The weak U.S. non-farm payroll data in July has injected new confidence into gold bulls, and the price of gold is expected to reach $3,400.

2025-08-04 11:51:46

Last Friday (August 1), the spot gold price closed at US$3,363.16, up 2.23% on the day, or US$73.24, reaching a high of US$3,363.37.

Lukman Otunuga, senior market strategist at FXTM, said gold prices saw an impressive rally on Friday, driven by a plunge in the US dollar.

He stated: “Looking at the chart, bulls were on a rampage on the day, with $3,400 less than 2% away at the time. The weekly chart is sharply bullish as the price broke through the $3,330 resistance level. A weekly close above this level could signal a move towards $3,400.”

Gold came under intense selling pressure last week after the Federal Reserve kept interest rates unchanged and Fed Chairman Powell raised uncertainty about a possible rate cut in September.

"We haven't made a decision yet about September," Powell said at a press conference after the Fed's decision.

Lingering doubts about a September rate cut dissipated after dismal U.S. job market data. The U.S. economy created just 73,000 jobs last month, according to the Bureau of Labor Statistics. Furthermore, total job growth in May and June was revised downward by 258,000 jobs. According to the revised data, only 14,000 jobs were created in June and 19,000 in May.

Aaron Hill, senior market analyst at FP Markets, said: "The weaker-than-expected jobs report has weakened confidence in the U.S. economy and put pressure on the dollar as the market expects the Federal Reserve to be more dovish and may be inclined to cut interest rates to stimulate economic growth. For gold, the disappointing jobs data reinforces its role as a hedge against economic uncertainty, supporting higher prices as investors seek stability."

Markets are pricing in about a 92% chance of the Fed easing monetary policy in September, according to the CME FedWatch tool. Last Thursday, the market was pricing in just a 38% chance of a rate cut.

Jamie Cox, managing partner at Harris Financial Group, said the Federal Reserve may ultimately regret its decision to keep interest rates unchanged earlier last week.

"There will definitely be a rate cut in September, perhaps even a 50 basis point cut, to make up for lost time," he said.

Naeem Aslam, chief investment officer at Zaye Capital Markets, said he sees potential for gold prices to rise steadily to $3,400 an ounce given the sharp shift in interest rate expectations.

"If the Fed signals a dovish stance, speculative inflows could push gold prices above the psychological level of $3,400, especially as investors seek safe-haven assets during economic uncertainty," he said. "Technical indicators, such as a bullish trend in gold ETFs and rising open interest, support this potential breakout. We believe traders are already positioning for a dip bounce, with some analysts pointing to seasonal patterns in gold that typically gain traction after August. While volatility could still limit near-term gains, the overall trend looks positive and the typical summer lull may be behind us."

This week is light on economic data, with investors continuing to digest Friday's jobs report. Meanwhile, some analysts expect economic uncertainty stemming from President Trump's ongoing trade war and global tariffs to further boost safe-haven demand for gold.

Trade tensions are providing another layer of support for gold. President Trump set an August 1 deadline for countries to finalize a trade deal. While the United States reached agreements with Japan and the European Union, resulting in a 15% increase in import tariffs, many major trading partners still face the risk of tariff increases.

As a result, exports from many countries now face significant cost increases. Specifically, Canada, the United States' second-largest trading partner, will face a 35% tariff increase. Meanwhile, India faces a 25% increase, Taiwanese exports will be subject to a 20% tariff, South African products face a 30% tariff, and Swiss goods will be subject to a 39% tariff.

Michael Brown, market strategist at Pepperstone, said he remains bullish on gold, citing global trade uncertainty as a key factor driving its value as a monetary asset.

He said: "The diversification trend of reserves away from the US dollar and towards gold, especially concentrated in emerging markets, will continue for the foreseeable future. Of course, potential safe-haven demand triggered by concerns about the state of the US economy will further support the bullish view. The upside level to watch remains the $3,400 mark, then the high of around $3,445, and then a possible run towards the all-time high of $3,500. I certainly don't rule out the possibility of new highs in gold prices before the end of this year."

Chris Vecchio, head of futures strategy and foreign exchange at Tastylive, said he believes gold would be very beneficial as a global currency.

“Tariffs mean that countries will trade less in dollars, so I expect gold to continue to do well as the world looks for an alternative monetary asset,” he said.

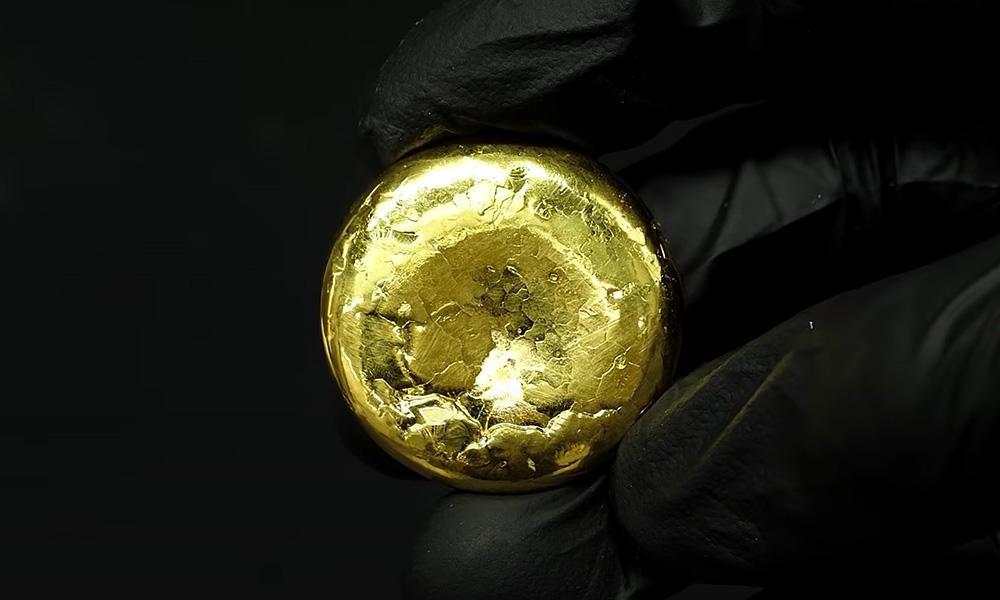

Spot gold daily chart Source: Yihuitong

At 11:51 Beijing time on August 4, spot gold was quoted at $3,359.57 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.