Technical analysis: Gold has a clear bullish trend above $3,325, supported by US fiscal uncertainty

2025-07-04 18:55:54

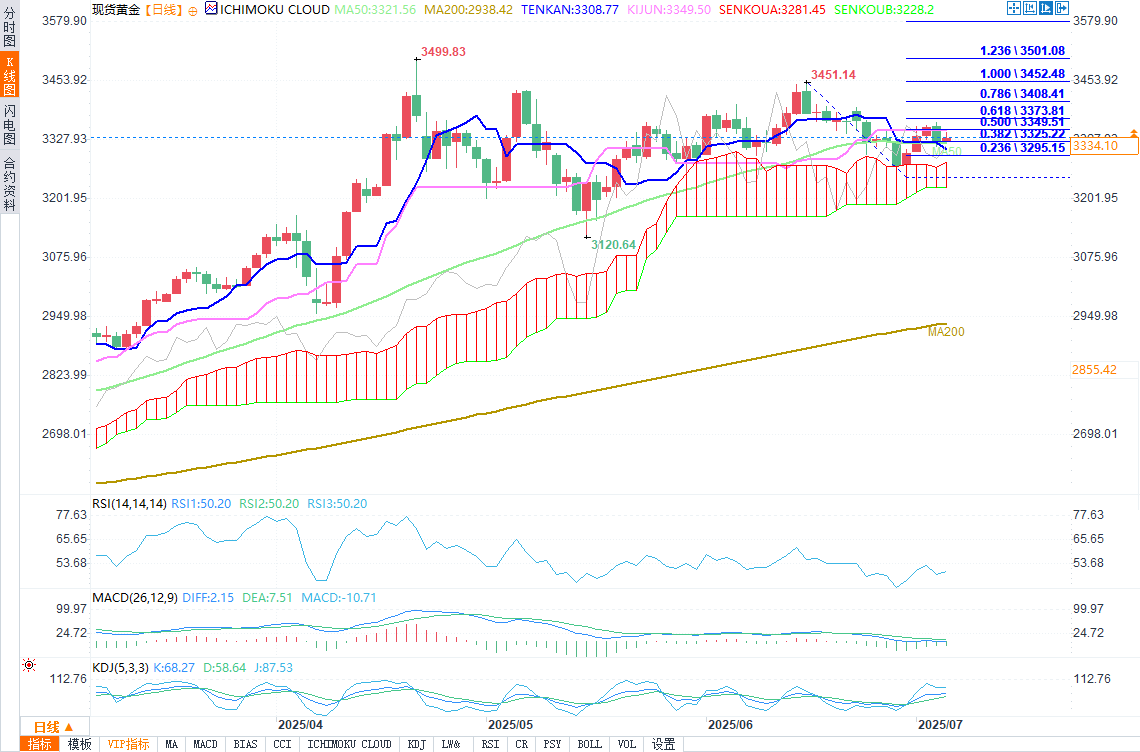

After two consecutive weeks of declines, gold is expected to rise this week, which is a further positive signal as prices remain at the upper end of a wider consolidation range ($3,500/3,120).

The negative impact of positive US labor data was relatively short-lived, while market concerns about fiscal issues intensified after the US Congress passed President Trump's tax cut and spending bill (which will add another $3.4 trillion to the US's huge debt), which is expected to put pressure on the dollar and support safe-haven demand.

The technical side of the daily chart is still showing a differentiated trend: the short-term trend is supported by the increasingly thick daily cloud chart, but the 14-day momentum indicator is still in the neutral range, and the stochastic indicator is overbought, offsetting this positive signal.

(Source of spot gold daily chart: Yihuitong)

As long as gold remains above $3,325 (38.2% Fibonacci retracement of $3,452-3,246 range, broken), the short-term bias remains bullish. However, a breakout above $3,350 resistance (50% retracement/daily base) and $3,365 (Thursday high) is needed to consolidate the short-term structure and shift the focus to targets such as $3,373 (61.8% Fibonacci) and $3,400 (psychological level).

However, Friday's trading may be quiet as trading volumes are expected to be low with U.S. markets closed for Independence Day.

Resistance levels: $3,345; $3,350; $3,365; $3,373

Support levels: $3,325; $3,311; $3,308; $3,300

At 18:52 Beijing time, spot gold was quoted at US$3,337.27 per ounce, up 0.34%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.