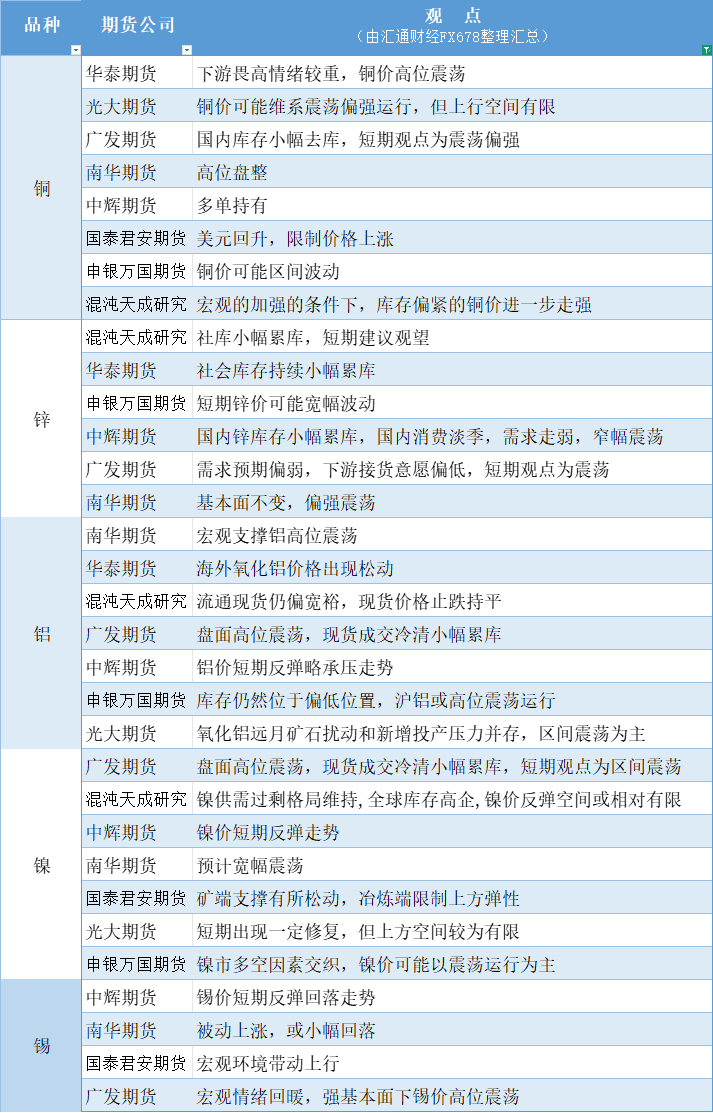

Futures companies' views summarized in one chart: July 4 non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2025-07-04 12:11:03

Copper: Copper prices may maintain a volatile and strong trend, but the upward space is limited. Domestic inventories have been reduced slightly, and the short-term view is that they will fluctuate and be strong. Zinc: Domestic zinc inventories have accumulated slightly. Domestic consumption is in the off-season, demand has weakened, and the market has fluctuated narrowly. Aluminum: Alumina long-term ore disturbances and new production pressure coexist, and the market mainly fluctuates within a range. Nickel: The nickel supply and demand surplus pattern is maintained, global inventories are high, and the room for nickel prices to rebound may be relatively limited. Nickel prices will rebound in the short term. Tin: Macro sentiment has warmed up, and tin prices are fluctuating at a high level under strong fundamentals.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.