September 19th Financial Breakfast: Markets assess the Fed's stance on further rate cuts, gold prices continue to fall from highs, and the UK significantly increased its holdings of US Treasuries in July.

2025-09-19 07:24:06

Focus on the day

Bank of Japan Governor Kazuo Ueda held a monetary policy press conference, and OPEC held preliminary discussions on the procedure for updating member countries' production capacity estimates.

stock market

Wall Street's major indexes closed at record highs on Thursday, a day after the Federal Reserve cut interest rates by 25 basis points. Chipmaker Intel surged after Nvidia announced it would take a stake in the company.

Intel shares surged 22.8%, their biggest one-day gain since October 1987, after Nvidia said it would invest $5 billion in the struggling U.S. chipmaker. Peer Advanced Micro Devices fell 0.8%.

Nvidia rose 3.5%, and the chip sector as a whole strengthened. The Philadelphia Semiconductor Index rose 3.6%. Technology stocks were also boosted. The Nasdaq and S&P 500 technology sectors rose 0.94% and 1.36% respectively. Seven of the 11 sectors of the S&P 500 index rose.

Meanwhile, the Russell 2000 index of small-cap stocks closed at 2,466, its first record closing high since November. Analysts point out that small companies tend to perform better in a low-interest rate environment.

Federal Reserve Chairman Jerome Powell emphasized on Wednesday that the weak job market is the current policy focus and hinted that interest rate cuts may continue at future policy meetings.

“We’re looking for support for economic growth and a rationale for high valuations, and the prospect of rate cuts provides that support,” said Sam Stovall, chief investment strategist at CFRA Research.

The Dow Jones Industrial Average rose 0.27% to 46,142.42, the S&P 500 rose 0.48% to 6,631.96, and the Nasdaq Composite rose 0.94% to 22,470.73. The biggest decliners in the S&P 500 were consumer staples and consumer discretionary.

The latest data showed that the number of initial unemployment claims in the United States fell last week, but the overall labor market tended to weaken, with both supply and demand for labor weakening.

The rate cut is expected to further fuel Wall Street’s recent rally, which has been fueled by expectations of easing monetary policy and a resurgence in trading in artificial intelligence-related stocks. Investors are pricing in around 44.2 basis points of further rate cuts by the end of 2025, according to data from the London Stock Exchange Group (LSEG).

Gold Market

Gold prices fell on Thursday amid profit-taking as the market assessed the Federal Reserve's stance on further rate cuts. This followed a record high hit in the previous session. Spot gold fell 0.4% to $3,643.40 an ounce. U.S. gold futures for December delivery settled down 1.1% at $3,678.30. The previous session saw volatility, with spot prices briefly reaching a record high of $3,707.40 before retreating from that level.

The US dollar index rose 0.5%. On Wednesday, the Federal Reserve cut interest rates for the first time since December and left the door open to further easing policy, but also issued warnings about stubborn inflation, making the pace of future policy adjustments uncertain. Fed Chairman Powell described the policy move as a risk management rate cut in response to labor market weakness, but stressed that the Fed is in no hurry to start easing.

"Powell's comments about rate cuts being a risk management measure have caused some confusion, and that uncertainty has prompted some profit-taking in the market," said Peter Grant, vice president and senior metals strategist at Zaner Metals. "However, I do believe that the long-term bullish trend for gold remains intact, and the pullback from yesterday's record high is a technical correction... Every time gold hits a new high, it further strengthens the credibility of its target of $4,000."

Gold, which tends to perform well in low-interest-rate environments and periods of uncertainty, has risen nearly 39% so far this year. Meanwhile, data showed Swiss gold exports to China surged 254% in August from July.

Among other metals, spot silver rose 0.3% to $41.78 an ounce, platinum rose 1.6% to $1,384.95 and palladium rose 0.5% to $1,160.25.

Oil Market

Oil prices retreated on Thursday, closing lower as traders remained concerned about the outlook for the U.S. economy a day after the Federal Reserve cut interest rates for the first time this year. Brent crude futures fell 0.8% to settle at $67.44, while U.S. crude futures fell 0.8% to settle at $63.57.

The Federal Reserve cut its policy rate by a quarter percentage point on Wednesday and signaled it would steadily lower borrowing costs for the rest of the year in response to signs of labor market weakness.

"They're doing this now, obviously because the economy is slowing and the Fed is trying to restore growth," said Jorge Montepeque, managing director at Onyx Capital Group.

The number of Americans filing new claims for unemployment benefits fell last week, reversing a sharp rise in the previous week, but the job market has softened as both the supply and demand for labor have decreased.

A persistent supply glut and weak fuel demand in the United States, the world's largest oil consumer, also weighed on the market.

Data released by the U.S. Energy Information Administration (EIA) on Wednesday showed that U.S. crude oil inventories fell sharply last week, with net imports hitting a record low and exports jumping to the highest level in nearly two years. However, distillate inventories increased by 4 million barrels, while the market expected an increase of 1 million barrels, which raised concerns about U.S. demand and put pressure on oil prices.

Russia's Finance Ministry announced new measures to protect the state budget from oil price fluctuations and Western sanctions on its energy exports. Russia is expected to be the world's second-largest crude oil producer after the United States in 2024.

Ukraine said its drones attacked a major Russian oil processing and petrochemical complex and a refinery as part of an escalating campaign to disrupt Moscow's oil and gas industry.

Kuwaiti Minister Tariq Al-Roumi expects oil demand to increase after the U.S. interest rate cut, especially in the Asian market.

foreign exchange market

The dollar rose against most major currencies on Thursday, a day after the Federal Reserve announced an expected interest rate cut but signaled it was in no rush to lower borrowing costs in the coming months. Data showed the number of Americans filing for unemployment benefits fell last week, reversing a surge the previous week.

The dollar's broad strength weighed on the pound, erasing earlier gains after the Bank of England kept interest rates steady and slowed the pace of its government bond sales.

The Federal Reserve cut interest rates by 25 basis points on Wednesday, as expected. Chairman Powell characterized the move as a "risk-managed rate cut" in response to labor market weakness, but said the Fed did not need to rush to ease policy.

Powell's comments fell short of the "unequivocally dovish tone that the market had been expecting," said Eric Theoret, a currency strategist at Scotiabank. He said Thursday's upbeat economic data, combined with heavy selling pressure on the dollar at the start of the week, were enough to fuel a rebound in the dollar.

"I think the market was completely skewed to one side, so it would take a lot of momentum to move the dollar further down from here," Theoret added. Analysts are divided on how to interpret the Fed's signals.

Goldman Sachs analysts believe there are many signs that Wednesday's rate cut will be the first of multiple actions, while ANZ analysts said the Fed chairman's remarks were "not dovish at all."

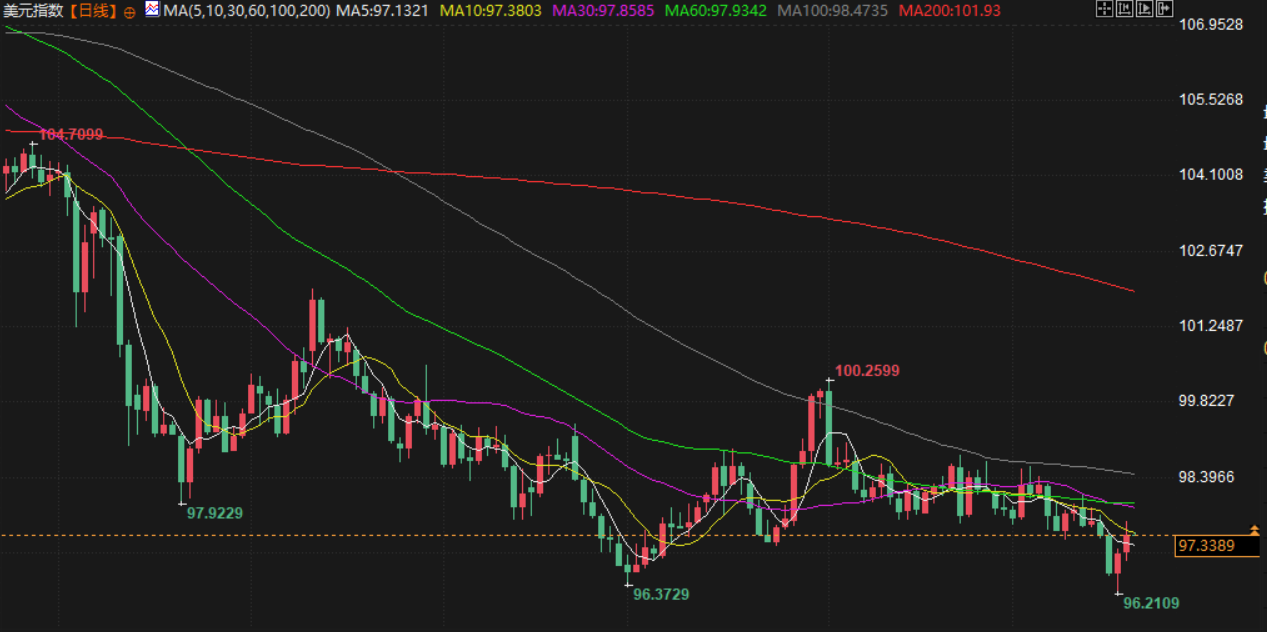

After the interest rate decision was announced on Wednesday, the US dollar index fell to 96.224, hitting a new low since February 2022, but rebounded 0.4% to 97.347 on Thursday.

Sterling initially edged up on the BoE's decision but fell 0.6% on the day to $1.35515, after briefly jumping to its highest since July 2 at $1.3726 in the previous session.

Bank of England policymakers voted 7-2 to slow the annual reduction in its government bond purchases to 70 billion pounds from 100 billion pounds between 2009 and 2021, roughly in line with the median poll forecast of 67.5 billion pounds.

"We think the market is overly pessimistic about the pound," said Benjamin Ford, a researcher at Macro Hive.

The euro fell 0.2% to 1.17893 against the dollar, having hit its highest since June 2021 at 1.19185 on Wednesday in a knee-jerk reaction to the Fed's statement.

The Norwegian crown fell 0.5% against the dollar after Norway's central bank cut its interest rate by 25 basis points to 4.0%, its second rate cut in three months. The bank hinted that further rate cuts are possible.

Elsewhere, the dollar rose 0.6% against the yen to 147.88 yen as investors closely watched the Bank of Japan's policy decision due on Friday.

The market generally expects the Bank of Japan to keep interest rates unchanged, but traders expect it to raise interest rates by 25 basis points by the end of March next year, with a probability of about 50% that it will be implemented this year.

The market is focused on Japan's Liberal Democratic Party, which will vote on October 4 to elect a new president to succeed Prime Minister Shigeru Ishiba, who resigned after a crushing defeat in the Senate election.

Data released on Thursday showed New Zealand's gross domestic product (GDP) fell 0.9% in the second quarter from the previous quarter, a sharper drop than the 0.3% drop forecast by analysts and the Reserve Bank of New Zealand. This pressured the New Zealand dollar, which fell 1.4% as traders increased bets on the Reserve Bank of New Zealand easing policy.

International News

Over 500,000 people strike in France to protest against government austerity measures

Strikes and demonstrations took place across France on the 18th. According to French government statistics, over 500,000 people participated in the strike, including approximately 55,000 in the capital, Paris. This marked another large-scale protest in France against the government's austerity plan. On that day, workers in the transportation, education, electricity, and pharmaceutical sectors, in varying degrees, responded to union calls for strikes, calling for a "more just" fiscal plan. Street demonstrations in cities such as Paris, Lyon, and Rennes were also accompanied by violence and vandalism. According to the French Ministry of the Interior, over 300 people were arrested across France. French Prime Minister Jean-Marie Le Corny posted on social media that evening that he would continue to consult with all sectors of society on the demands of French unions and protesters. He also condemned the violence during the demonstrations.

The US Senate confirmed 48 Trump nominees in a single vote

On Thursday, local time, the U.S. Senate confirmed 48 of President Trump's nominees in a single vote after the Republican majority invoked the "nuclear option" to implement major rule changes. The 51-47 party-line vote confirmed a series of deputy cabinet and ambassadorial nominees. These included former New York Republican Congressman Brandon Williams as Under Secretary of State for Nuclear Security; former Fox News host Kimberly Guilfoyle as U.S. Ambassador to Greece; and Callista Gingrich, wife of the former House Speaker, as U.S. Ambassador to Switzerland and Liechtenstein.

British and US leaders hold talks; Trump: Russia-Ukraine issue is very complicated

On the 18th local time, British Prime Minister Starmer and visiting US President Trump held a joint press conference at Chequers, the British Prime Minister's official country residence. Discussing the situation between Russia and Ukraine, Trump said he had initially thought the Ukraine-Russia issue might be the easiest to resolve, but it was actually very complex, and they would wait and see the outcome of the negotiations with Ukraine. Starmer said the two sides discussed how to increase defense support for Ukraine during the talks.

UK increases holdings of US Treasuries in July

U.S. Treasury data showed that China held $731 billion in U.S. Treasuries in July, up from $756 billion in June. Japan held $1.151 trillion in U.S. Treasuries in July, up from $1.148 trillion in June. The U.K. held $899 billion in U.S. Treasuries in July, up from $858 billion in June.

A major blunder in the U.S. continuing jobless claims data revealed one state underestimated its figures by nearly 20,000 people.

Due to a technical error, North Carolina's application data was mistakenly underestimated by more than 19,000 people in the weekly unemployment claims report released by the U.S. Department of Labor on Thursday. The report showed that as of the week of September 6, the number of people continuing to apply for unemployment benefits in North Carolina was only 205, the lowest level on record in the state, and the number is usually close to 20,000. The North Carolina Department of Commerce, which is responsible for collecting and transmitting data to Washington, said the figure was caused by a "technical error" and the correct number should be 19,355. A spokesman for the Department of Labor said they are still investigating the matter. "Therefore, when the data is revised, we expect the number of people continuing to apply for unemployment benefits nationwide to increase by about 20,000. This will still keep the number of unemployment claims at the level of previous weeks." JPMorgan economist Abir Reinhart said.

Houthi rebels claim to have attacked Israeli military targets in Tel Aviv

On the evening of September 18th, local time, Yemeni Houthi armed forces spokesman Yahya Sarea said in a speech that the Houthi armed forces used the "Palestine 2" hypersonic ballistic missile to attack Tel Aviv, Israel, and the missile hit a military target. The Houthi armed forces also attacked multiple targets in Eilat in southern Israel with three drones, and one drone attacked a target in Beersheba.

Trump opposes UK plan to recognize Palestinian state

During a meeting with British Prime Minister Starmer at Chequers, the prime minister's country residence, on the 18th, US President Trump expressed his opposition to Britain's plan to recognize a Palestinian state. Trump said he and Starmer disagreed on the Gaza issue, which was "one of the few differences" during the meeting. Starmer, in turn, stated that the UK and the US agreed to support peace in Gaza and develop a roadmap, while also emphasizing the need for expedited humanitarian aid to Gaza.

Senior Hamas official: No negotiations at this time

On the 18th local time, Bassem Naim, a senior official of the Palestinian Islamic Resistance Movement (Hamas), said in a live interview with Qatar's Arab TV that the organization agreed with Qatar's position that given Israel's continued attacks, especially Israel's continued escalation of its military operations against Gaza City, it is impossible for Hamas to negotiate at this time.

As the US government shutdown crisis approaches, top Democrats are considering a tough fight with Republicans on health care.

In Trump's Washington, Democrats are powerless to block the president's policy agenda, and even making headlines has become difficult. But now the party's leadership is considering a strategy that could lead to a government shutdown on October 1st, both blocking Trump's agenda and gaining public attention. This marks a dramatic shift for the risk-averse Democratic Party. Six months ago, Democrats bowed to pressure from Trump and congressional Republicans and agreed to a temporary funding bill. At the time, Democratic leaders, concerned about the newly inaugurated president's popularity, believed that a hard-fought approach was inappropriate. But now, the party's grassroots is growing increasingly anxious, urging the leadership to fight to prevent the surge in premiums for Obamacare, or at least to try to reverse the drastic cuts to Medicaid in Trump's $4 trillion tax and spending cuts bill.

Domestic News

155 projects signed at the 22nd China-ASEAN Expo

On the 18th, the signing ceremony for the 22nd China-ASEAN Expo was held in Nanning, Guangxi. 155 projects were signed, including 94 industrial projects, 44 "AI+" empowering various industries, and 17 international trade and economic projects. This year's CAEXPO signing ceremony focused on the theme of "AI plays a leading role, enterprises are the main players," focusing on building a highland for international AI cooperation oriented towards ASEAN and establishing cross-regional and cross-border industrial chains and supply chains, and promoting the signing of a number of landmark cooperation projects.

Giants "bet" billions of dollars! Chinese pharmaceutical industry ushered in the "DeepSeek moment"

In the biopharmaceutical field, some innovative domestically produced drugs have demonstrated efficacy comparable to star drugs from international pharmaceutical companies. In recent years, an increasing number of international pharmaceutical companies have invested heavily in collaborations with Chinese pharmaceutical companies. Earlier this year, China's artificial intelligence model, DeepSeek, garnered global attention for its exceptionally low development costs and powerful performance. In fact, in the biotechnology sector, China is also experiencing a similar "DeepSeek moment," as Chinese pharmaceutical companies are transitioning from the era of generic drugs to the era of innovative drugs, attracting numerous international collaborations. The primary form of collaboration is licensing: foreign parties obtain the rights to develop, produce, and commercialize Chinese drugs or related technologies in markets outside of China. (CCTV Finance)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.