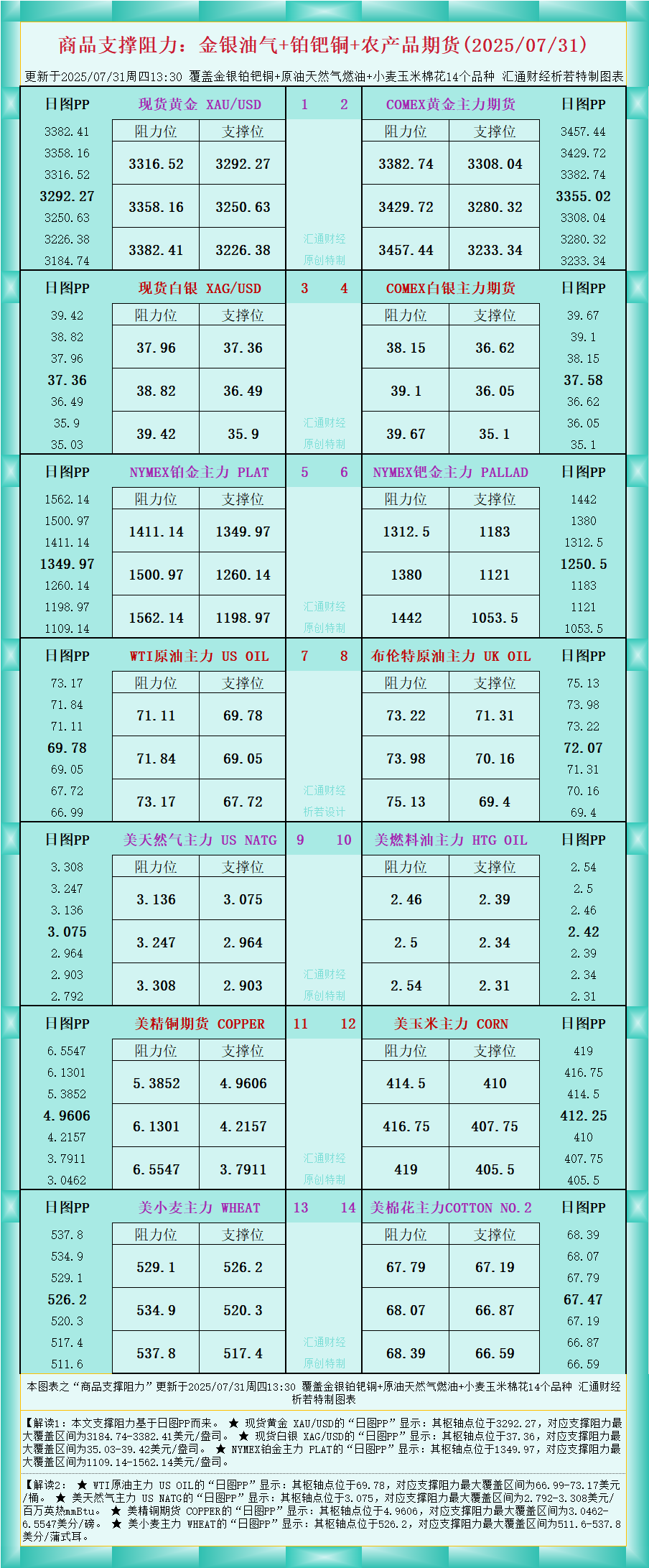

Commodity support and resistance chart: Gold, Silver, Oil, Gas, Platinum, Palladium, Copper, and Agricultural Products Futures (July 31, 2025)

2025-07-31 13:33:41

As shown in the data, Interpretation 1: The support and resistance in this article are based on the daily chart PP.

★ The "Daily PP" of spot gold XAU/USD shows that its pivot point is at 3292.27, and the corresponding maximum support and resistance range is 3184.74-3382.41 US dollars per ounce.

★ The "Daily PP" of spot silver XAG/USD shows that its pivot point is at 37.36, and the corresponding maximum support and resistance range is 35.03-39.42 US dollars per ounce.

★ The "daily PP" of NYMEX platinum main force PLAT shows that its pivot point is at 1349.97, and the corresponding maximum support and resistance range is US$1109.14-1562.14 per ounce.

Interpretation 2:

★ The "daily PP" of the main WTI crude oil US OIL shows that its pivot point is at 69.78, and the corresponding maximum support and resistance range is 66.99-73.17 US dollars per barrel.

★ The "daily PP" of US NATG, the main U.S. natural gas, shows that its pivot point is at 3.075, and the corresponding maximum support and resistance range is US$2.792-3.308 per million British thermal units (mmBtu).

★ The "Daily PP" of COPPER, a US copper futures contract, shows that its pivot point is at 4.9606, and the corresponding maximum support and resistance range is 3.0462-6.5547 cents/pound.

★ The "daily PP" of the main U.S. wheat commodity WHEAT shows that its pivot point is at 526.2, and the corresponding maximum support and resistance range is 511.6-537.8 cents/bushel.

For more detailed information on various varieties, please see the chart. This information is original and copyrighted by Huitong Finance and is for reference only.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.