Technical analysis: Gold sends bearish signal, breaks below symmetrical triangle pattern

2025-07-28 19:15:49

However, the market soon returned to caution, and the price of gold precious metals rebounded to above Friday's closing price, as the positive impact of the agreement on the EU is still unclear. According to the agreement, the United States will impose import tariffs on EU cars, while the EU is expected to invest heavily in US energy and military equipment without taking any retaliatory measures. It is worth noting that the 50% tariff imposed by the United States on EU steel and aluminum products will remain unchanged for now.

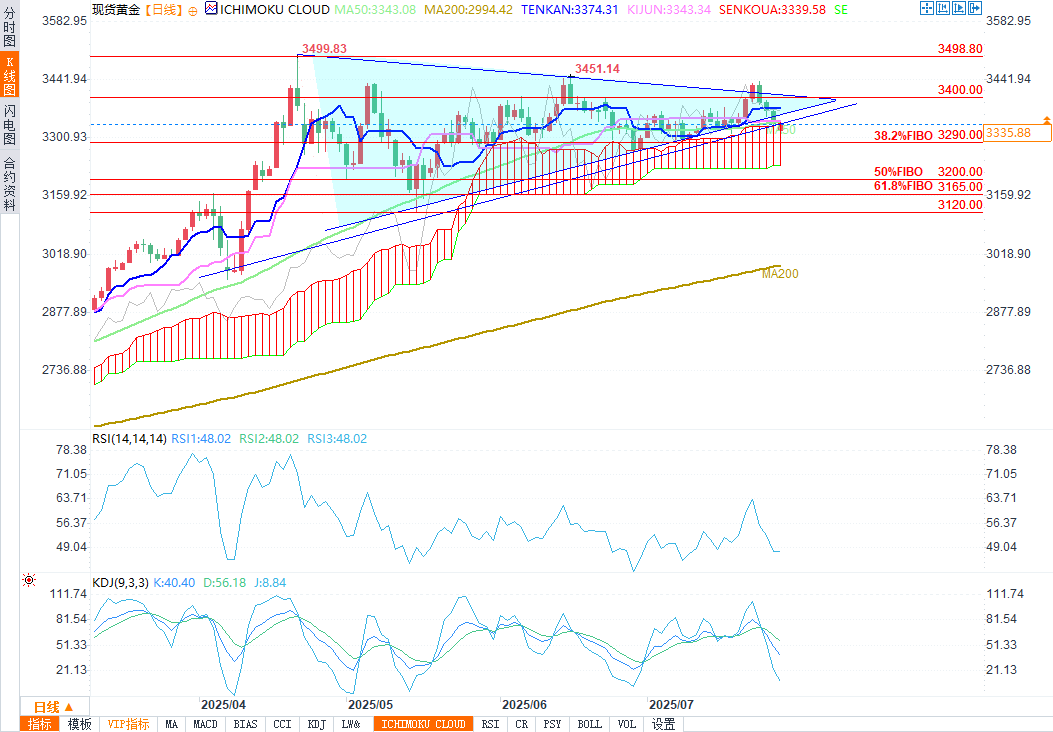

From a technical perspective, today's decline has pushed gold prices below the symmetrical triangle pattern, the short-term simple moving average, and into the Ichimoku cloud range, all signs of a potential bearish continuation trend. With the relative strength index (RSI) falling below the neutral 50 level and the stochastic oscillator turning down, downside risks remain dominant - especially if strong resistance forms in the $3,345 area.

(Source of spot gold daily chart: Yihuitong)

If the decline continues, it may initially retest the 38.2% Fibonacci retracement level of the April rally, around $3,290. Further declines may be buffered at the 50% Fibonacci level of $3,230 to the key support range of $3,200. However, from a macro-trend perspective, only a break below the 61.8% Fibonacci retracement level of $3,165 can officially confirm a bearish trend reversal.

On the upside, a breakout above the $3,345–3,370 range could revive buying interest. However, a clear close above the upper boundary of the triangle near $3,400 and last week’s resistance at $3,430 may be needed to trigger a quick rebound towards the key resistance at $3,500.

In short, today’s decline has shifted the market bias to the bearish side. If the $3,345 area forms strong resistance, selling pressure may re-emerge.

At 19:11 Beijing time, spot gold was trading at $3,336.10 an ounce, down 0.01%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.