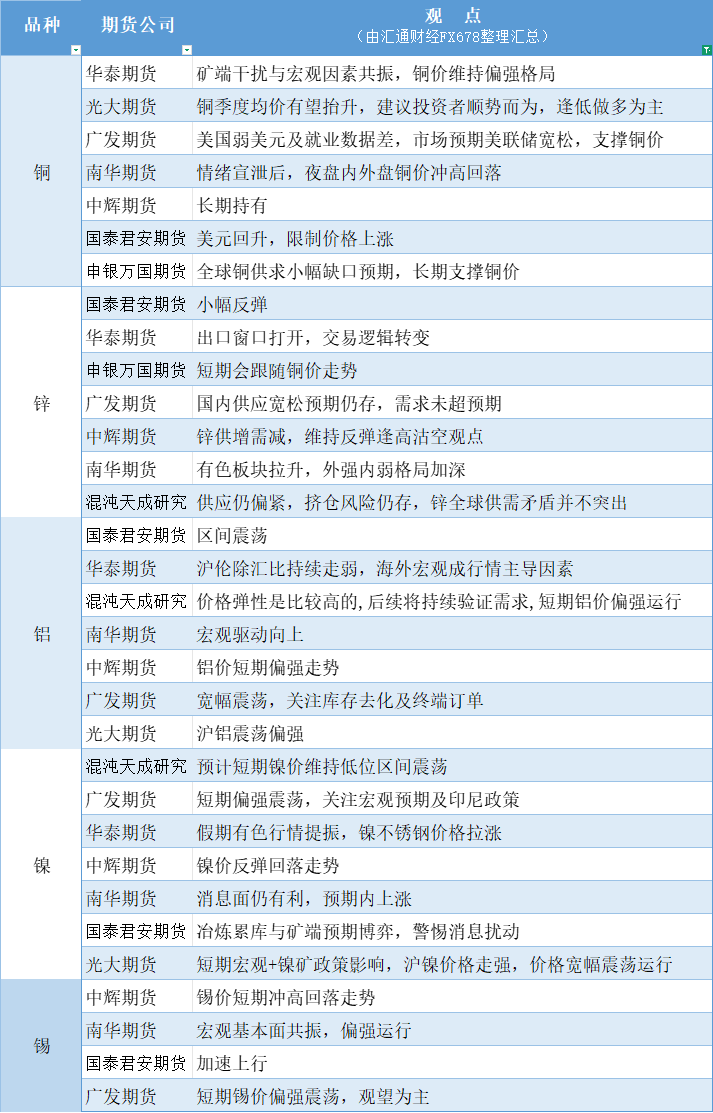

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on October 10

2025-10-10 11:35:18

Copper: The quarterly average price of copper is expected to rise. Investors are advised to follow the trend and mainly go long on dips. The interference from the mine end and the resonance of macro factors will keep the copper price strong. Zinc: The supply is still tight and the risk of squeeze still exists. The contradiction between global supply and demand of zinc is not prominent. The expectation of loose domestic supply still exists and the demand has not exceeded expectations. Aluminum: The price elasticity is relatively high and the demand will continue to be verified in the future. The short-term aluminum price will be strong. Nickel: In the short term, the macro + nickel ore policy will have an impact. The Shanghai nickel price will strengthen and the price will fluctuate widely. Tin: The macro fundamentals resonate and the price will be strong. Tin price will rise and fall in the short term.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.