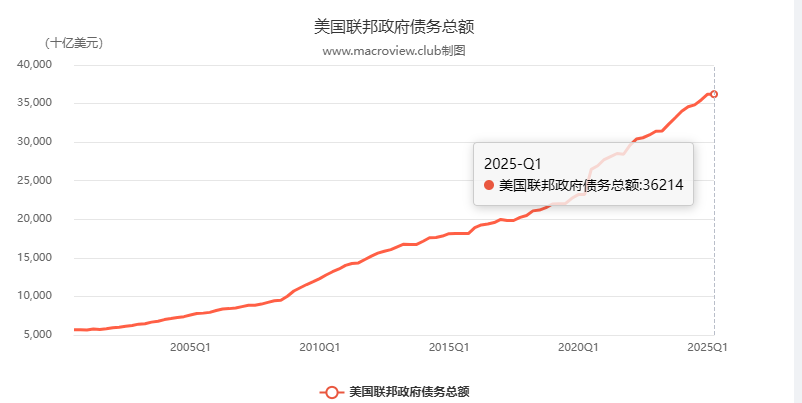

With $37 trillion in debt and soaring deficits, what's next for the dollar?

2025-08-13 13:16:43

Data shows that U.S. customs revenue increased by 273%, or $21 billion, in July compared to the same period last year, despite an increase in overall spending. An anonymous Treasury official, previewing the data, said the increase was due in part to a combination of expenses, including increased interest payments on the public debt, cost-of-living increases for Social Security payments, and other costs. Meanwhile, the federal government's total debt is creeping toward $37 trillion.

(Trend chart of total U.S. federal government debt)

Despite Trump's talk of enriching the US with his import tax increases, federal spending still exceeds the tax revenue collected by the government. Businesses are depleting their pre-tariff inventory, forcing them to import more goods and generate more tax revenue, as if this behavior will help change the government's financial situation and reduce financial pressures. However, the deficit has not actually decreased as significantly as promised.

If the tariffs fail to deliver on Trump's promise to improve the government's finances, the American public could face fewer jobs, greater inflationary pressures, and higher interest rates on mortgages, auto loans, and credit cards. The budget deficit is the difference between what the U.S. government collects in taxes and what it spends each year, which accumulates into the overall national debt over time.

The Committee for a Federal Budget says the tariff revenue would be meaningful — projecting about $1.3 trillion over the four years of a Trump presidency — but some economists, such as Kent Smetters of the University of Pennsylvania’s Wharton School, say the tariffs would likely result in “only a modest reduction” in the federal debt.

In June, the Congressional Budget Office estimated that President Donald Trump's sweeping tariff plan would reduce the deficit by $2.8 trillion over ten years, while shrinking the economy, increasing inflation, and reducing overall household purchasing power. However, tax projections are difficult because Trump has repeatedly changed his tariff rates, and because the new tariffs were imposed under the guise of an economic emergency, they are currently under appeal in U.S. courts. (The Trump administration's tariff-related tax policies, which have been justified by the economic emergency, are facing legal challenges.)

A Treasury official did not respond to a request for comment on when the U.S. might start seeing tariff revenues impact the deficit.

U.S. Treasury Secretary Scott Bessent said last month on Fox Business Network's "Mornings with Maria" that the Trump administration is "focused on getting that deficit down." The Trump administration anticipates reaching more trade deals with other countries. On Monday, Trump extended the trade truce with China to 90 days, retaining the 30% tariffs imposed as a condition of the negotiations. The previous deadline was 12 a.m. Tuesday.

Trump announced on social media that he had signed an executive order extending the tariffs and stated that "all other elements of the agreement will remain unchanged." At the same time, the Ministry of Commerce also announced the extension of the tariff suspension.

Summarize:

The current total federal debt is approaching 37 trillion US dollars. The increase in interest payments will squeeze the space for other fiscal expenditures. If the deficit is financed through means such as issuing bonds, it may push up market interest rates and be transmitted to the consumer end, exacerbating inflation. In the long run, it may suppress economic vitality. High deficits may squeeze out private investment, reduce household purchasing power, and even affect the stability of the job market.

For the US dollar index, the high deficit may be interpreted as the economy needs loose policy support, and the market will be under pressure in the short term due to increased expectations of the Federal Reserve to cut interest rates. However, in the long term, if the deficit triggers concerns about debt credibility or inflation gets out of control, it will weaken the credit of the US dollar and further suppress the US dollar index. However, if the US economy remains resilient relative to other economies, the US dollar may gain temporary support due to its safe-haven properties and show a fluctuating characteristic.

From a technical perspective , the US dollar has failed to maintain its upward trend, and it is difficult to break through upward. As the daily RSI has entered the oversold range, the price has limited downward space, and it is easy to have a false breakthrough and then turn into a box-shaped oscillation.

(Daily chart of the US dollar index, source: Yihuitong)

At 13:16 Beijing time, the US dollar index is currently at 98.02.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.