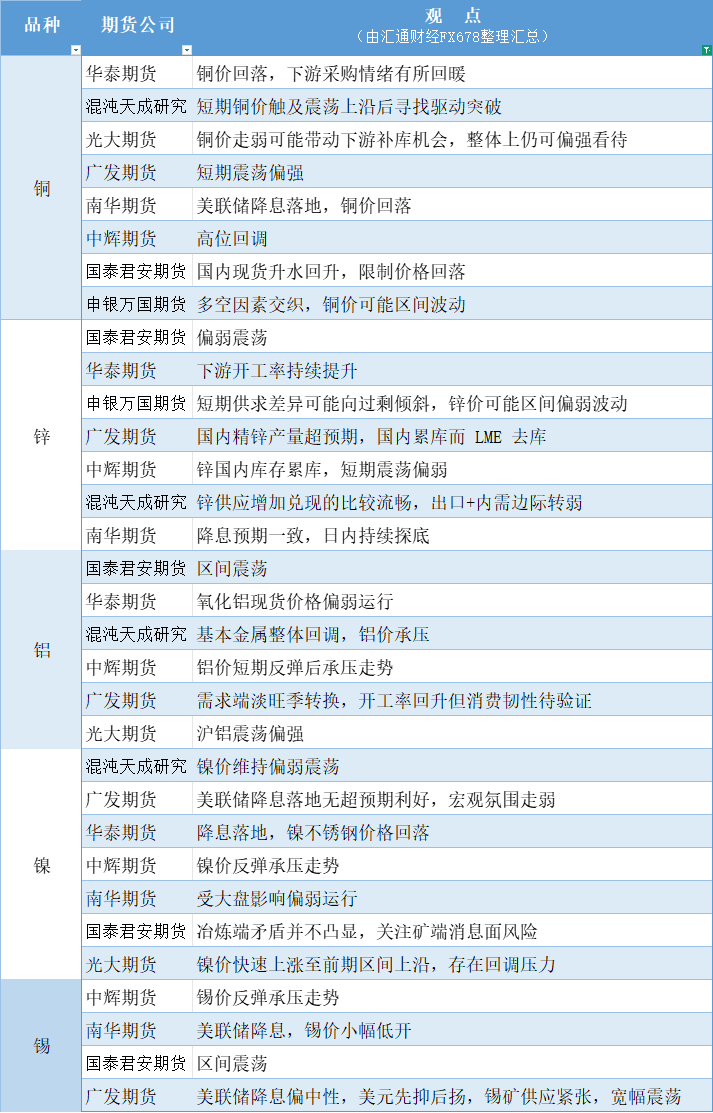

A chart summarizing the views of futures companies: September 19th nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2025-09-19 14:20:08

Copper: The weakening of copper prices may lead to opportunities for downstream restocking, and it can still be viewed as relatively strong overall. With the interweaving of bullish and bearish factors, copper prices may fluctuate within a range; Zinc: The short-term supply and demand difference may tilt towards surplus, and zinc prices may fluctuate within a weak range; Aluminum: The demand side is transitioning from off-season to peak season, and the operating rate has rebounded, but the resilience of consumption remains to be verified. Base metals have generally retreated, and aluminum prices are under pressure; Nickel: The Fed's interest rate cut has no unexpected benefits, the macro atmosphere has weakened, and nickel prices have rebounded under pressure; Tin: The Fed's interest rate cut was neutral, the US dollar first declined and then rose, the supply of tin ore was tight, and it fluctuated widely.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.