Analysts: Gold is facing resistance at $5,000; the short-term outlook is not optimistic.

2026-02-05 11:12:33

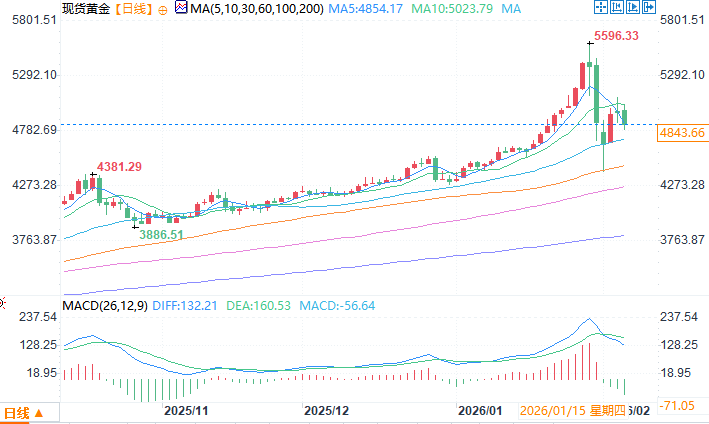

Gold and silver saw their biggest single-day gains in recent history on Tuesday, but even with some follow-through buying earlier on Wednesday, gold seemed unable to maintain its gains above $5,000 per ounce. Silver followed a similar pattern, failing to sustain its gains above $90 per ounce.

Despite the rebound, one analyst warned investors that gold and silver may face further selling pressure in the near term. Market analyst Fawad Razaqzada stated, "To me, the short-term outlook for gold is far from optimistic. "

Razaqzada stated that it is too early for investors to look for a bottom amid market volatility. He added that he believes the buying momentum of the past two days is a contrarian rebound.

In a report, he stated, "For months, gold has essentially been trading in one direction, then falling from its highs to its lows by nearly 20%. What we've just seen feels like the first proper trend reversal in the precious metal. A move of this magnitude won't be corrected overnight, so it's too early to declare the end of our recent bearish forecast for gold. "

Razaqzada said that while gold faces some technical resistance, there are also some fundamental changes in the market that investors need to pay attention to. He explained that the dollar's weakness looks a bit overdone, and there is a risk of the dollar rising in the short term.

He said, "A stronger dollar often becomes a headwind for precious metals, and if this trend proves to be more than just a short-lived rebound, it could continue to drag down gold prices. More broadly, the slowdown in the US economy doesn't seem to be as rapid as the market expected. As a result, expectations for a significant interest rate cut have diminished. Unless there are significant negative shocks in the data, it will still be difficult to establish a convincing bearish case for the dollar."

From a technical perspective, Razaqzada stated that $5,000 per ounce will be a key level to watch.

He said, "It's not just because it's a round number, but also because of the speed and strength of the move. Gold currently appears to be climbing within a short-term rising wedge pattern, a pattern that tends to be a continuation of the bearish trend rather than a bullish signal. On the upside, resistance is around $5,000, and further down could be close to $5,100, which now look like areas where sellers might be keen to weaken their position."

Razaqzada said that on the downside, he sees initial support around $4,900, then $4,800, but he added that gold prices could fall to $4,500 per ounce.

Senior market analyst Rania Gule said in a report on Tuesday that she also expects gold prices to face some headwinds in the short term, but the long-term fundamentals remain strong.

She said, “In my view, the market is still in a ‘bottom-testing’ phase, with investors seeking confirmation that the corrective decline has truly ended. My outlook for gold leans towards a neutral to slightly bearish corrective range rather than a new impulsive rally. I believe the $4,800 level will remain a key area, which buyers will defend as long as the dollar lacks strong momentum, but any significant break below this level could open the door to a retest of lower levels. Conversely, a sustainable return to record highs would require one of two conditions: a sharp and unexpected escalation of geopolitical risks, or a significant shift in the Fed’s stance on accommodative policy, neither of which is currently present.”

Gule said that gold investors should not seek more capital gains, but should be more cautious and focus on risk management. She said, "Gold has not lost its luster as a safe haven, but it also lacks the reason to launch a new historic rally."

Spot gold daily chart source: EasyForex

At 11:07 AM Beijing time on February 5th, spot gold was trading at $4843.66 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.