Silver Forecast: After the PMI-driven rebound, the key resistance level of $37.87 is in focus

2025-08-06 01:34:55

The report showed significant weakness in the labor market, which further pressured the dollar and boosted the appeal of silver. The services sector employment index fell to 46.4, the fourth contraction in five months.

The new orders index also fell to 50.3, while the business activity index slipped to 52.6 from 54.2 in June. The overall tone reinforced expectations of a deceleration in services sector activity, despite ongoing supply chain bottlenecks.

Prices, tariffs and delivery delays: Potential inflation risks persist

Despite a slowdown in overall services activity, inflation signals strengthened. The price index surged to 69.9, the highest level since October 2022, highlighting continued pressure on input costs. The supplier delivery index also climbed to 51, indicating that logistical constraints remain a factor. Several respondents cited concerns related to tariffs, particularly regarding imported feed ingredients, trace minerals, and equipment purchases.

Contractions in sectors such as accommodation and food services, construction, and mining indicate growing pressure on interest rate and trade-sensitive sectors. Tariff uncertainty was widely cited as a cause of project delays, public project cancellations, and cost inflation. However, transportation and warehousing, as well as retail trade, remained relatively resilient.

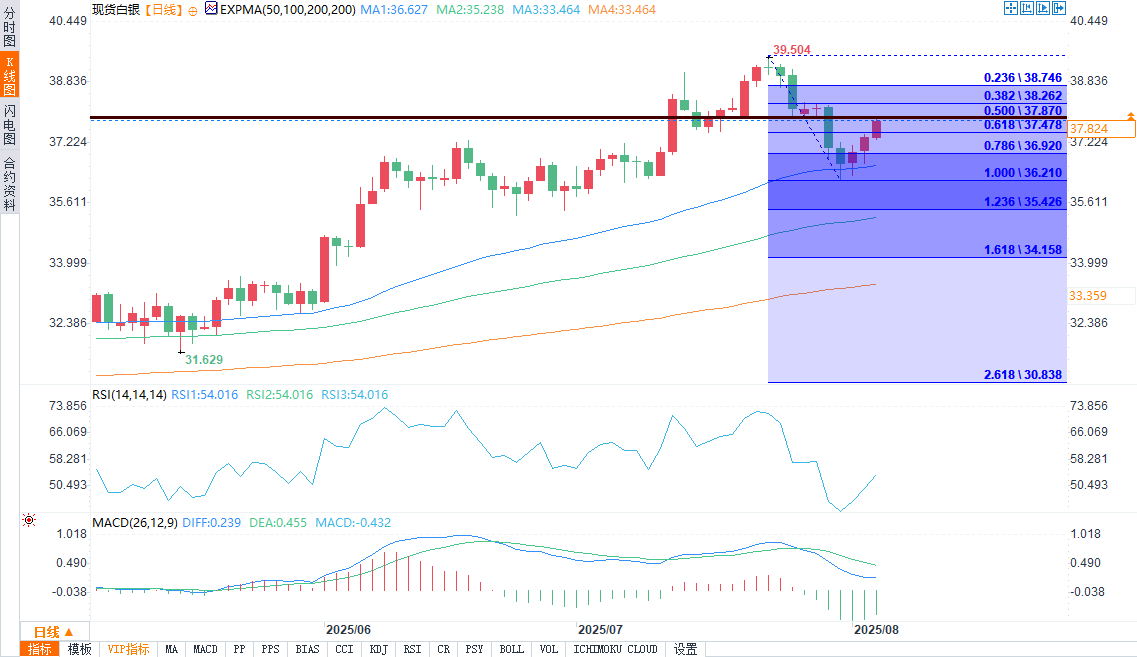

Technical layout: If it breaks through the key level of $37.87, silver is expected to break through

(Source of spot silver daily chart: Yihuitong)

From a technical perspective, silver is testing a key pivot point at $37.87, representing the 50% retracement of its short-term range from $39.50 to $36.21. This area is not only resistance but could also trigger a breakout if decisively broken. Support remains strong at the 50-day moving average at $36.70, while the swing low at $36.21 provides additional downside protection.

Outlook: Dollar and Fed policy depend on more data

With softer services sector data and persistently weak employment, traders are increasingly betting on easier policy from the Federal Reserve.

If subsequent data is consistent with today’s tone, silver could accelerate its advance after breaking out of $37.87 and potentially retest the recent high of $39.504.

However, persistent inflation from tariffs and input costs is likely to curb expectations of rate cuts, limiting silver's upside unless broader economic indicators deteriorate further.

At present, silver technically remains in a constructive position, supported by weakening economic signals and strong underlying price levels.

At 01:27 Beijing time, spot silver was quoted at $37.798 per ounce, up 1.09%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.