The boss sees gold and silver reaching $4,000 and $50 respectively this year, saying mining stocks will usher in a bull market.

2025-07-30 13:06:44

“Basically, we’re in a boom-bust period, which means everything goes higher because they destroy the purchasing power of fiat currencies, whether it’s the euro, the U.S. dollar or the Canadian dollar,” said Grummes, managing director of Midas Touch Consulting.

Gold prices will definitely exceed $4,000 this year

Gold prices held around $3,325 an ounce on Wednesday after recovering slightly following four consecutive sessions of losses of more than $130, which Grummes said was part of a typical summer pattern.

"It's trading sideways, it's consolidating, it's digesting, it takes time and people need to be patient," he said.

Back in April, he said gold wouldn't fall below $3,000, and that statement still rings true. "We may have seen a short-term top," he said, referring to the $3,500 high. "We saw a low of $3,120, and gold quickly rallied and has failed to break through $3,450 four times since then."

He sees support at $3,285 and resistance at $3,450, with a long-term upside target of $4,000. “For the rest of the year, I think we’re definitely going to see above $4,000,” he said.

Grummes’ short-term bias flips to bullish above $3,365. “Until then, the bias favors sideways or down, but it’s not a huge negative,” he said.

Silver price could still reach $50

Grummes maintained his bold silver price target from April, predicting a rise to $50 in the second half of 2025. “Since April, silver prices have risen 23%, which is slower than expected, but it’s bullish and it’s moving at a steady pace,” he said.

He pointed to slow price action, light trading volumes and a lack of speculative froth as signs of strength. “The spot market is leading prices and slowly but surely, physical demand is pushing prices higher,” he said.

He puts a $37.50 level on his preferred level and dismissed concerns of a failed breakout. "Even if silver pulls back further, I'm not worried at all," Grummes said. "Even if silver pulls back further, I'm not worried at all. Silver is still very cheap compared to gold. If you want to invest in silver, you have to buy silver."

mining stocks

Silver mining stocks outperformed, and Grummes singled out one small-cap stock as a winner. "Silver Tiger Metals of Mexico is up 125% since three months ago," he said. "All they needed was a permit, which takes 18 months, and they're already producing."

He noted a resurgence in mergers and acquisitions in Mexico, with examples like SilverCrest’s $1.7 billion acquisition by Coeur, Gatos’s acquisition by First Majestic, and MAG Silver’s acquisition by Pan American Silver.

“There’s renewed interest in Mexico,” he said. “The big producers clearly trust the new government, otherwise they wouldn’t be investing so much money.”

Asked whether large or junior mining companies were more attractive now, he leaned towards juniors. "Some of the large companies, many are doing very well, some are disappointing," he said. "Now is the time to really look at the smaller juniors and explorers."

He believes the next leg up in gold prices will ignite this sector. “Once gold breaks above $3,500 and heads towards $4,000 and above, you’re going to see some of the smaller names really break out.”

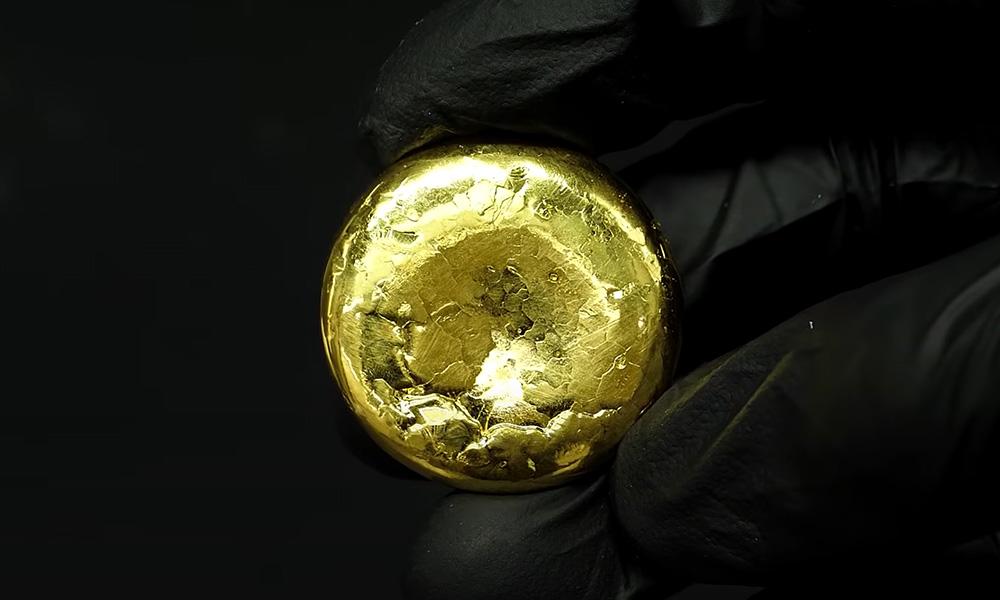

Spot gold daily chart Source: Yihuitong

At 13:06 Beijing time on July 30, spot gold was quoted at $3326.21 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.