Gold prices fall sharply amid uncertainty over US tariff policy

2025-08-11 22:22:21

Gold prices took a hit today after a strong rally early Friday, as traders await further clarity from the Trump administration regarding its gold import tariffs. In April, the US government exempted the precious metal from the tariffs, and precious metals markets are likely to remain nervous until there is long-term clarity on the policy. "As the industry awaits this potential policy clarity, we are seeing orderly movement across various sectors of the gold market," wrote Joseph Cavatoni, senior market strategist for North America at the World Gold Council.

In other news, the Shanghai Composite Index rose 0.34% and the Shenzhen Component Index rose 1.46% on Monday, extending last week's gains as investors awaited news on whether the U.S.-China tariff truce would be extended before a Tuesday deadline. Reports indicate that China is seeking U.S. concessions on export controls on artificial intelligence chips as part of a trade deal, a move that could come ahead of a summit between Presidents Donald Trump and Xi Jinping.

The United States expects to essentially complete trade negotiations with countries with which it has yet to reach trade agreements by the end of October, Nikkei Asia reported, citing an interview with U.S. Treasury Secretary Scott Bessent.

Bessant made the comments in an interview with the Nikkei Asian Review on Thursday, Bloomberg reported, just after President Trump's new tariffs took effect. Some major trading partners, including Canada, Mexico and Switzerland, are still seeking more favorable terms with the United States.

In key external markets today, the U.S. dollar index rose slightly. Crude oil futures on the New York Mercantile Exchange (Nymex) were essentially flat, trading around $64.00 per barrel. The benchmark 10-year U.S. Treasury yield is currently at 4.26%.

There was no major U.S. economic data released on Monday.

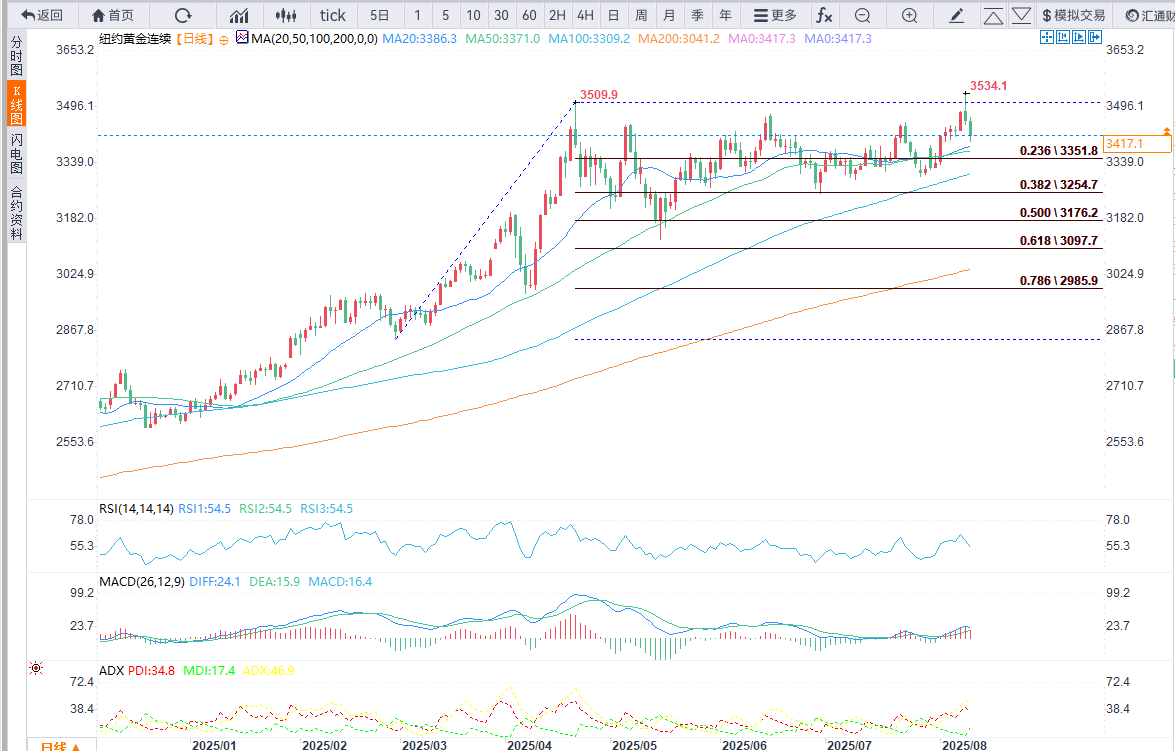

(Comex gold futures daily chart source: Yihuitong)

From a technical perspective, December gold futures bulls still have the overall solid short-term technical advantage, but have lost some ground today. Bulls' next upside price objective is closing prices above strong resistance at $3,500.00. Bears' next near-term downside price objective is pushing futures prices below strong technical support at the July low of $3,319.20. First resistance is seen at $3,450.00 and then at the overnight high of $3,466.30. First support is seen at $3,400.00 and then at $3,350.00.

September silver futures bulls have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above strong technical resistance at the July high of $39.91. The next downside price objective for the bears is closing prices below strong support at the July low of $36.28. First resistance is seen at the overnight high of $38.56 and then at last week's high of $38.875. Next support is seen at the overnight low of $37.65 and then at $37.50.

At 22:17 Beijing time, spot gold was trading at $3,356.30 per ounce, down 1.2%. COMEX gold futures were trading at $3,414.6 per ounce, down 2.2%. Spot silver was trading at $37.808 per ounce, down 1.28%. COMEX gold futures were trading at $37.925 per ounce, down 1.60%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.