The Fed maintains a neutral stance, and gold prices try to return to above $3,300

2025-07-31 11:52:35

As expected, the Federal Reserve kept interest rates unchanged, keeping them in a range of 4.25% to 4.50%. The most notable change in the Fed's monetary policy statement was a slight downward revision in its assessment of the economy, noting that economic growth in the first half of the year slowed from the "solid pace" reported in June.

"While fluctuations in net exports continue to influence the data, recent indicators suggest that the growth of economic activity has moderated somewhat in the first half of the year," the Fed said in its monetary policy statement.

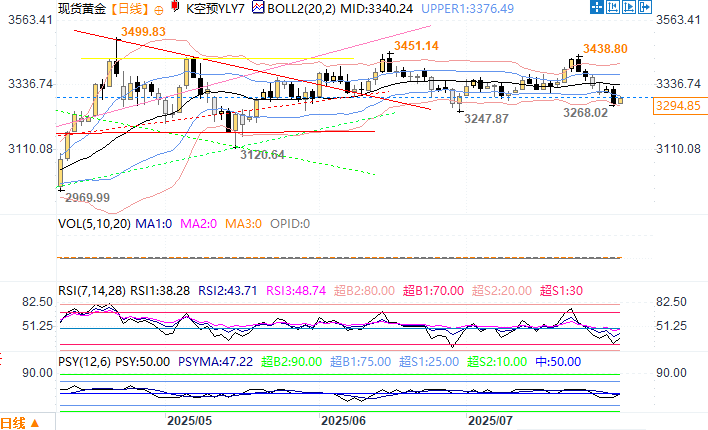

The market's initial reaction to the Fed's announcement was renewed volatility in gold prices. On Wednesday (July 30), spot gold closed at $3,274.88, down $51.47, or 1.55% on the day, with an intraday low of $3,268.02. In early Asian trading on Thursday, spot gold rebounded to around $3,296, within reach of the previous support level of $3,300.

Although the Fed maintained its neutral monetary policy stance, dissent began to emerge within the committee. Fed Governors Bowman and Waller both voted in favor of a rate cut at this meeting.

But analysts noted the split vote was not surprising, as both committee members had been outspoken about their dovish views.

With the Fed’s decision bearing no surprises, Michael Brown, senior market analyst at Pepperstone, expects the Fed to be slightly more hawkish this year than the market currently anticipates.

Despite the Fed's current neutral stance, markets still expect the central bank to cut interest rates twice this year, starting as early as September.

“My base case remains that the resilient nature of the labor market and the continued emergence of tariff-induced price pressures will keep the Fed on the sidelines for now,” Brown said. “My view remains that only one quarter-point rate cut is likely this year, likely at the December meeting.”

Spot gold daily chart Source: Yihuitong

At 11:52 Beijing time on July 31, spot gold was quoted at $3296.85 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.