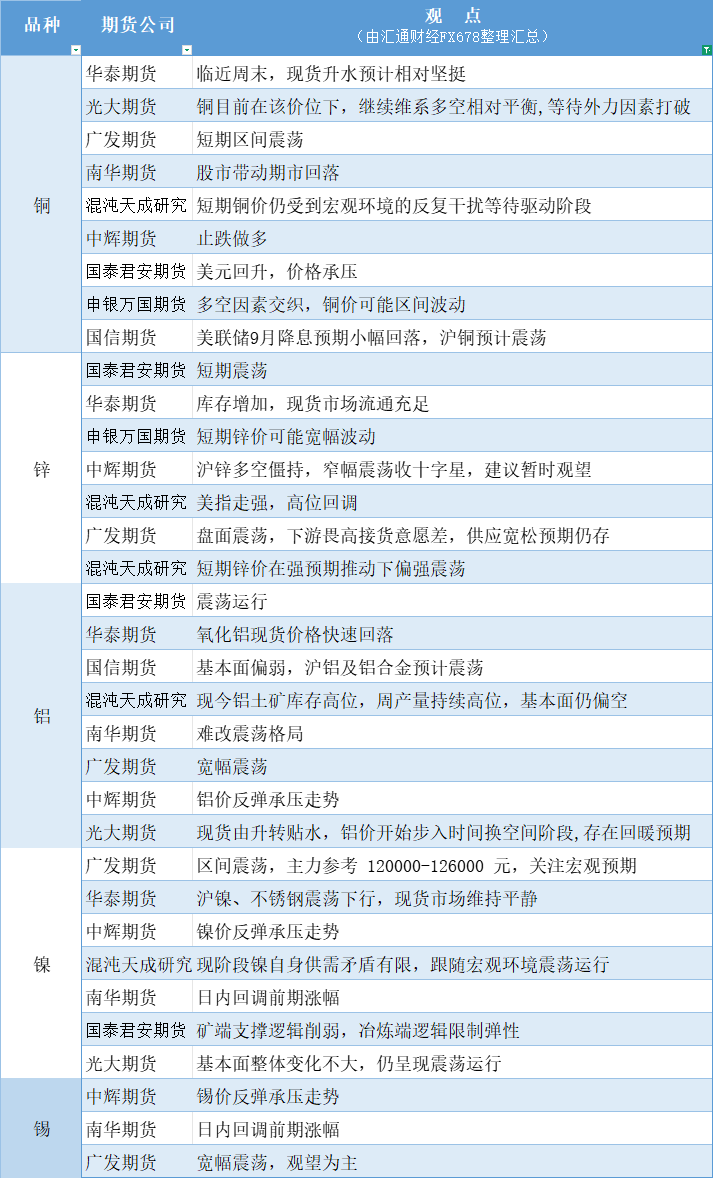

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on August 15

2025-08-15 13:22:14

Copper: Copper is currently at this price level, and continues to maintain a relative balance between long and short positions, waiting for external factors to break it. In the short term, copper prices are still subject to repeated interference from the macro environment and are waiting to be driven; Zinc: The market is volatile, downstream companies are afraid of high prices and have little willingness to accept goods, and expectations of loose supply still exist. Zinc prices may fluctuate widely in the short term; Aluminum: Today's bauxite inventories are high, weekly production continues to be high, and the fundamentals are still bearish; Nickel: The support logic on the mining side is weakened, and the logic on the smelting side limits flexibility. At this stage, nickel's own supply and demand contradictions are limited, and it fluctuates with the macro environment; Tin: Tin prices rebounded under pressure.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.