Gold weakened modestly as the dollar strengthened on trade developments

2025-07-29 12:02:35

The main catalyst for market moves came from progress in multiple trade areas. The United States and the European Union reached an agreement to impose a 15% tariff on EU goods imported into the United States, clarifying their crucial trade relationship. Meanwhile, media outlets in major Asian countries reported that the United States and China may extend their existing tariff agreement for 90 days, providing temporary stability in the world's largest bilateral trading relationship. The Trump administration stated that countries that do not reach a negotiated trade agreement will soon face a designated tariff structure, hinting at a comprehensive approach to trade policy implementation.

These positive trade developments fueled the dollar's biggest one-day gain since April, with the Intercontinental Exchange (ICE) Dollar Index surging over 1% to an intraday high of 98.66 on Monday (July 28). The dollar's strength was further bolstered by monetary policy expectations, as the Federal Reserve's upcoming meeting indicated a low probability of an interest rate cut. According to the FedWatch tool, market participants see only a 3.1% chance of a rate cut, with 96.9% expecting rates to remain unchanged. The Federal Open Market Committee (FOMC) will not meet in August, suggesting that the current high interest rate environment will persist at least until its September meeting.

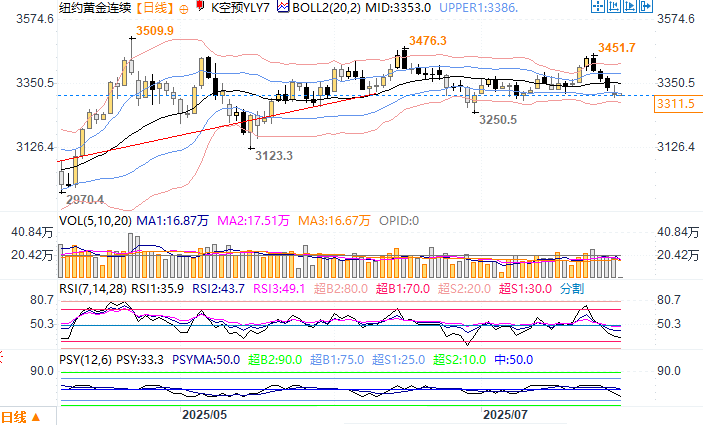

Despite the significant strengthening of the US dollar, gold has demonstrated some underlying resilience. While gold futures fell $24.50, or 0.73%, to $3,314 on the same day, this decline was significantly milder relative to the dollar's over 1% appreciation. This divergence suggests that despite the challenging technical environment created by the strengthening US dollar, there are still strategic buyers willing to accumulate gold positions. Gold prices fluctuated within a narrow range in Asian trading on Tuesday (July 29).

US Dollar Index Daily Chart Source: Yihuitong

New York Gold Continuous Daily Chart Source: Yihuitong

At 12:00 Beijing time on July 29, the US dollar index was at 98.69, and New York gold continued to trade at US$3311.5 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.