Vale: Production and Sales Report for the Third Quarter of 2025

2025-10-22 10:24:08

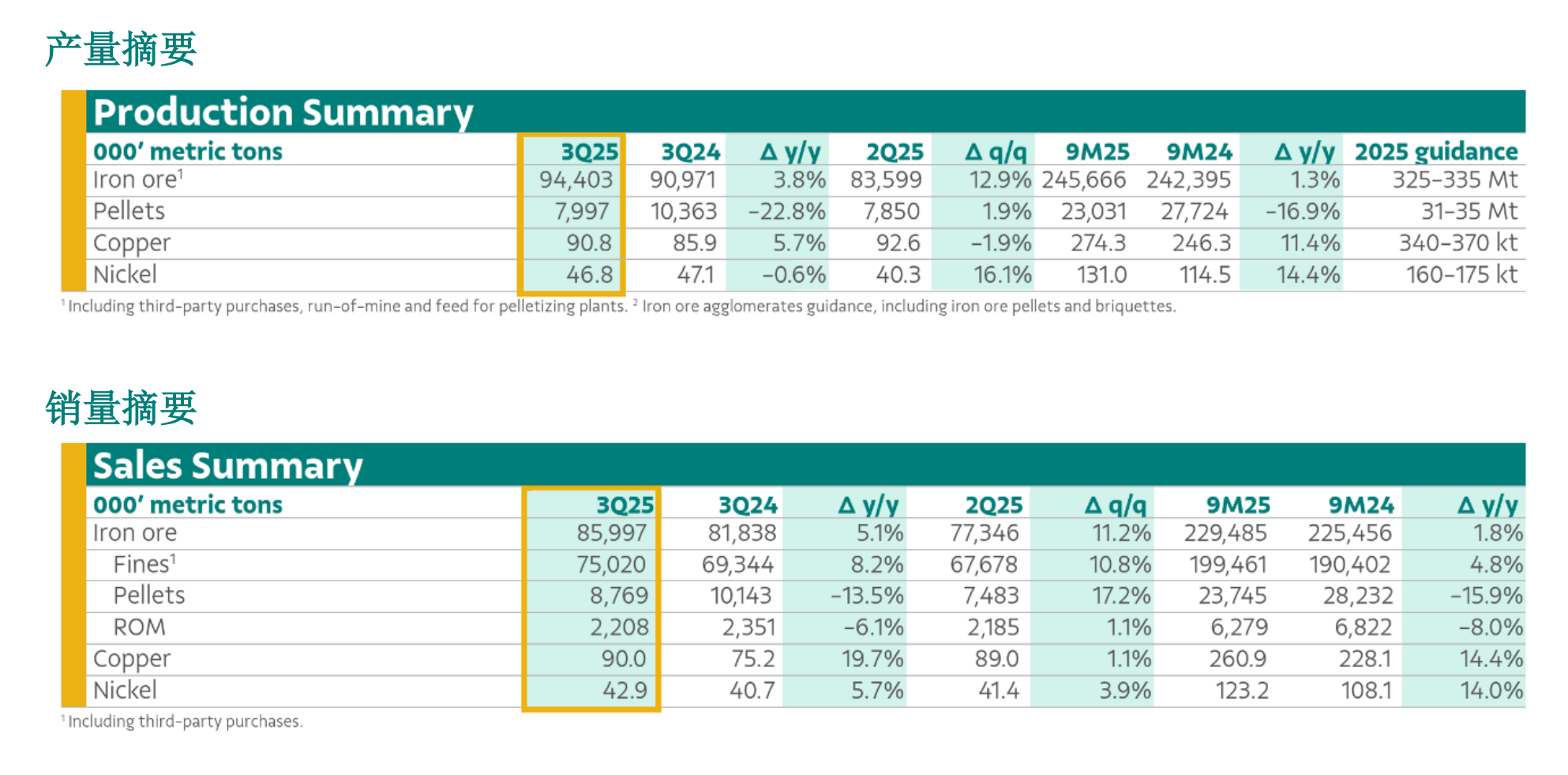

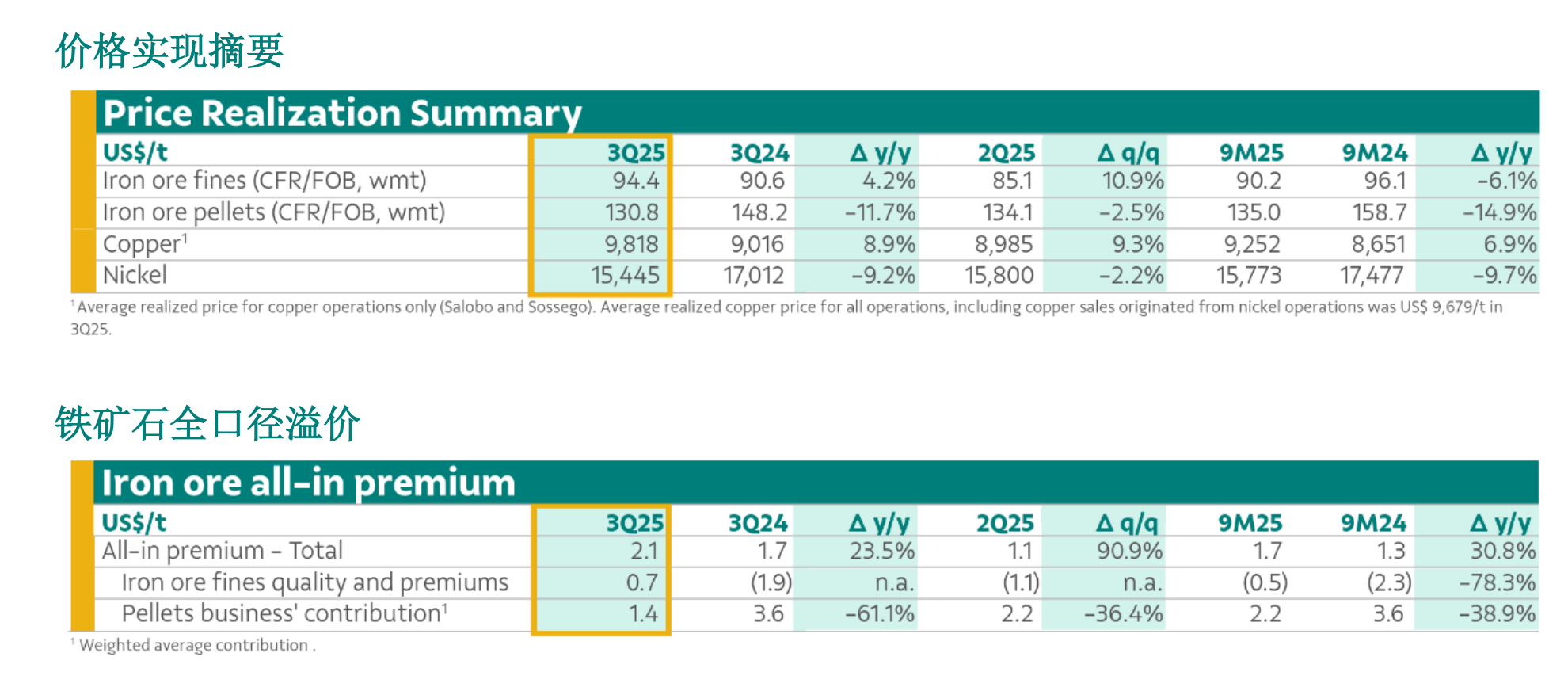

In the third quarter of 2025, iron ore production totaled 94.4 million tons, a year-on-year increase of 3.4 million tons, or 4%. This was driven by record quarterly production at the S11D mining area and the continued ramp-up of key projects. Iron ore sales reached 86 million tons, a year-on-year increase of 4.2 million tons, or 5%. Prices also improved, primarily due to an increase in the premium for iron ore fines (up $1.80/ton quarter-on-quarter). Pellet production totaled 8 million tons, a year-on-year decrease of 2.4 million tons, or 23%, reflecting market conditions.

In the third quarter of 2025, copper production totaled 90,800 tons, an increase of 4,900 tons, or 6%, year-on-year, mainly due to stable output in the Salobo operating area and increased copper concentrate production in the Voisey's Bay and Sudbury operating areas.

Nickel production totaled 46,800 tonnes in the third quarter of 2025, essentially flat year-on-year. Record production at the Long Harbour refinery offset maintenance at the Copper Cliff refinery in Sudbury.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.