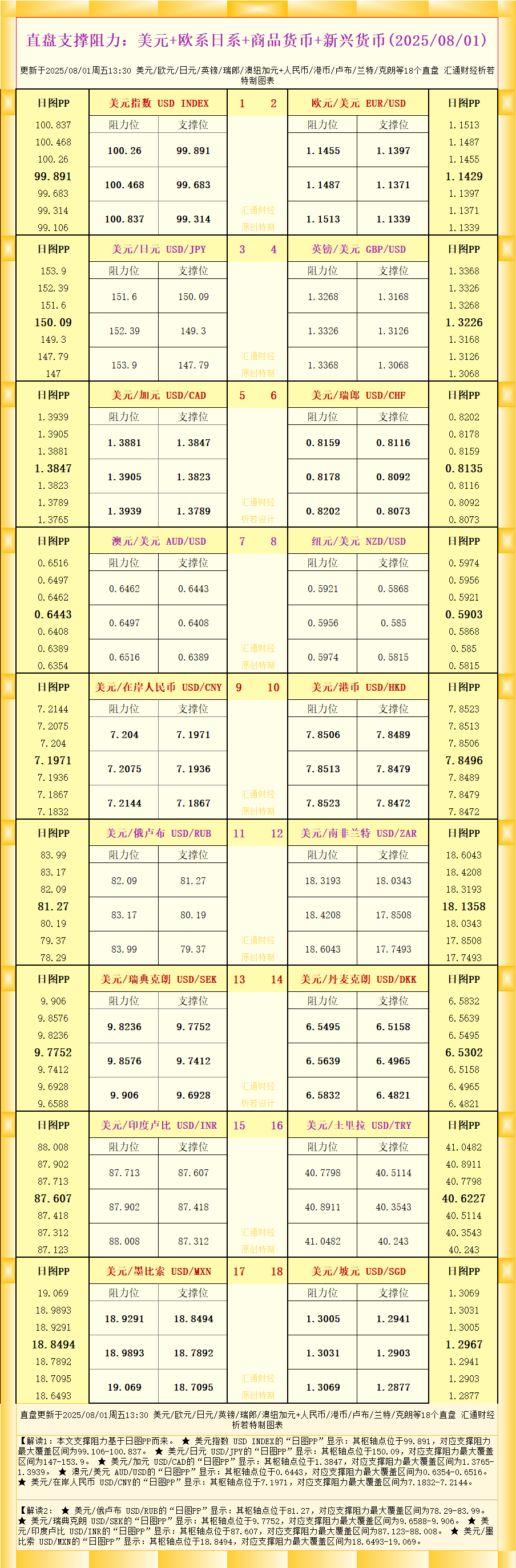

18 Forex Support and Resistance Charts in One Chart: US Dollar + European and Japanese Currencies + Commodity Currencies + Emerging Currencies (August 1, 2025)

2025-08-01 13:39:05

As shown in the data, Interpretation 1: The support and resistance in this article are based on the daily chart PP.

★ The "Daily PP" of the US Dollar Index USD INDEX shows that its pivot point is at 99.891, and the corresponding maximum support and resistance range is 99.106-100.837.

★ The "Daily PP" of USD/JPY shows that its pivot point is at 150.09, and the corresponding maximum support and resistance range is 147-153.9.

★ The "Daily PP" of USD/CAD shows that its pivot point is at 1.3847, and the corresponding maximum support and resistance range is 1.3765-1.3939.

★ The "Daily PP" of Australian Dollar/US Dollar AUD/USD shows that its pivot point is at 0.6443, and the corresponding maximum support and resistance range is 0.6354-0.6516.

★ The "daily PP" of the US dollar/onshore RMB USD/CNY shows that its pivot point is at 7.1971, and the corresponding maximum support and resistance range is 7.1832-7.2144.

Interpretation 2:

★ The "Daily PP" of USD/RUB shows that its pivot point is at 81.27, and the corresponding maximum support and resistance range is 78.29-83.99.

★ The "Daily PP" of USD/SEK shows that its pivot point is at 9.7752, and the corresponding maximum support and resistance range is 9.6588-9.906.

★ The "Daily PP" of USD/INR shows that its pivot point is at 87.607, and the corresponding maximum support and resistance range is 87.123-88.008.

★ The "Daily PP" of the US dollar/Mexican peso USD/MXN shows that its pivot point is at 18.8494, and the corresponding maximum support and resistance range is 18.6493-19.069.

For more detailed information on various varieties, please see the chart. This information is original and copyrighted by Huitong Finance and is for reference only.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.