PPI unexpectedly "brakes", the US dollar plunges and gold rises, all eyes turn to tomorrow's CPI

2025-09-10 20:49:26

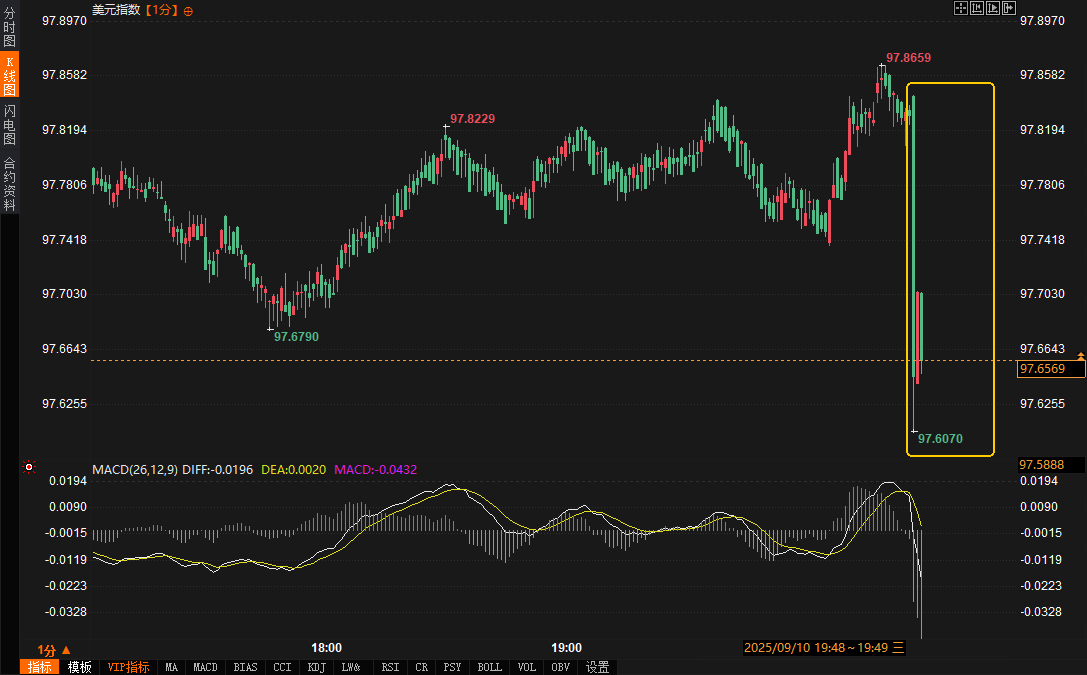

This unexpected drop in sentiment quickly triggered market volatility, with the US dollar index plunging approximately 24 points to 97.6070, while spot gold surged approximately $10 to $3,657.30 per ounce. Market sentiment shifted to cautious optimism following the release of the data, prompting investors to reassess the Fed's rate cut path and future market trends.

This article will analyze the deep impact of this data from the perspectives of market background, real-time market reactions, institutional and retail investor interpretations, and future trend outlook.

Market Background: A Delicate Balance Amid Multiple Risks

Prior to the release of the PPI data, global financial markets were navigating a complex web of risks. The ongoing situation between Russia and Ukraine and geopolitical tensions in the Middle East, coupled with risk aversion fueled by Trump's tariff rhetoric, briefly weighed on market risk appetite. However, strong earnings from tech giant Oracle (a 1529% surge in database and cloud revenue) boosted market sentiment, with Nasdaq futures already showing upward momentum before the data was released. Meanwhile, US mortgage applications increased by 9.2% during the holiday-shortened week, with home purchase and refinance indices rising by 6.6% and 12.2%, respectively, demonstrating the supportive effects of low interest rates on the real estate market. Market expectations for the PPI were relatively modest, with a consensus forecast of a 0.3% monthly increase and a flat annual rate of 3.3%, suggesting that inflationary pressures might be stabilizing. However, the unexpectedly weaker actual data upset this equilibrium, triggering a swift market repricing.

Real-time market reaction: US dollar under pressure, gold and stock markets rebound

The market reaction to the PPI data was swift and significant. The US dollar index fell approximately 24 points in the short term, hitting a low of 97.6070, reflecting that concerns about slowing inflation have weakened the dollar's appeal. Meanwhile, spot gold surged, reaching a high of $3,657.30 per ounce, with a daily gain of nearly 0.3%, demonstrating the temporary appeal of safe-haven assets following the downward revision of inflation expectations. The platinum market was also active, with spot platinum breaking through the $1,400 per ounce mark, rising 1.29% on the day, while the main Nymex platinum futures contract rose an even greater 2.94%. The reaction in US stock futures was particularly pronounced, with the S&P 500 and Nasdaq 100 futures extending gains after the data release, each rising 0.49%, indicating that increased expectations of a Federal Reserve rate cut have boosted risk assets.

The U.S. Treasury market showed divergent trends. The 10-year Treasury yield fell slightly by 0.6 basis points to 4.068%, the 2-year yield fell by 1.1 basis points to 3.531%, and the 30-year yield rose slightly by 0.5 basis points to 4.722%. This divergence reflects the market's downward revision of short-term inflation expectations and a mixed view of the long-term economic outlook. The EUR/USD exchange rate hit an intraday high of 1.1728 after the data was released, rising 0.10% on the day. The technical "long-legged doji" pattern and the upward reversal of the daily RSI further reinforced the bullish signals, although the market remains vigilant against the potential for a pullback.

Fed rate cut expectations: a subtle shift in market sentiment

The unexpectedly weak PPI data directly impacted market expectations for the Federal Reserve's monetary policy. Previously, the market generally expected the Fed to cut interest rates by 25 basis points at the September FOMC meeting, but after the data was released, the likelihood of a 50 basis point cut significantly increased. A prominent analyst noted that the August core PPI's -0.1% month-over-month decline marked the largest month-over-month drop in nearly a decade, indicating that inflationary pressures on the production side are rapidly receding. This signal could foreshadow similarly weak August CPI data, released Thursday. If the CPI falls short of expectations, the Fed's case for a rate cut would be further strengthened.

The interpretations of institutional and retail investors present divergent but complementary perspectives. Institutional investors believe that although the PPI data showed a mild reaction, combined with Thursday's CPI data, it will directly affect the expectations of the Fed's dot plot. He pointed out: "The decline in PPI indicates that corporate cost pressures have eased, which may be transmitted to a downward trend in CPI, and expectations of interest rate cuts will further increase." Retail investors have more complicated emotions. Some traders said the day before the data was released that the PPI data may not cause drastic fluctuations, but combined with the downward revision of non-farm payroll data and weaker retail data, market concerns about the downside risks of the US economy have intensified, and expectations of interest rate cuts have become the main driving factor. After the data was released, some traders further commented: "PPI weakened more than expected, and the short-term plunge in the US dollar was expected. The rebound in gold and US stock futures reflects the market's optimistic expectations for loose policies, but the CPI data is the key."

Compared to pre-data expectations, market sentiment shifted from cautious balance to cautious optimism. Before the release, modest expectations for PPI reflected confidence in stable inflation. However, the weakening actual data shattered this assumption, prompting investors to quickly adjust their positions. In particular, technical signals in the EUR/USD pair further reinforced market expectations of a weaker dollar, prompting traders to bet on a short-term rebound in risky assets.

Interpretation by institutions and retail investors: Optimism and caution coexist

Institutional interpretations focus on the profound impact of PPI data on monetary policy and asset prices. An analyst at a US financial website stated, "The unexpected decline in PPI provides a strong signal that CPI will be lower than expected, and the rise in US stock futures reflects the market's optimistic pricing of interest rate cuts. If CPI confirms slowing inflation, the probability of a 50 basis point Fed rate cut will increase significantly." This view echoes institutional commentary, with one institution further noting, "PPI data is highly volatile, and a single month's data is insufficient to alter the long-term trend. However, in the short term, downward pressure on the US dollar index and US Treasury yields will persist."

Retail investors' interpretations are more focused on market sentiment and trading opportunities. Before the data was released, one trader warned that the PPI, as a leading indicator of the CPI, could delay the Fed's interest rate cuts if it showed inflationary pressures. However, after the data was released, they adjusted their views, stating, "The PPI's -0.1% monthly rate suggests inflationary pressures are far lower than expected. The surge in gold and the plunge in the dollar are typical market reactions, but traders should monitor whether the CPI data continues this trend." This shift from caution to optimism reflects retail investors' keen sense of short-term trading opportunities, but also reveals concerns about the uncertainty of future data.

Outlook for future trends: short-term rebound and long-term uncertainty

Looking ahead, the unexpectedly weak PPI data has injected short-term optimism into the market, but the long-term trend remains uncertain. In the short term, the rebound in US stock futures and gold is likely to continue, especially if Thursday's CPI data further confirms slowing inflation. Anticipation of a Fed rate cut will drive risk assets higher. Bullish technical signals in EUR/USD also provide a basis for short-term long positions, but traders should be wary of a pullback near the 1.1728 high. The US dollar index will face a test of support at 97.60; a break below could lead to further declines towards 97.00.

In the long term, the market needs to monitor the evolving nature of multiple risks. The situation in Russia and Ukraine and Trump's tariff rhetoric are likely to continue to destabilize market sentiment, while downside risks to the US economy (downward revisions to non-farm payrolls and weaker retail sales figures) could intensify safe-haven demand. The Federal Reserve's monetary policy path will be a key determinant of market trends. If CPI data continues the weak performance of PPI, expectations of rate cuts could push US Treasury yields further downward, benefiting gold and growth stocks. However, if geopolitical risks or unexpected inflation data disrupt the current equilibrium, the market could return to a volatile pattern.

Overall, the unexpectedly cool August PPI data presents short-term trading opportunities, but investors should remain vigilant. Thursday's CPI data will be crucial in validating the PPI signal. If inflation continues to slow, expectations of an easing Fed policy will be further reinforced, benefiting risk assets. Conversely, if the CPI unexpectedly rises, the market may reprice, potentially leading to a rebound in the US dollar and US Treasury yields. Traders should closely monitor technical signals and macroeconomic data, flexibly adjusting their strategies to respond to a volatile market environment.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.