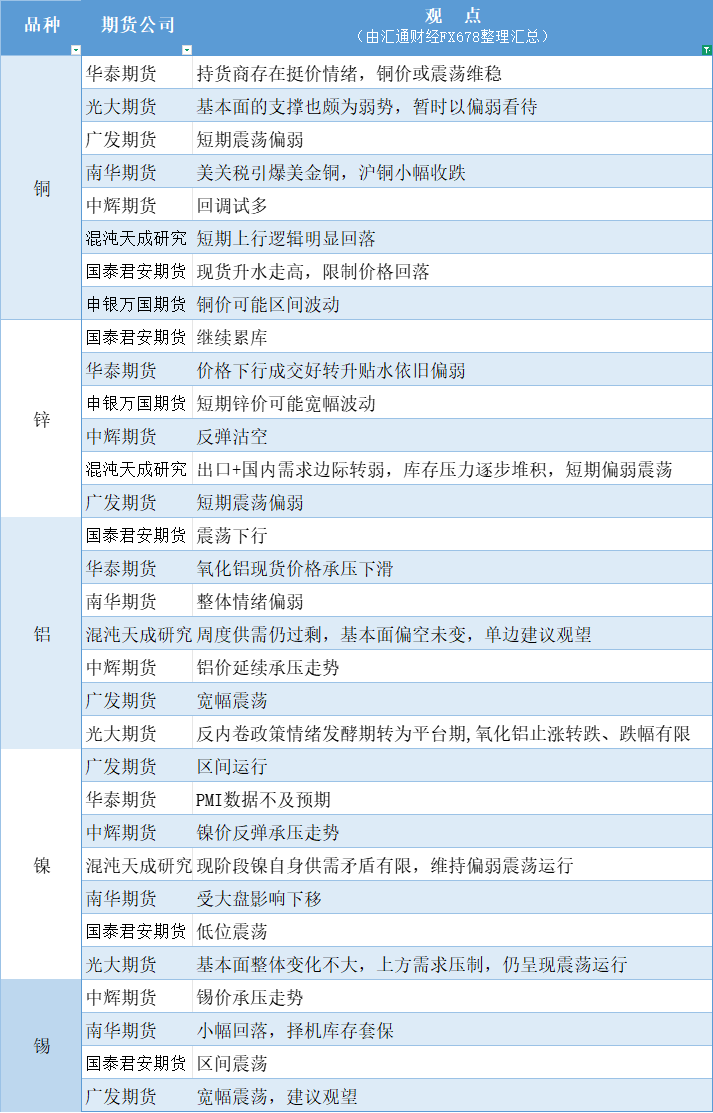

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on August 1

2025-08-01 13:16:46

Copper: The support from fundamentals is also quite weak, and it is temporarily regarded as weak. The spot premium has risen, limiting the price decline; Zinc: Exports + domestic demand have weakened marginally, inventory pressure has gradually accumulated, and it is weak and volatile in the short term; Aluminum: The fermentation period of anti-involutionary policy sentiment has turned into a platform period, alumina has stopped rising and turned to fall, with a limited decline, weekly supply and demand are still in excess, the fundamentals are bearish and have not changed, and it is recommended to wait and see; Nickel: At this stage, the contradiction between nickel's own supply and demand is limited, and it maintains a weak and volatile operation; Tin: It has fallen slightly, and inventory hedging is carried out at the right time. It fluctuates widely, and it is recommended to wait and see.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.