GBP/USD Forex Signal: Bollinger Bands Indicator Suggests Potential Sharp Drop Ahead of Bank of England Decision

2025-11-03 19:22:56

The pound/dollar exchange rate has recently fallen to its lowest level since April, continuing the downward trend that began after reaching a peak of 1.3726 in September.

The pound fell after the Fed's decision.

The pound/dollar pair retreated after the Federal Reserve announced its latest interest rate decision. As widely expected, the Fed decided to cut interest rates by 0.25% due to continued concerns about the labor market.

This resolution was announced at a time when the US government was in a shutdown, and several major companies announced massive layoffs. Amazon, UPS, and Target all announced thousands of job cuts. In the preceding weeks, an ADP report showed that the US economy lost more than 36,000 jobs in September.

The main reason for the decline in the pound/dollar exchange rate was the more hawkish stance of the Federal Reserve's decision than analysts had expected. In his statement, Powell indicated that the Fed remains concerned about inflation. Therefore, he warned that the Fed might not continue cutting interest rates as most analysts had anticipated.

The pound/dollar exchange rate will be the focus of the market this week, with the Bank of England (BoE) announcing its interest rate decision on Thursday. Reports in recent weeks have shown that the UK's overall Consumer Price Index (CPI) rose to a multi-month high in September.

The inflation report suggests that the UK is in a state of stagflation – one of the most difficult situations for the central bank to handle.

Economists expect the Bank of England to keep interest rates unchanged and may hint at a rate cut in December. Other key UK macroeconomic data to watch this week include the manufacturing and services purchasing managers' indices (PMIs), as well as housing-related data.

GBP/USD Technical Analysis

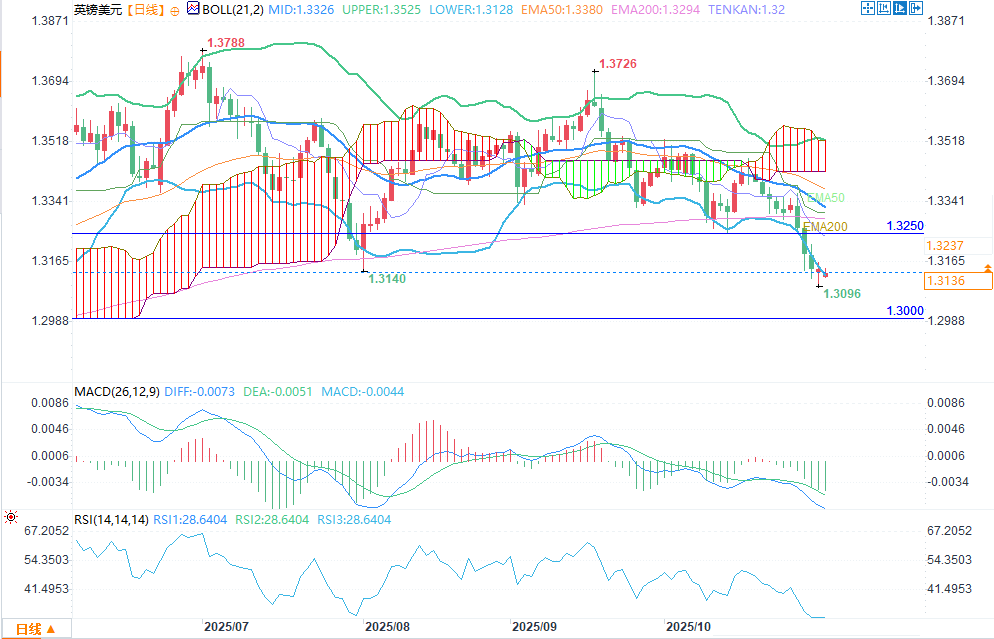

(GBP/USD daily chart source: FX678)

The daily chart shows that GBP/USD has been declining over the past few months, falling from a high of 1.3726 in September to the current 1.3096.

The currency pair has fallen below its 50-day exponential moving average (EMA). Meanwhile, the Relative Strength Index (RSI) has fallen into oversold territory, below 30.

The pound has broken below the Bollinger Bands (Supertrend) and the Ichimoku Cloud. Therefore, the path of least resistance is bearish, with the next key level to watch being the psychological level of 1.3000. A break above the resistance level of 1.3250 would invalidate the current bearish view.

bearish view

Sell the GBP/USD currency pair, setting a take-profit target at 1.3000 and a stop-loss target at 1.3250. Timeframe: 1-2 days.

Bullish viewpoints

Buy the GBP/USD currency pair and set a take-profit level at 1.3250. Set a stop-loss level at 1.3000.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.