Investors warn of global economic conditions, urge 15% gold allocation

2025-07-29 10:48:33

The Bridgewater Associates founder shared his gloomy economic outlook on Sunday, using the United States as an example, noting that while the U.S. government's revenues are about $5 trillion, its spending is $7 trillion.

“It’s spending 40% more than it’s taking in, and it can’t really cut spending because so much of it is fixed,” he said. “It’s accumulated debt that’s six times its takings in… The credit system is like a circulatory system, bringing nutrients, purchasing power, to different parts of the economy. If that purchasing power is used to create income, then that income can pay down the debt, and it’s a healthy system. But when debt, debt service, and interest rates go up, they start to crowd out other spending, like plaque in the circulatory system, causing a problem akin to an economic heart attack.”

His comments come as the U.S. government debt exceeds $37 trillion.

Dalio noted that due to continued deficit spending, the U.S. government may need to issue nearly $12 trillion in Treasury bonds next year to repay its debts.

"There is no going back," Dalio warned, adding that the only remaining option is for governments to borrow more money and rely on central banks to print money. He also reminded investors that indicators such as the emergence of capital controls have begun to send warning signs.

Although Dalio focused on the United States, he stressed that all Western-led economies face similar challenges. “They tend to go down together, just like in the 1970s or the 1930s,” he said. “We look at their relative movements, but they all go down in value, not relative to fiat currencies, but relative to hard money, and that hard money is gold.”

Dalio noted that gold has become the world’s second-largest reserve currency, surpassing the euro earlier this year.

Dalio stressed that the key goal is to have assets that can withstand broad currency depreciation. He added that a neutral balanced portfolio should include about 15% exposure to gold. He said: "In my own portfolio, I hold gold and a small amount of other assets. I prefer gold, but it depends on the individual. The real problem is currency depreciation."

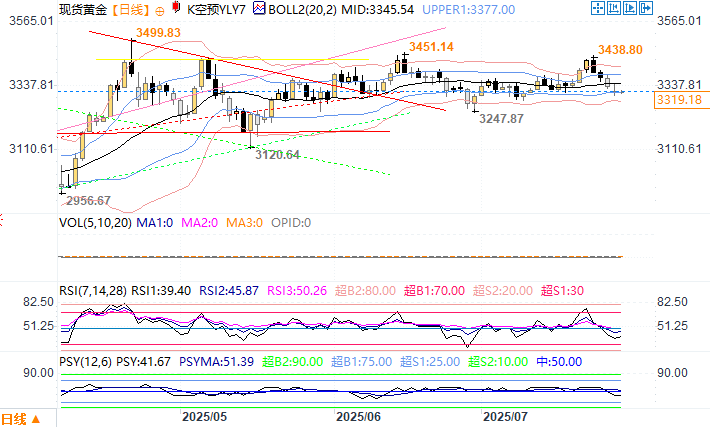

Spot gold daily chart source: Yihuitong

At 10:48 am on July 29th, Beijing time, spot gold was quoted at $3,319.38 per ounce

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.