Gold prices fell on profit-taking and easing risk aversion

2025-08-06 23:09:57

European and Asian stock markets were mostly higher in overnight trading, while U.S. stock indexes were expected to open slightly higher when the New York trading day begins.

In overnight news, Bloomberg reported that gold inventories in warehouses affiliated with the Shanghai Futures Exchange have climbed to a record high, a sign that China's demand for gold remains strong. Over 36 tons of gold bars have been registered for delivery on futures contracts, with traders and banks profiting from the price gap between futures and physical gold. John Reid, senior market strategist at the World Gold Council, said, "This demonstrates the current robust demand for gold trading in China," driven by a surge in futures demand and a surge in arbitrage activity. The Bloomberg report indicates that traders and banks are capitalizing on this price gap by buying cheaper gold in the spot market and delivering it to exchange warehouses. This gold can then be used to offset futures sales, allowing them to close their positions at a profit.

Today's key external markets showed that the US dollar index weakened; crude oil futures prices on the New York Mercantile Exchange rose, trading around $66.25 per barrel; the benchmark 10-year U.S. Treasury bond yield is currently around 4.236%.

U.S. economic data due for release on Wednesday includes the MBA mortgage applications survey and the U.S. Energy Information Administration's (DOE) weekly liquid energy stocks report.

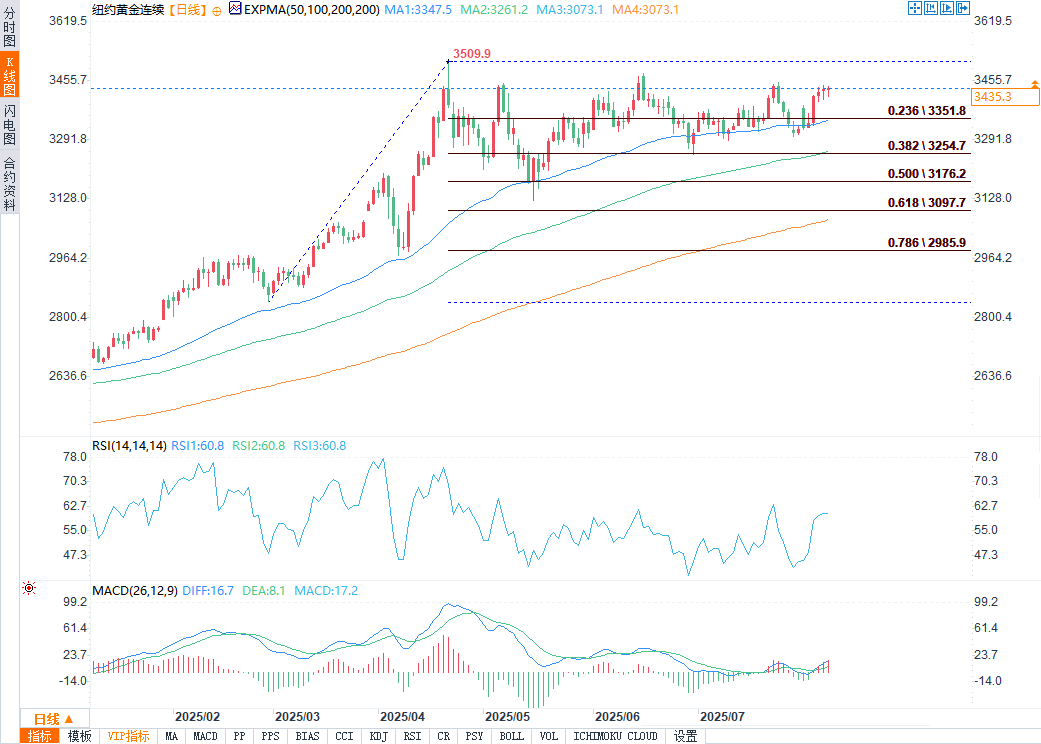

(Comex gold futures daily chart source: Yihuitong)

From a technical perspective, December gold futures bulls have the overall near-term advantage. Bulls' next upside price objective is closing prices above solid resistance at the July high of $3,509.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $3,300.00. First resistance is seen at this week's high of $3,444.90, followed by $3,450.00. First support is seen at this week's low of $3,397.90, followed by $3,350.00. Wyckoff Market Rating: 6.5.

September silver futures bulls have the overall near-term technical advantage, but that advantage is fading quickly. The uptrend on the daily bar chart has been broken. Silver bulls' next upside price objective is closing prices above solid technical resistance at this week's high of $38.51. The next downside price objective for the bears is closing prices below solid support at $35.00. First resistance is seen at $38.00, followed by $38.50. Next support is seen at this week's low of $36.76, followed by last week's low of $36.28.

At 23:06 Beijing time, spot gold was trading at $3,378.21 per ounce, down 0.07%. COMEX gold futures were trading at $3,434.1 per ounce, down 0.02%. Spot silver was trading at $37.874 per ounce, up 0.24%. COMEX silver futures were trading at $37.955 per ounce, up 0.35%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.