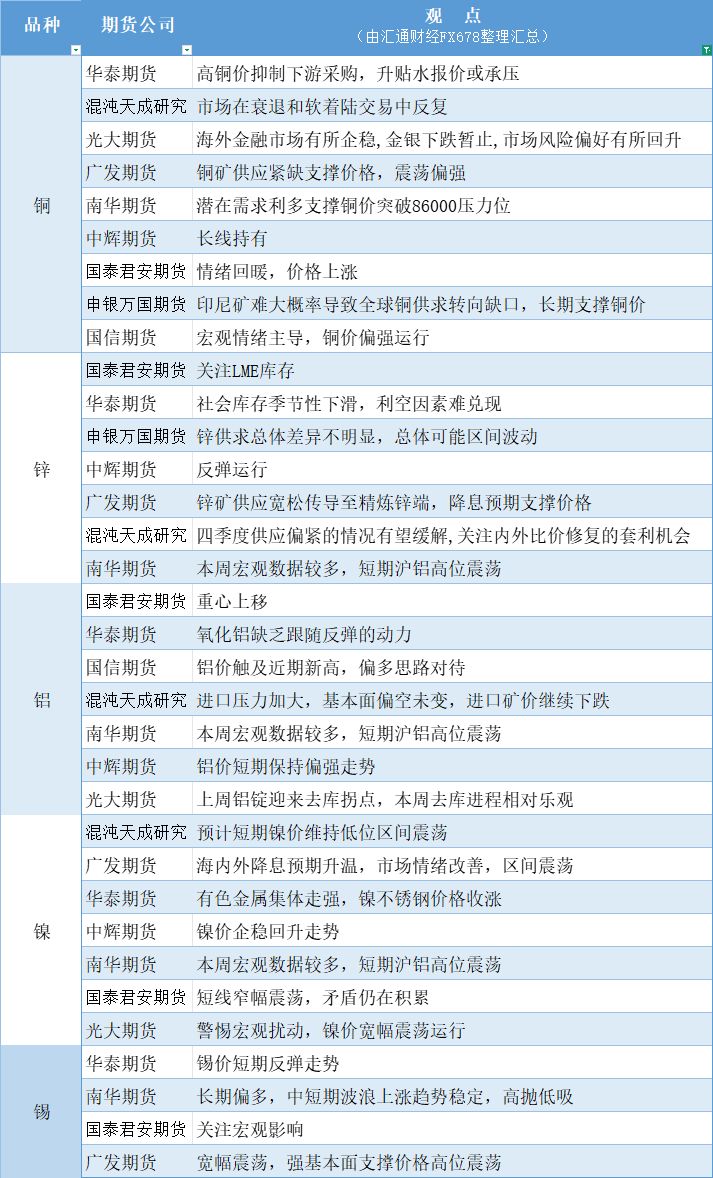

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on October 24

2025-10-24 13:11:47

Copper: Overseas financial markets have stabilized, the decline in gold and silver has temporarily stopped, market risk appetite has rebounded, and the tight supply of copper ore supports prices, with fluctuations being strong; Zinc: The tight supply situation in the fourth quarter is expected to ease, and attention should be paid to arbitrage opportunities in the recovery of domestic and foreign price ratios. The overall difference in zinc supply and demand is not obvious, and the overall fluctuation may be within a range; Aluminum: Import pressure has increased, the fundamentals remain bearish, and the price of imported ore continues to fall; Nickel: Expectations of interest rate cuts at home and abroad are heating up, market sentiment has improved, and the price is fluctuating within a range; Tin: Long-term bullish, medium- and short-term wave upward trend is stable, and high selling and low buying are recommended.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.