects his position. Trump has repeatedly called on Powell to cut interest rates, and this week there were reports that Trump had discussed the idea of firing Powell with other Republicans. However, Trump quickly downplayed those discussions, saying it was "highly unlikely" to fire the Fed chairman.

Therefore, if Powell sticks to defending the Fed's independence and reiterates the need to remain patient and wait for more data to reveal the impact of tariffs, the dollar may continue to rebound. That said, it is too early to assert that the dollar will see a bullish reversal. Granted, as the world's reserve currency, the dollar has recently reacted positively to news that has heightened tariff-related anxiety, but if tariffs begin to reignite recession fears, traders may repeat their actions in April - selling the dollar.

Thursday’s purchasing managers’ indexes will provide the latest picture of how the world’s largest economy is performing amid trade uncertainty, with price and employment components likely to draw extra attention. June existing home sales data will be released on Wednesday, while new home sales for the same month will be released on Thursday.

Will Lagarde be more dovish this time?

In the eurozone, the European Central Bank will hold a monetary policy meeting on Thursday. In June, the European Central Bank decided to cut interest rates by 25 basis points, reducing the deposit rate to 2.0%. At the press conference, President Lagarde pointed out that the current interest rate path is in "good shape", and a few days after the resolution was announced, a Reuters report said that all parties at the meeting generally agreed to keep the policy unchanged in July, and some members also advocated a longer suspension.

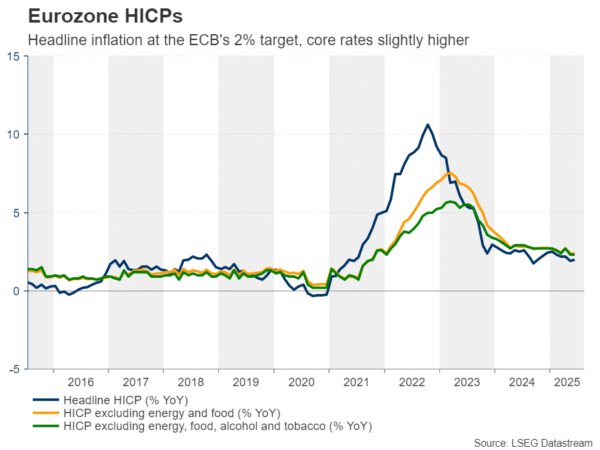

Since then, gross domestic product data showed stronger-than-expected growth in the first quarter, and retail sales also accelerated in April. Headline inflation has rebounded to the bank’s 2% target, with core inflation stabilizing at 2.4%, lending credence to the view that the ECB may wait a while before cutting rates again. Investors are pricing in just one more 25 basis point cut before the end of this easing cycle, fully expected in December, according to money market data.

(Year-on-year change in the Eurozone Index of Consumer Prices (HICP). Headline inflation is close to the ECB’s 2% target, with core inflation slightly higher.)

However, even if the ECB keeps interest rates unchanged, Trump's threat to impose a 30% tariff on European goods could complicate the bank's decision. If Lagarde shows more concern about the trade situation this time, investors may anticipate the next rate cut in advance, which may put pressure on the euro. If the preliminary purchasing managers' index for July released before the decision performs poorly, it may prompt traders to increase their bets on rate cuts before the interest rate statement.

Sterling traders bet on BoE rate cut in August, UK PMI in focus

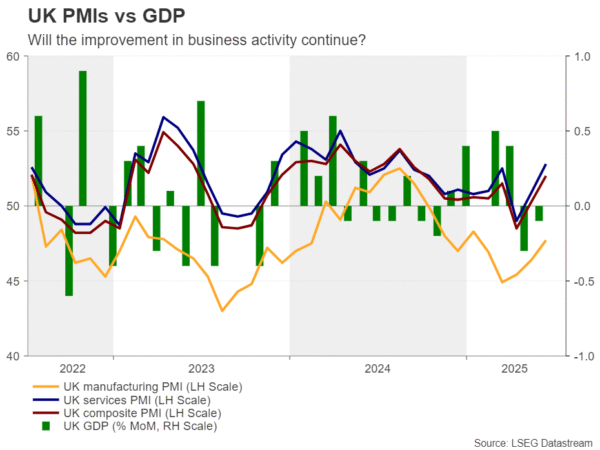

Sterling traders will also need to digest the PMI data as the euro zone data will be followed shortly by preliminary data from the UK. This week, UK consumer price index data showed that inflation unexpectedly accelerated in June, but this did little to change market bets that the Bank of England will cut interest rates in August.

After all, the Bank of England has recently turned dovish due to a deteriorating labor market, and it has long been aware that inflation will accelerate this year. With this in mind, the PMI may have a greater impact on rate cut bets than the inflation data. If the June data showed an improvement in business activity, and the trend continues in July, traders may have the confidence to reduce their rate cut bets. Even if they still believe that an August rate cut is justified, they may delay the next rate cut from December to February next year. Strong retail sales data released on Friday may also help, helping the pound to recover some of its recent losses.

(Comparison of UK Purchasing Managers' Indexes (PMIs) and Gross Domestic Product (GDP) from 2022 to 2025)

Elsewhere, the Reserve Bank of Australia will release its latest decision minutes on Tuesday, and Japan's Tokyo Consumer Price Index for July will be released during the Asian session on Friday.

Wall Street focuses on Alphabet and Tesla earnings

On the earnings front, Google parent Alphabet and Elon Musk's Tesla are set to report results after the market closes on Wednesday.

First, let's look at Alphabet, which beat expectations last quarter, but analysts expect growth to slow in the second quarter. Earnings per share are expected to fall from $2.27 in the first quarter to $2.18, and revenue is expected to increase from $90.2 billion to $93.9 billion, but year-on-year growth will fall from 12.04% to 10.85%.

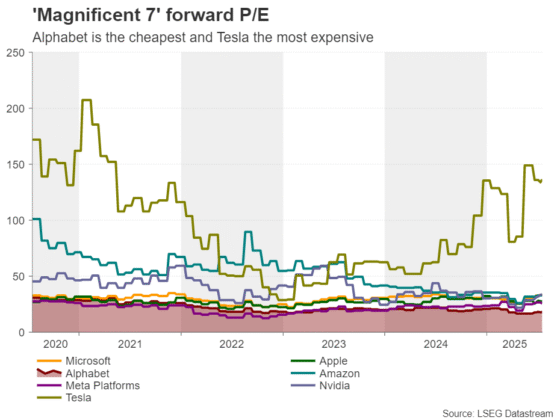

(Forward P/E ratio changes of Magnificent7 technology companies from 2020 to 2025)

The rise of AI chatbots has hit Google's search business and dragged down advertising revenue. Therefore, investors may focus on how the company can expand the user base of its own Gemini chatbot without further damaging traditional search usage. Given that Alphabet's forward price-to-earnings ratio has fallen to 18.4 times from this year's high of 21.56 times, good results may help the stock continue the rebound momentum that started in April.

Looking at Tesla, its first-quarter financial report showed a 9% drop in revenue, and management withdrew its full-year outlook, citing "changing trade policies" and an "uncertain macroeconomic environment."

Therefore, the market focus is likely to fall on the 2025 outlook and any comments from Musk on tariffs and the overall political situation, especially after his public dispute with US President Trump. Investors are also eager to learn about the latest progress of the Robotaxi program. There are reports that the Robotaxi launched in Austin has unstable driving problems. It will be worth watching whether Musk will respond to safety concerns and restore market confidence in the company's autonomous driving program.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.